Question: Comprehensive problem Garmen Technologies Ince a machin and over the internet, with a roughly wen the two channel monitoring The company recently be i ng

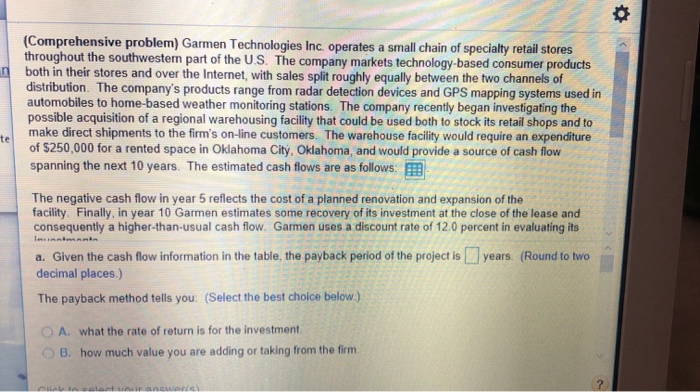

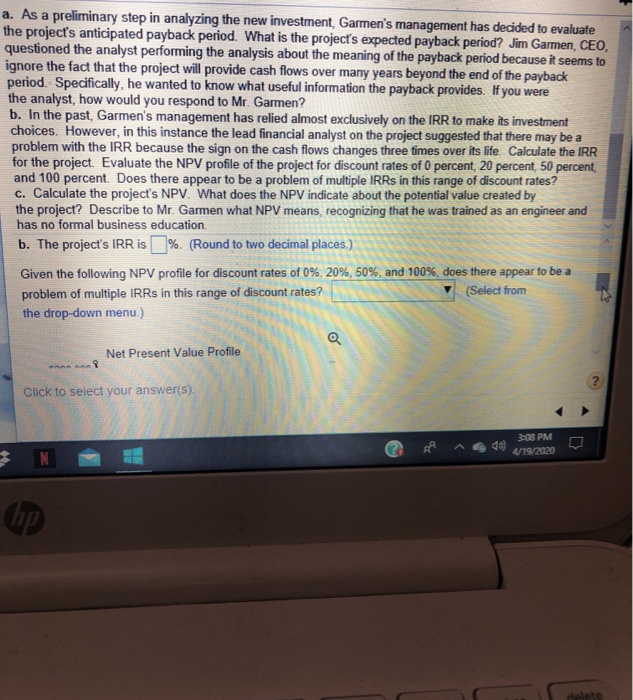

Comprehensive problem Garmen Technologies Ince a machin and over the internet, with a roughly wen the two channel monitoring The company recently be i ng the posible acqui customers. The warehouse teci p are of 250 000 for e s thoughout the st a rt of the US. The company mas technology and commerproducts this there The comp a n i devices and GPSmapping e d in tomobiles to home based her red w oung e we both stocks shops and to make him to the fm's on-line i n O ma Oy. Odhon and ideas of cash low sparing the 18 years Themed cash ose The negative cash low in year este co m e and game of the fact that in very of the decease and.com has found 120 percig a. As a rulinary hep in waying the new n ame's management has decided to the p o w e red What is the respected payback period Im Garmen, CEO oned the analysteeming the analysis whout the wing of the payback period because t here the fact that will shows over many years beyond the end of the payback pe Specifically wanted to know what to the payback s you were the way www.yourdo Garment b. In the p armens management has alma y on the makes the Hewer instance the d a y on the project sted at there may be able with lven the information in the the p ack period of the s ea OA who is the Choong you w a Cack lost your answers) (Comprehensive problem) Garmen Technologies Inc. operates a small chain of specialty retail stores throughout the southwestern part of the US. The company markets technology-based consumer products both in their stores and over the Internet, with sales split roughly equally between the two channels of ution. The company's products range from radar detection devices and GPS mapping systems used in automobiles to home-based weather monitoring stations. The company recently began investigating the possible acquisition of a regional warehousing facility that could be used both to stock its retail shops and to make direct shipments to the firm's on-line customers. The warehouse facility would require an expenditure of $250,000 for a rented space in Oklahoma City, Oklahoma and would provide a source of cash flow spanning the next 10 years. The estimated cash flows are as follows: The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some recovery of its investment at the close of the lease and consequently a higher than usual cash flow. Garmen uses a discount rate of 12.0 percent in evaluating its years. (Round to two a. Given the cash flow information in the table, the payback period of the project is decimal places.) The payback method tells you: (Select the best choice below.) O A. what the rate of return is for the investment B. how much value you are adding or taking from the firm M O UU. He company markets Technology-based consumer products h in their stores and over the Internet, with sales split roughly equally between the two channels of triby i Data Table Com ssib ake $25 anni Year Cash Flow $(250,000) me ne cility onse Years 6 7 AWNO Cash Flow $65,000 65.000 65,000 65,000 60,0008 60,000 6 5.000 9 - Giv ecima g 10 60,000 90,000 (45,000) he pe DA Print Done B. TUW TITUCIT value you are doing or taking Tom T . Click to select your answer(s) 3:07 PM 0 The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some recovery of its investment at the close of the lease and consequently a higher-than-usual cash flow. Garmen uses a discount rate of 12.0 percent in evaluating its investments. a. As a preliminary step in analyzing the new investment Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR a. Given the cash flow information in the table, the payback period of the project is 3 years. (Round to two decimal places.) The payback method tells you: (Select the best choice below.) O A. what the rate of return is for the investment OB. how much value you are adding or taking from the firm. Click to select your answer(s) Q g 3:07 PM 09 4/19/2020 date a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent, and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? C. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education a. Given the cash flow information in the table, the payback period of the project is years. (Round to two decimal places.) The payback method tells you: (Select the best choice below.). A. what the rate of return is for the investment OB. how much value you are adding or taking from the firm. Click to select your answer(s). 3:08 PM o gl - 40 2/10/2000 0 isn't sign ws 10 Update a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CE questioned the analyst performing the analysis about the meaning of the payback period because it seems ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? C. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education OB. how much value you are adding or taking from the firm. O C. how long it takes you to recover your outflows of cash. OD. all of the above. b. The project's IRR is (%. (Round to two decimal places.) Given the following NPV profile for discount rates of 0% 20%, 50%, and 100%, does there appear to be a Click to select your answer(s). of ^600) om O a 3 N = 18 a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education b. The project's IRR is %. (Round to two decimal places.) Given the following NPV profile for discount rates of 0% 20%, 50%, and 100%, does there appear to be a (Select from problem of multiple IRRs in this range of discount rates? the drop-down menu.) Net Present Value Profile Click to select your answer(s). 3:08 PM hp Net Present Value Profile $280,000 $240,000 $200,000 $160,000- $120.000 Click to select your answer(s). gl A 2 J19/2020 An insert insert prt sc prt se dele [delet isn't sign vs 10 Update a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent, and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education c. The project's NPV is 5 (Round to the nearest dollar.) A positive NPV implies: (Select the best choice below.) O A. value is added to the company if the project is undertaken. O B. there is no change in value to the company if the project is undertaken. C. nothing about the value of the company. Click to select your answer(s). 0 of 309 PM 19/2020 ^64 the projects anticipated payback period. What is the project's expected payback period? Jim Ga questioned the analyst performing the analysis about the meaning of the payback period because ignore the fact that the project will provide cash flows over many years beyond the end of the payl period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its invest choices. However, in this instance the lead financial analyst on the project suggested that there mi problem with the IRR because the sign on the cash flows changes three times over its life. Calculat for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 54 and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engin has no formal business education. A positive NPV implies: (Select the best choice below.) O A. value is added to the company if the project is undertaken. O B. there is no change in value to the company if the project is undertaken C. nothing about the value of the company OD. value is subtracted from the company if the project is undertaken. Click to select your answer(s). 2 g 1 3:09 PM 1/19/2020 0 + 0 Comprehensive problem Garmen Technologies Ince a machin and over the internet, with a roughly wen the two channel monitoring The company recently be i ng the posible acqui customers. The warehouse teci p are of 250 000 for e s thoughout the st a rt of the US. The company mas technology and commerproducts this there The comp a n i devices and GPSmapping e d in tomobiles to home based her red w oung e we both stocks shops and to make him to the fm's on-line i n O ma Oy. Odhon and ideas of cash low sparing the 18 years Themed cash ose The negative cash low in year este co m e and game of the fact that in very of the decease and.com has found 120 percig a. As a rulinary hep in waying the new n ame's management has decided to the p o w e red What is the respected payback period Im Garmen, CEO oned the analysteeming the analysis whout the wing of the payback period because t here the fact that will shows over many years beyond the end of the payback pe Specifically wanted to know what to the payback s you were the way www.yourdo Garment b. In the p armens management has alma y on the makes the Hewer instance the d a y on the project sted at there may be able with lven the information in the the p ack period of the s ea OA who is the Choong you w a Cack lost your answers) (Comprehensive problem) Garmen Technologies Inc. operates a small chain of specialty retail stores throughout the southwestern part of the US. The company markets technology-based consumer products both in their stores and over the Internet, with sales split roughly equally between the two channels of ution. The company's products range from radar detection devices and GPS mapping systems used in automobiles to home-based weather monitoring stations. The company recently began investigating the possible acquisition of a regional warehousing facility that could be used both to stock its retail shops and to make direct shipments to the firm's on-line customers. The warehouse facility would require an expenditure of $250,000 for a rented space in Oklahoma City, Oklahoma and would provide a source of cash flow spanning the next 10 years. The estimated cash flows are as follows: The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some recovery of its investment at the close of the lease and consequently a higher than usual cash flow. Garmen uses a discount rate of 12.0 percent in evaluating its years. (Round to two a. Given the cash flow information in the table, the payback period of the project is decimal places.) The payback method tells you: (Select the best choice below.) O A. what the rate of return is for the investment B. how much value you are adding or taking from the firm M O UU. He company markets Technology-based consumer products h in their stores and over the Internet, with sales split roughly equally between the two channels of triby i Data Table Com ssib ake $25 anni Year Cash Flow $(250,000) me ne cility onse Years 6 7 AWNO Cash Flow $65,000 65.000 65,000 65,000 60,0008 60,000 6 5.000 9 - Giv ecima g 10 60,000 90,000 (45,000) he pe DA Print Done B. TUW TITUCIT value you are doing or taking Tom T . Click to select your answer(s) 3:07 PM 0 The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some recovery of its investment at the close of the lease and consequently a higher-than-usual cash flow. Garmen uses a discount rate of 12.0 percent in evaluating its investments. a. As a preliminary step in analyzing the new investment Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR a. Given the cash flow information in the table, the payback period of the project is 3 years. (Round to two decimal places.) The payback method tells you: (Select the best choice below.) O A. what the rate of return is for the investment OB. how much value you are adding or taking from the firm. Click to select your answer(s) Q g 3:07 PM 09 4/19/2020 date a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent, and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? C. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education a. Given the cash flow information in the table, the payback period of the project is years. (Round to two decimal places.) The payback method tells you: (Select the best choice below.). A. what the rate of return is for the investment OB. how much value you are adding or taking from the firm. Click to select your answer(s). 3:08 PM o gl - 40 2/10/2000 0 isn't sign ws 10 Update a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CE questioned the analyst performing the analysis about the meaning of the payback period because it seems ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? C. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education OB. how much value you are adding or taking from the firm. O C. how long it takes you to recover your outflows of cash. OD. all of the above. b. The project's IRR is (%. (Round to two decimal places.) Given the following NPV profile for discount rates of 0% 20%, 50%, and 100%, does there appear to be a Click to select your answer(s). of ^600) om O a 3 N = 18 a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education b. The project's IRR is %. (Round to two decimal places.) Given the following NPV profile for discount rates of 0% 20%, 50%, and 100%, does there appear to be a (Select from problem of multiple IRRs in this range of discount rates? the drop-down menu.) Net Present Value Profile Click to select your answer(s). 3:08 PM hp Net Present Value Profile $280,000 $240,000 $200,000 $160,000- $120.000 Click to select your answer(s). gl A 2 J19/2020 An insert insert prt sc prt se dele [delet isn't sign vs 10 Update a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO questioned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem with the IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 50 percent, and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engineer and has no formal business education c. The project's NPV is 5 (Round to the nearest dollar.) A positive NPV implies: (Select the best choice below.) O A. value is added to the company if the project is undertaken. O B. there is no change in value to the company if the project is undertaken. C. nothing about the value of the company. Click to select your answer(s). 0 of 309 PM 19/2020 ^64 the projects anticipated payback period. What is the project's expected payback period? Jim Ga questioned the analyst performing the analysis about the meaning of the payback period because ignore the fact that the project will provide cash flows over many years beyond the end of the payl period. Specifically, he wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr. Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its invest choices. However, in this instance the lead financial analyst on the project suggested that there mi problem with the IRR because the sign on the cash flows changes three times over its life. Calculat for the project. Evaluate the NPV profile of the project for discount rates of 0 percent, 20 percent, 54 and 100 percent. Does there appear to be a problem of multiple IRRs in this range of discount rates c. Calculate the project's NPV. What does the NPV indicate about the potential value created by the project? Describe to Mr. Garmen what NPV means, recognizing that he was trained as an engin has no formal business education. A positive NPV implies: (Select the best choice below.) O A. value is added to the company if the project is undertaken. O B. there is no change in value to the company if the project is undertaken C. nothing about the value of the company OD. value is subtracted from the company if the project is undertaken. Click to select your answer(s). 2 g 1 3:09 PM 1/19/2020 0 + 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts