Question: COMPREHENSIVE PROBLEM N 25. Toni Tornan is a single parent. During 2019 she earned wages $26,750. Her employer did not withhold federal income taxes from

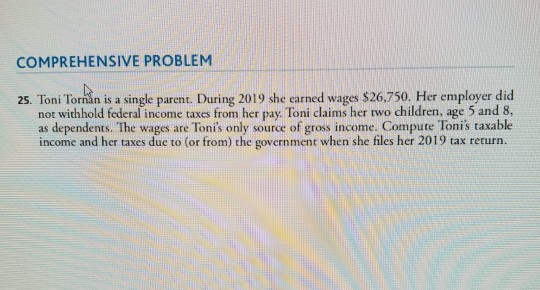

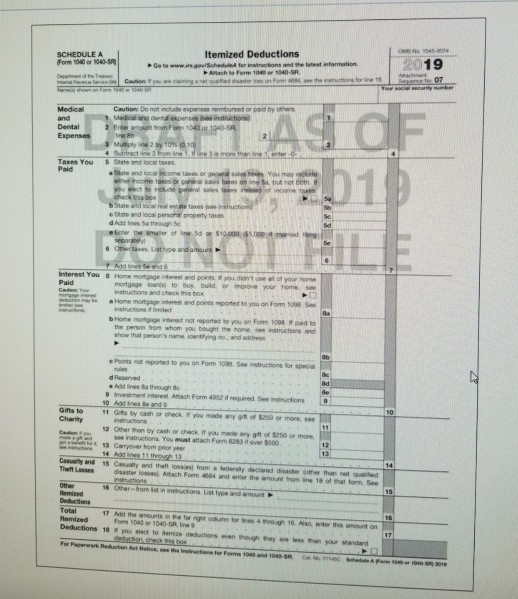

COMPREHENSIVE PROBLEM N 25. Toni Tornan is a single parent. During 2019 she earned wages $26,750. Her employer did not withhold federal income taxes from her pay. Toni claims her two children, age 5 and 8, as dependents. The wages are Toni's only source of gross income. Compute Tonis taxable income and her taxes due to (or from the government when she files her 2019 tax return. SCHEDULE A Itemized Deductions Form 1000 or 1040-SR Go to www.in.govih ter t ion and the latest information Aracht Form 1040 540-SR. Can you d onFami Nemethode Medical EAT I de Caution: Do not include expenses remunted or paid by the 1 Medical and compenso isto 2 Endermount om 1040 1040-SR Dental Expenses Taxes You Paid 3 Music by 10% 0,10 4 Subtracted from his more than 5 Sate and locales Stand local income tax or You may home and son industrot both you set to be the come Stewartetencion State and local personal property taxes .000 her the male of $10.000 separately spedamot 6 O 7 Aadlines and Interest You & Home more interest and presyou didn't use of your mortgage loan to buy build m ove your home. See instructions and check this bar Home mortgage interest and poned to you on Form 1008S bone mongest not reported to you on Fm 1090 adto The person to whom you bought the home s truction and show that personna g , and contreported to you on om 10 S u ctions for d Resed Add in a through nvestment Attach Form 4952 10 Adressed 91 c a red u ctions y Of more 12 Other than by cash or check if you a s tructions. You must attach Form 6283 13 Carryover om prior gt of $250 more 0 0 y Casuan 15 Casual and that m The losses dastro Attach Form 6604 16 Oer-from intors cre the mount om a ted 18 tom se and mot Deductions 11 Add the amounts t o A Deductions 18 nton you to cho o s e your wanded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts