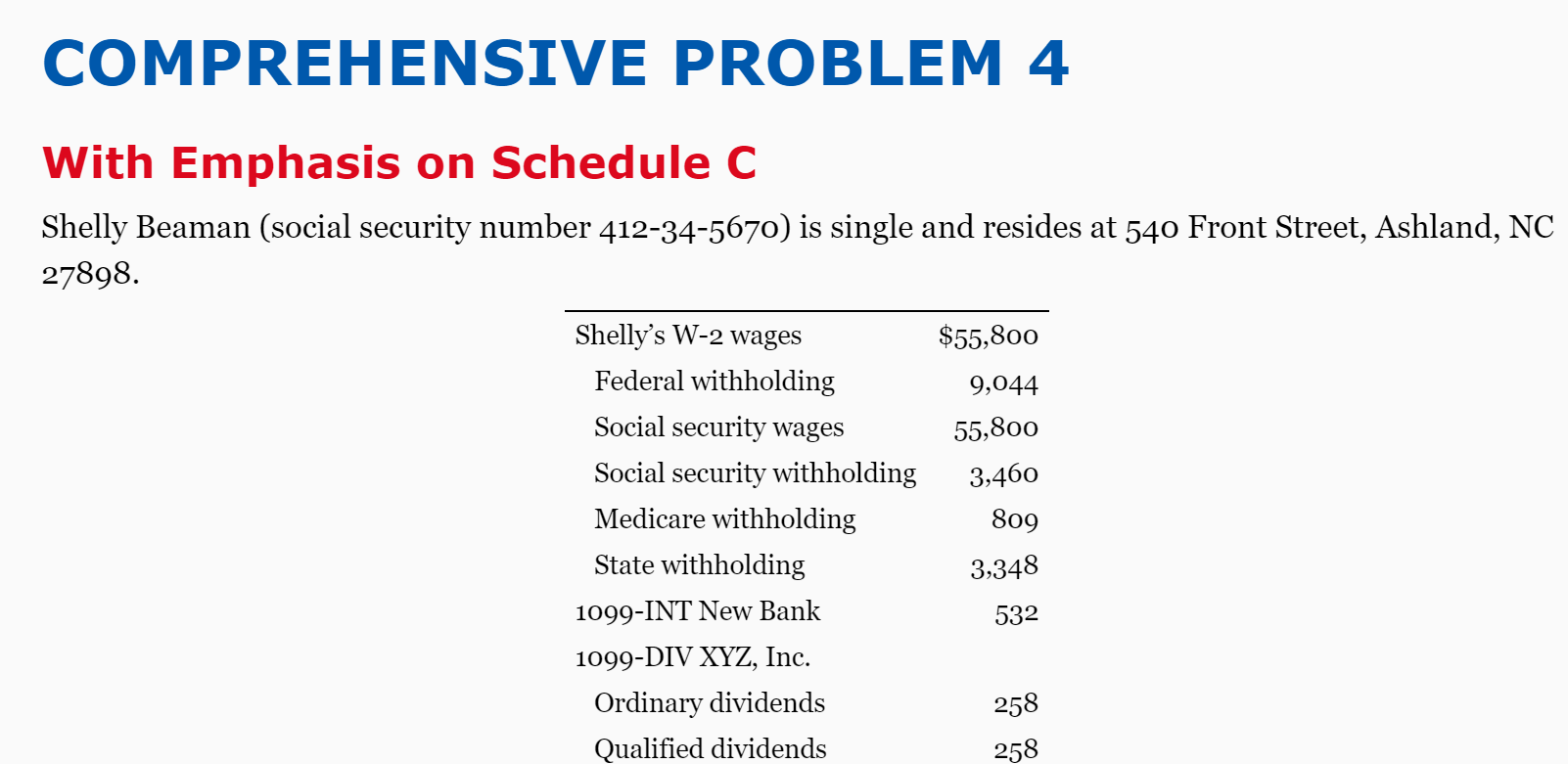

Question: COMPREHENSIVE PROBLEM 4 With Emphasis on Schedule C Shelly Beaman (social security number 412-34-5670) is single and resides at 540 Front Street, Ashland, NC 27898.

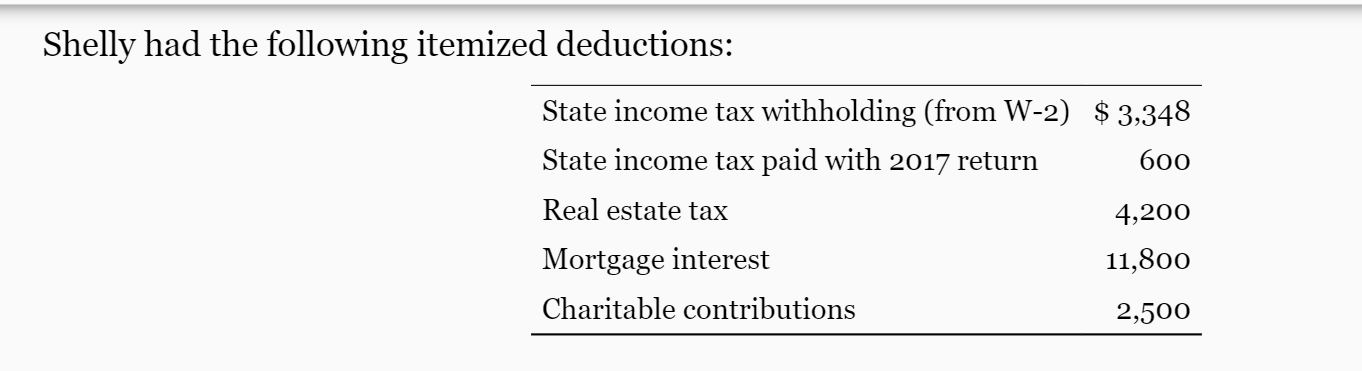

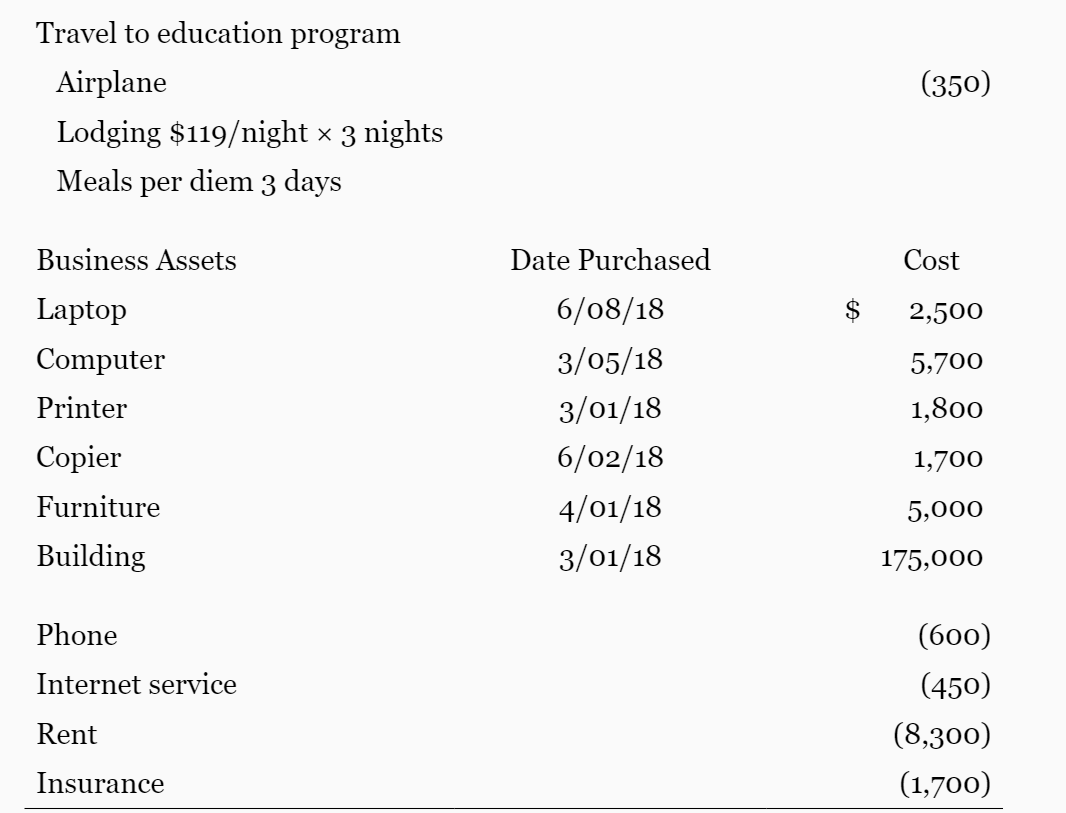

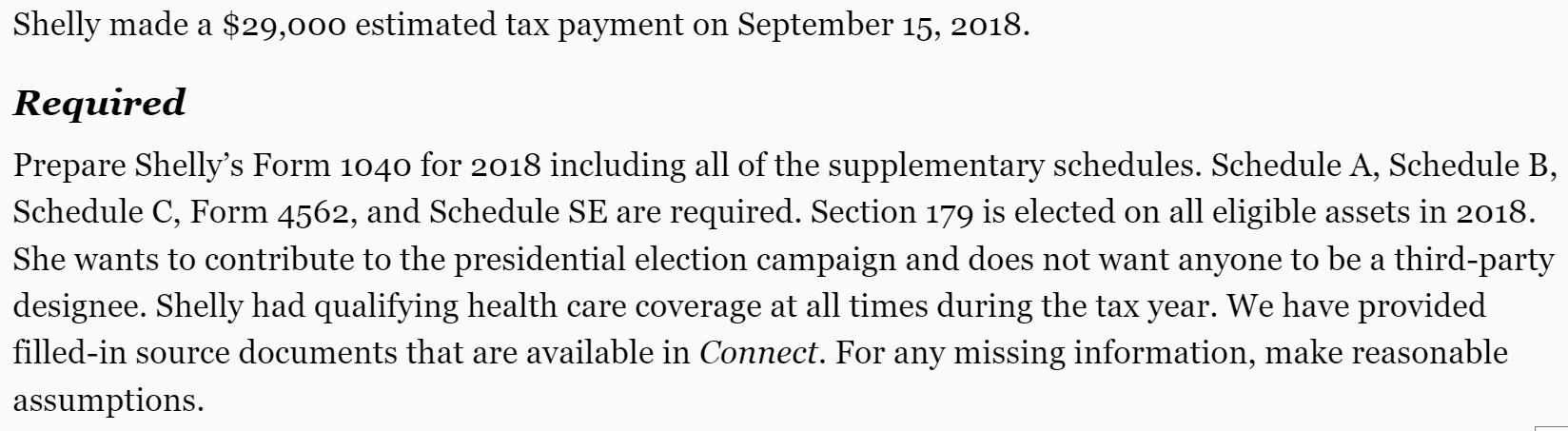

COMPREHENSIVE PROBLEM 4 With Emphasis on Schedule C Shelly Beaman (social security number 412-34-5670) is single and resides at 540 Front Street, Ashland, NC 27898. Shelly's W-2 wages $55,800 Federal withholding 9,044 Social security wages 55,800 Social security withholding 3,460 Medicare withholding 809 State withholding 3,348 1099-INT New Bank 532 1099-DIV XYZ, Inc. Ordinary dividends 258 Qualified dividends 258Shelly had the following itemized deductions: State income tax withholding (from W2) $ 3,348 State income tax paid with 2017 return 600 Real estate tax 4,200 Mortgage interest 11,800 Charitable contributions 2,500 Shelly also started her own home design consulting business in March 2018. The results of h business operations for 2018 follow: Gross receipts from clients $154,000 Vehicle mileage 21,000 business miles (2,100 per month) 32,000 total miles during the year 2010 Chevy Suburban Placed in service 03/01/18 Postage (750) Office supplies (1,500) State license fees (155) Supplies (5,300) Professional fees (2,500) Design software (1,000) Professional education programs (registration) (550)Travel to education program Airplane Lodging $119/ night x 3 nights Meals per diem 3 days Business Assets Laptop Computer Printer Copier Furniture Building Phone Internet service Rent Insurance Date Purchased 6/08/18 3/05/ 18 3/01/ 18 6/02/18 4/01/18 3/01/18 $ (350) Cost 2,500 5,700 1,800 1,700 5,000 175,000 (600) (450) (8,300) (1,700) Shelly made a $29,000 estimated tax payment on September 15, 2018. Required Prepare Shelly's Form 1040 for 2018 including all of the supplementary schedules. Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE are required. Section 179 is elected on all eligible assets in 2018. She wants to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Shelly had qualifying health care coverage at all times during the tax year. We have provided lled-in source documents that are available in Connect. For any missing information, make reasonable assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts