Question: Comprehensive Problem 3 Part 4: Note: You must complete parts 1, 2, and 3 before completing part 4 of this comprehensive problem. Based on the

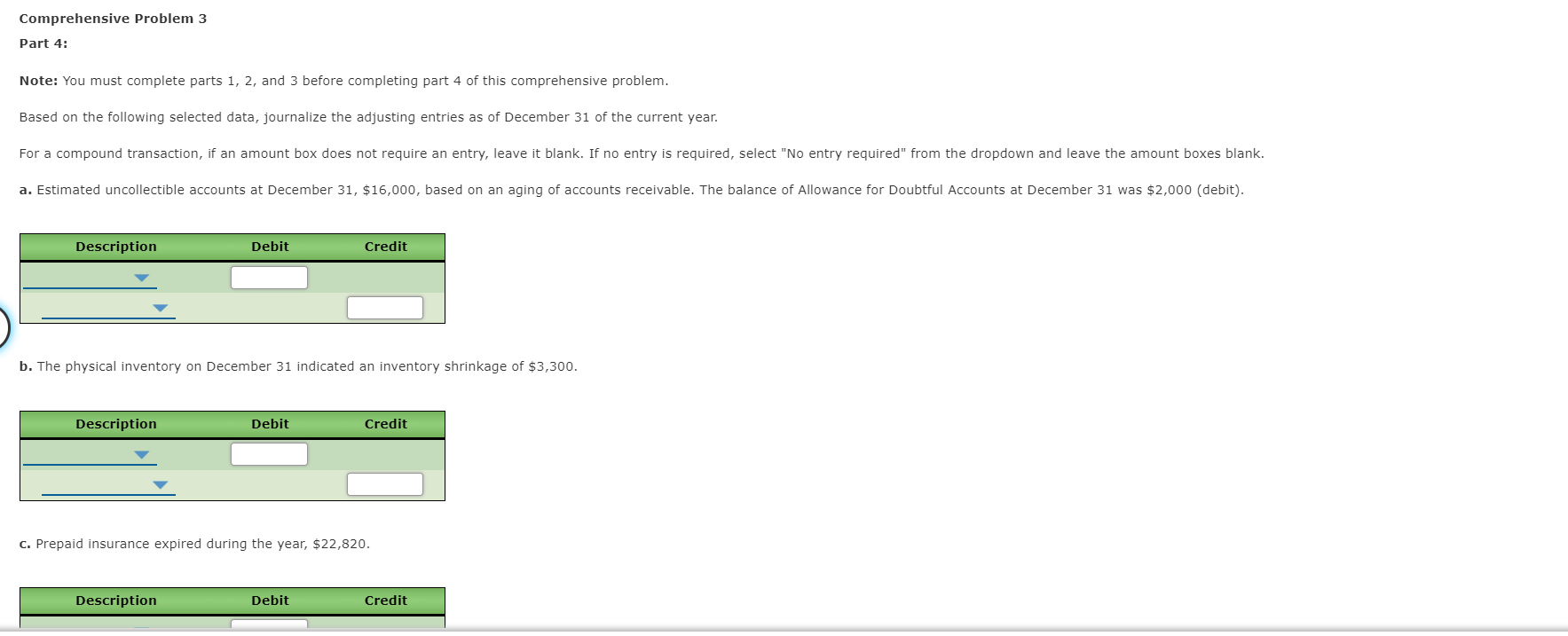

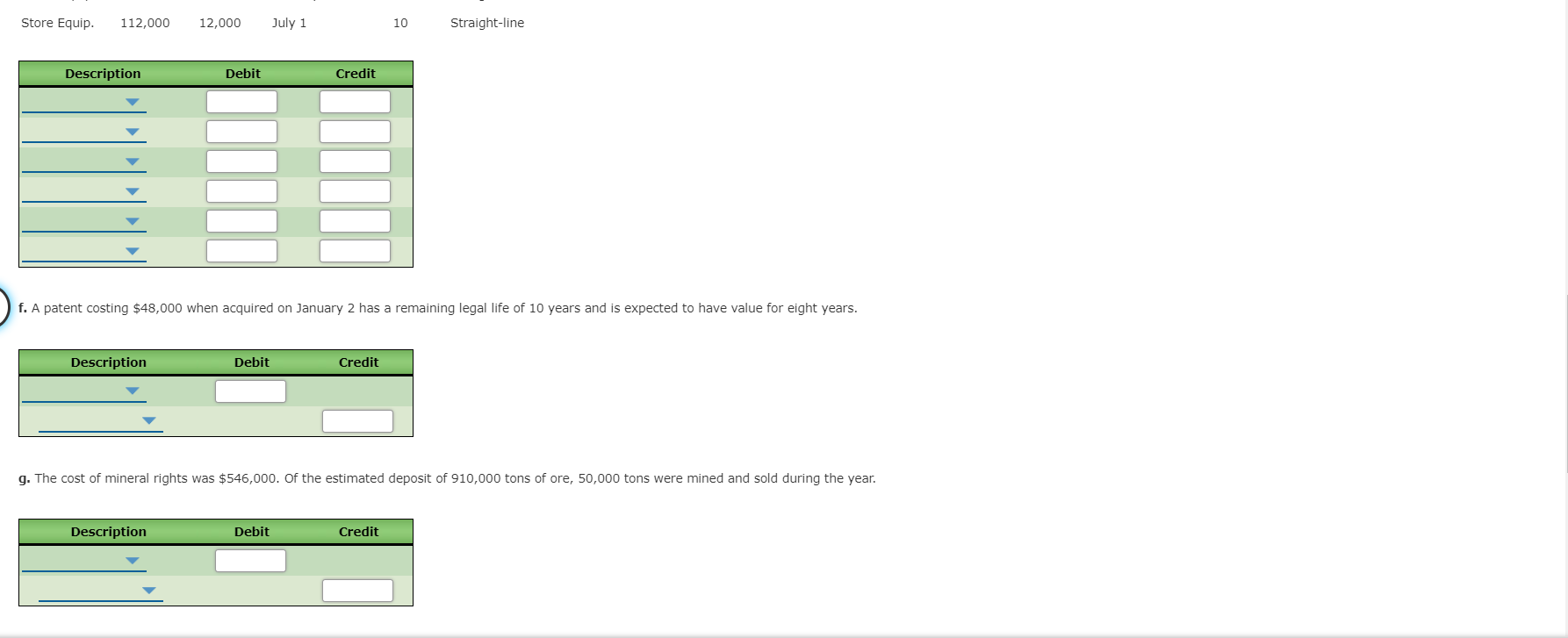

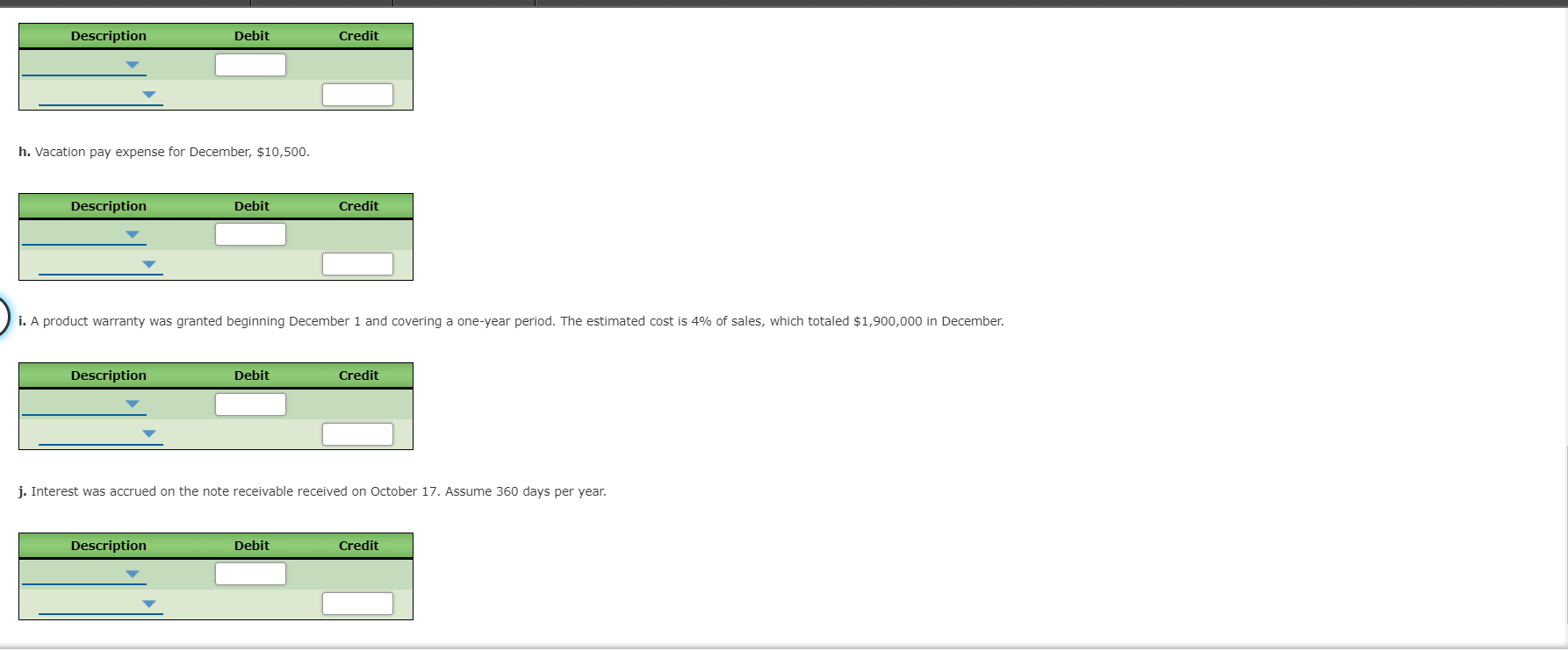

Comprehensive Problem 3 Part 4: Note: You must complete parts 1, 2, and 3 before completing part 4 of this comprehensive problem. Based on the following selected data, journalize the adjusting entries as of December 31 of the current year. For a compound transaction, if an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. a. Estimated uncollectible accounts at December 31, $16,000, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was $2,000 (debit). Description Debit Credit b. The physical inventory on December 31 indicated an inventory shrinkage of $3,300. Description Debit Credit c. Prepaid insurance expired during the year, $22,820. Description Debit Credit c. Prepaid insurance expired during the year, $22,820. Description Debit Credit d. Office supplies used during the year, $3,920. Description Debit Credit e. Depreciation is computed as follows: Residual Acquisition Useful Life Depreciation Asset Cost Value Date in Years Method Used Buildings $900,000 $0 January 2 50 Double-declining-balance Office Equip. 246,000 26,000 January 3 5 Straight-line Store Equip. 112,000 12,000 July 1 10 Straight-line Description Debit Credit Store Equip. 112,000 12,000 July 1 10 Straight-line Description Debit Credit f. A patent costing $48,000 when acquired on January 2 has a remaining legal life of 10 years and is expected to have value for eight years. Description Debit Credit g. The cost of mineral rights was $546,000. Of the estimated deposit of 910,000 tons of ore, 50,000 tons were mined and sold during the year. Description Debit Credit Description Debit Credit h. Vacation pay expense for December, $10,500. Description Debit Credit i. A product warranty was granted beginning December 1 and covering a one-year period. The estimated cost is 4% of sales, which totaled $1,900,000 in December. Description Debit Credit j. Interest was accrued on the note receivable received on October 17. Assume 360 days per year. Description Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts