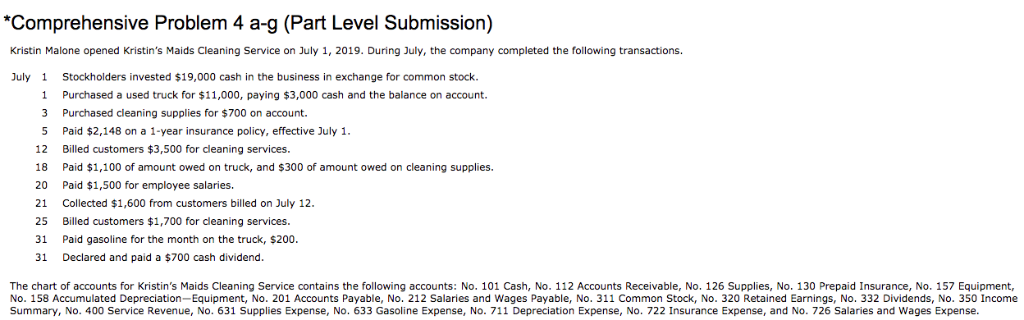

Question: Comprehensive Problem 4 a-g (Part Level Submission) Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2019. During July, the company completed the following

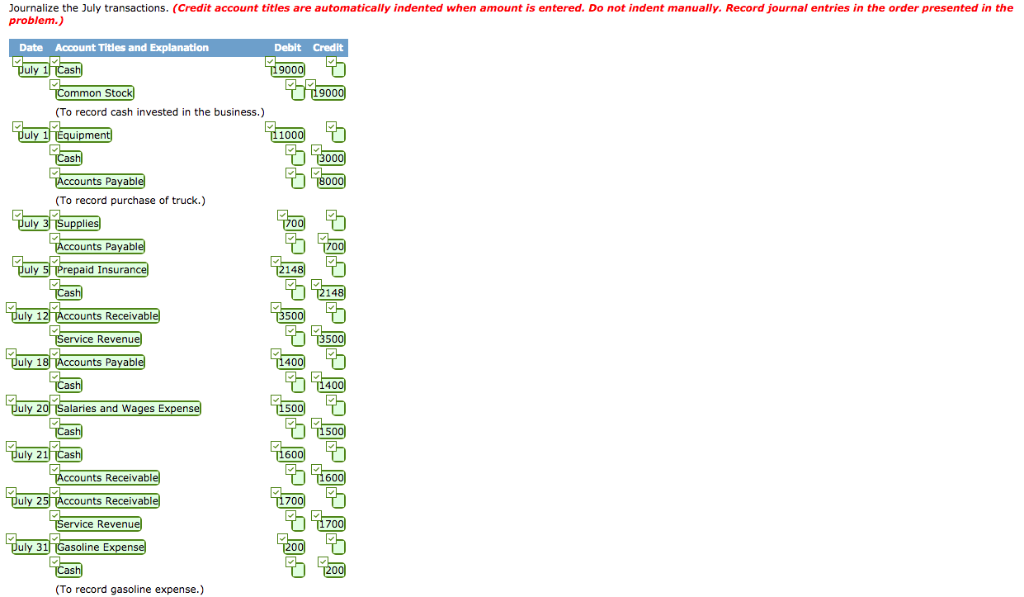

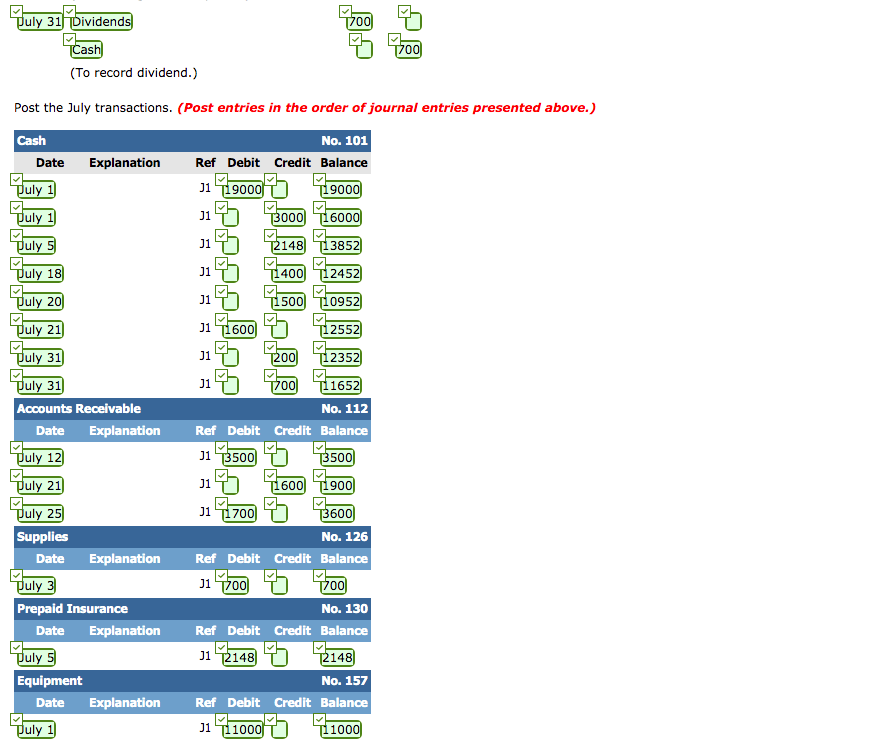

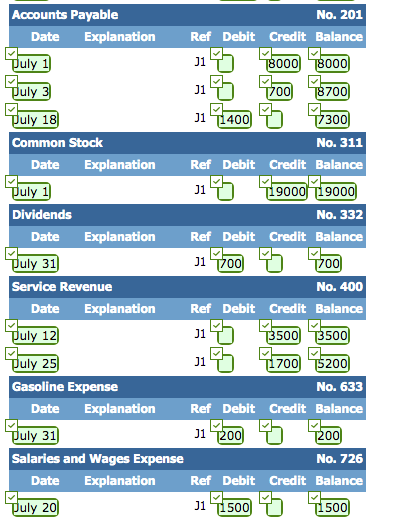

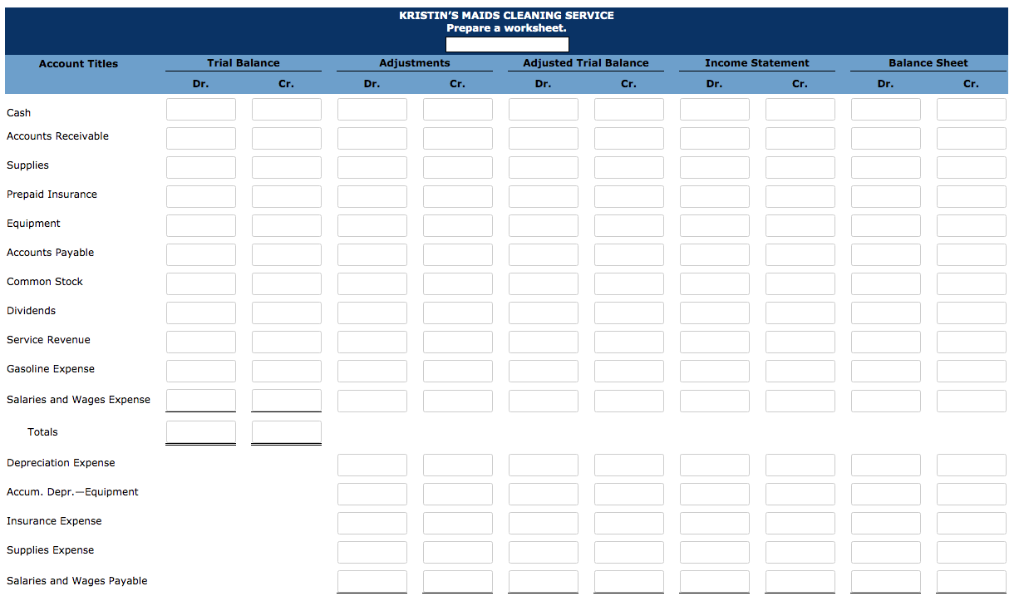

"Comprehensive Problem 4 a-g (Part Level Submission) Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2019. During July, the company completed the following transactions. July 1 Stockholders invested $19,000 cash in the business in exchange for common stock 1 Purchased a used truck for $1,000, paying $3,000 cash and the balance on account 3 Purchased cleaning supplies for $700 on account. 5 Paid $2,148 on a 1-year insurance policy, effective July 1 12 Billed customers $3,500 for cleaning services. 18 Paid $1,100 of amount owed on truck, and $300 of amount owed on cleaning supplies. 20 Paid $1,500 for employee salaries. 21 Collected $1,600 from customers billed on July 12. 25 Billed customers $1,700 for cleaning services. 31 Paid gasoline for the month on the truck, $200 31 Declared and paid a $700 cash dividend The chart of accounts for Kristin's Maids Cleaning Service contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation-Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 311 Common Stock, No. 320 Retained Earnings, No. 332 Dividends, No. 350 Income Summary, No. 400 Service Revenue, No. 631 Supplies Expense, No. 633 Gasoline Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense. ournalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit mon Stock 90 (To record cash invested in the business.) 1100 3000 ounts Payabl (To record purchase of truck.) 00 unts Payabl aid Insuran 135001 nts Receivabl ice Revenu 11400 ounts Payabl alaries and Wages Expens 1500 ) unts Receivabl ounts Receivabl ice Revenu asoline Expens (To record gasoline expense.) ) uly 31Dividend as (To record dividend.) Post the July transactions. (Post entries in the order of journal entries presented above.) No. 101 Date Explanation Ref Debit Credit Balance 119000 9000 ul ul ul uly 18 uly 20 uly 21 uly 31 uly 31 00016000 2148 T1385 400 2452 5001 T0952 2552 2352 1652 1T1600 Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance 1 T3500 uly 12 uly 21 uly 25 Supplies 500 600 1900 600 JI 1700 No. 126 Date Explanation Ref Debit Credit Balance 1 1700 0 ul Prepaid Insurance No. 130 Date Explanation Ref Debit Credit Balance J1L12 148 148 Equipment No. 157 Date Explanation Ref Debit Credit Balance 1T1100 1000 Accounts Payable No. 201 Date Explanation ul ul uly 1 Ref Debit Credit Balance JI 000 8000 1 400 300 Common Stock No. 311 Date Explanation Ref Debit Credit Balance JI uly 900019000 Dividends No. 332 Date Explanation Ref Debit Credit Balance 1 1700 uly 31 0 Service Revenue No. 400 Date uly 12 uly 25 Explanation Ref Debit Credit Balance JI JI 500 500 1700 5200 Gasoline Expense No. 633 Date Explanation Ref Debit Credit Balance 1T200 uly 31 0 Salaries and Wages Expense Date Explanation No. 726 Ref Debit Credit Balance 1 T1500 uly 20 500 "(b) and (c) (b) Prepare a trial balance at July 31 on a worksheet. (c) Enter the following adjustments on the worksheet, and complete the worksheet. (1) Unbilled fees for services performed at July 31 were $1,400. (2) Depreciation on equipment for the month was $280 (3) One-twelfth of the insurance expired (4) An inventory count shows $200 of cleaning supplies on hand at July 31 S) Accrued but unpaid employee salaries were $500. KRISTIN'S MAIDS CLEANING SERVICE Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Dr Cr Dr Cr Dr Cr Cr Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Common Stock Dividends Service Revenue Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr.-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals Net Income Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts