Question: Comprehensive Problem 5 Part C:Note: This section is a continuation from Parts A and B of the comprehensive problem. Be sure you have completed Parts

Comprehensive Problem Part C:Note: This section is a continuation from Parts A and B of the comprehensive problem. Be sure you have completed Parts A and B before attempting Part C You may have to refer back to data presented in Parts A and B as well as use answers from those parts when completing this section.Genuine Spice Inc. began operations on January of the current year. The company produces ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in bottle cases for $ per case. There is a selling commission of $ per case. The January direct materials, direct labor, and factory overhead costs are as follows:DIRECT MATERIALSProductsCostBehaviorUnits per CaseCostper UnitDirect MaterialsCost per CaseCream baseVariable ozs.$$ Natural oilsVariable ozs Bottle ozVariable bottles Total direct materials cost per case $ DIRECT LABORDepartmentCostBehaviorTime per CaseLabor Rateper HourDirect LaborCost per CaseMixingVariable min.$$ FillingVariable min. Total direct labor cost per case min. $ FACTORY OVERHEADLine Item DescriptionCost BehaviorTotal CostUtilitiesMixed$ Facility leaseFixed Equipment depreciationFixed SuppliesFixed Total cost $ Part CAugust Variance AnalysisDuring September of the current year, the controller was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and quantities per case. There were actual cases produced during August, which was more cases than planned at the beginning of the month. Actual data for August were as follows:ProductsActual Direct MaterialsPrice per UnitActual Direct MaterialsQuantity per CaseCream base$ per oz ozs.Natural oils$ per oz ozs.Bottle oz$ per bottle bottlesLine Item DescriptionActual Direct LaborRateActual Direct LaborTime per CaseMixing$ min.Filling min.Actual variable overhead$Normal volume casesThe prices of the materials were different than standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a lower grade labor classification during the month, thus causing the actual labor rate to be less than standard.Required:Enter subtracted amounts with minus sign.Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number Determine and interpret the direct materials price and quantity variances for the three materials. Enter the costs in dollars and cents carried to three decimal places when requiredDetermine and interpret the direct materials price and quantity variances for the three materials. Enter the costs in dollars and cents carried to three decimal places when required

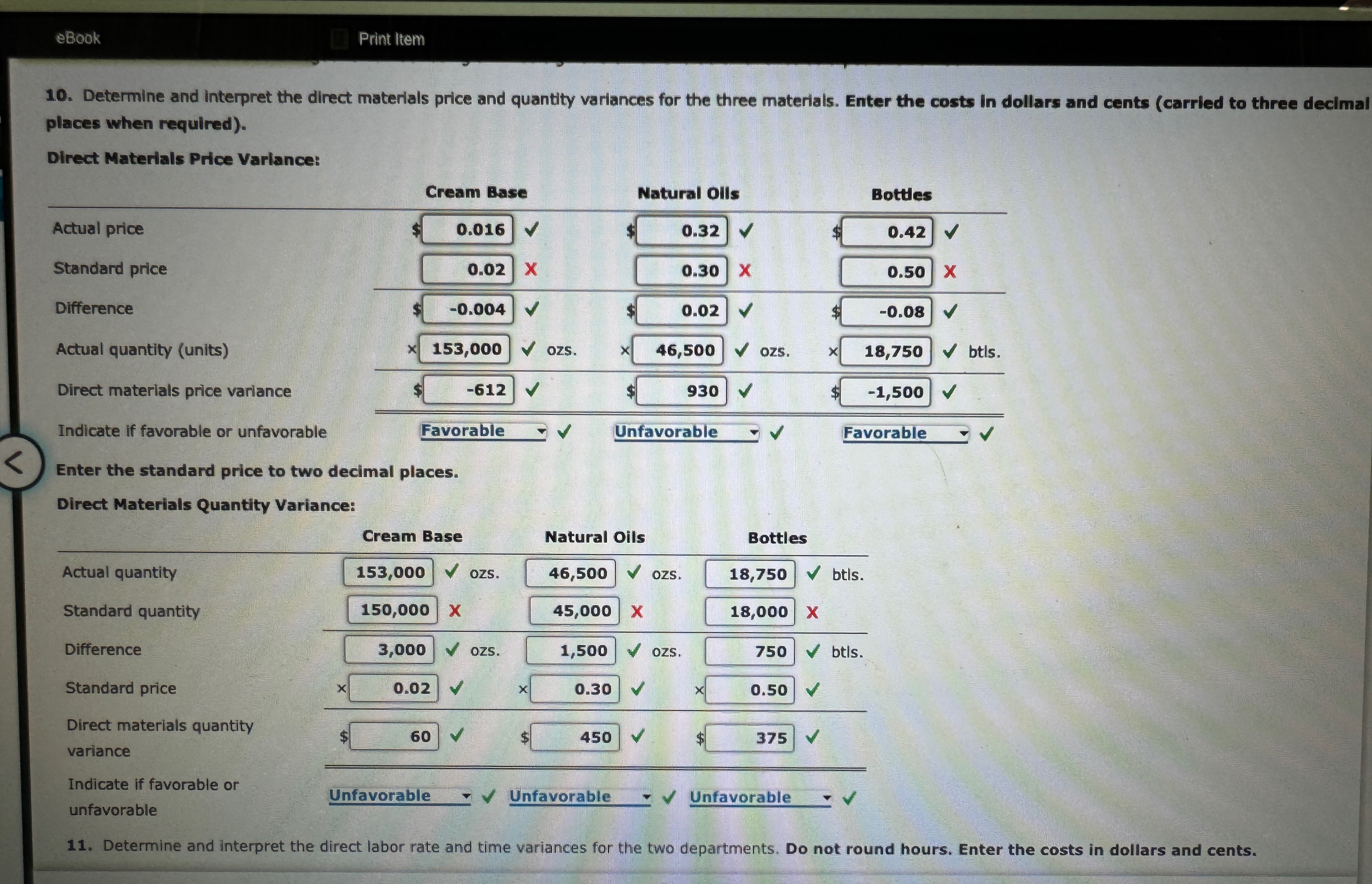

Direct Materials Price Variance:

Enter the standard price to two decimal places.

Direct Materials Quantily Variance:

Determine and interpret the direct labor rate and time variances for the two departments. Do not round hours. Enter the costs in dollars and cents.

Determine and interpret the direct labor rate and time varisnces for the two departments. Do not round hours. Enter the costs In dollars and cents:Direct Labor Rate Varlance:

Actual rate Mixing Department Fliling Department

Standard rate

Difference

Actual time hours

Direct labor rate variance

Indicate if favorable or unfavorable

Direct Labor Time Varlance:

tableActual time hoursMixing Department,Filling Department

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock