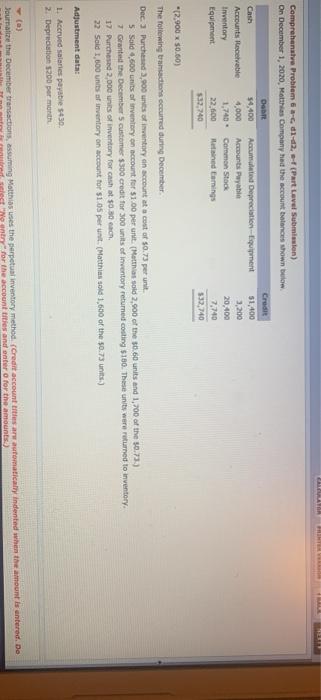

Question: Comprehensive Problem - dl.d. -- (Part Level Submission) On December 1, 2020, Matthias Company had the account balances shown below Cash Accounts Receivable Inventory Equipment

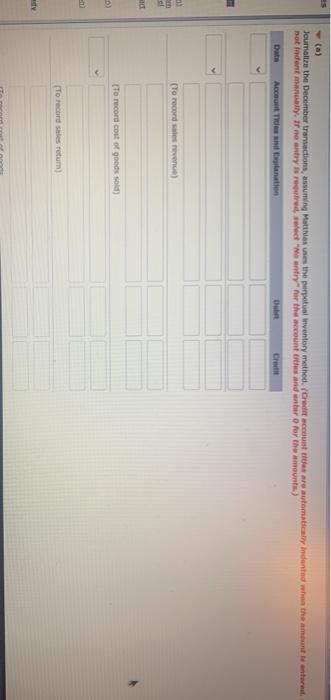

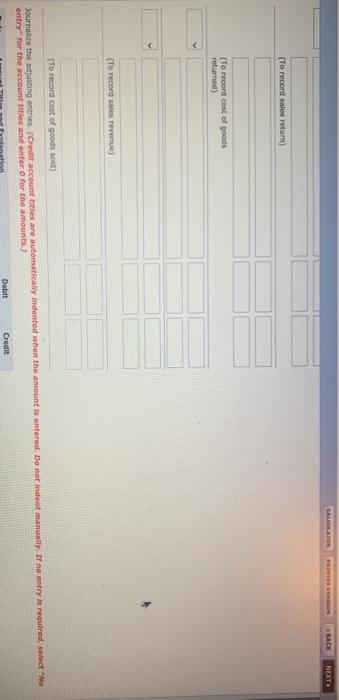

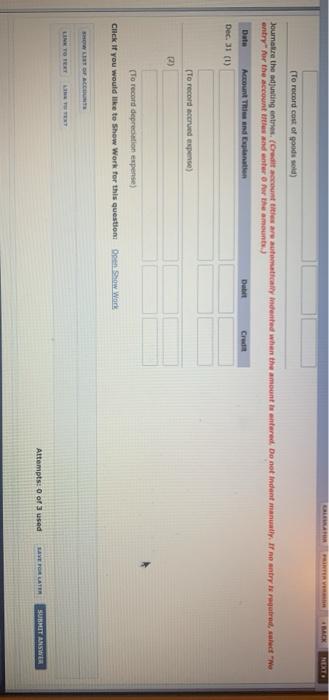

Comprehensive Problem - dl.d. -- (Part Level Submission) On December 1, 2020, Matthias Company had the account balances shown below Cash Accounts Receivable Inventory Equipment De 54,400 Accumulated Depreciation Equipment 4,000 Accounts Payable 1,740 - Common Stock 22 600 Red Earings $33,740 Credit $1,400 3,200 20,400 7,740 $32,740 12,900 x 50.60) The following transions occurred during December Dec. Purchased 3,900 units of inventory an account at a cost of $0.73 per unit 5 Sold 4,600 units of inventory on account for $1.00 per unit (Matthias sold 2,000 of the 1960 units and 1,700 of the 50.73.) 7 Granted the December customer $300 credit for 300 units of inventory returned costing $100. These units were returned to inventory 17 Purchased 2.000 units of inventory for cash at $0.30 G 22 Sold 1,600 units af inventory on account for $1.05 per unit.(Matthias sold 1,600 of the 50.73 units) Adjustment data: Accrued salaries payable 5430 2. Depreciation 200 per month Journalize the December transactions, assuming Matthias uses the perpetual inventory method (Credit account thes ar automatically indented when the amount is entered. De entry for the accountries and one for the amounts (a) Jeumoltze the December transactions, assuming Mattiases the perpetual inventory method Cred countries are automatically indented when the amount interest pot indent many. If no antry fortret "Mentry for the counters and there for the amounts) Accountant Det Creatit To record sales) (To record cost of goods sold) (To record sales return) CALCULATOR NEXT (To record sales return) [To record cost of goods returned) (To record sales revenue) (To record cost of goods sold) Journalize the adjusting entries. Credit account titles are automatically indented when the amount is entered. Do not ment manually. If no entry is required, select "No entry for the account tries and enter for the amounts) Debit Credit GRATOR (To record cost of goods sold) Joumature the adjusting entries. (Credit count title are many indeed when the amount to entered. Do not indent manually. If no antys regard, colect entry for the accounts and enter the amount Date Credit Date Accountries and atten Dec 31 (1) (To record de pense) (To record depreciation expense) Click if you would like to show Work for this question Open Show Work OF AN Attempts: 0 of 3 used SVETOLAT SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts