Question: Comprehensive Problem (Problem info and working papers) Bob opened Bob's Plumbing on July 01, 2020. During July the company completed these transactions. July 01 Bob

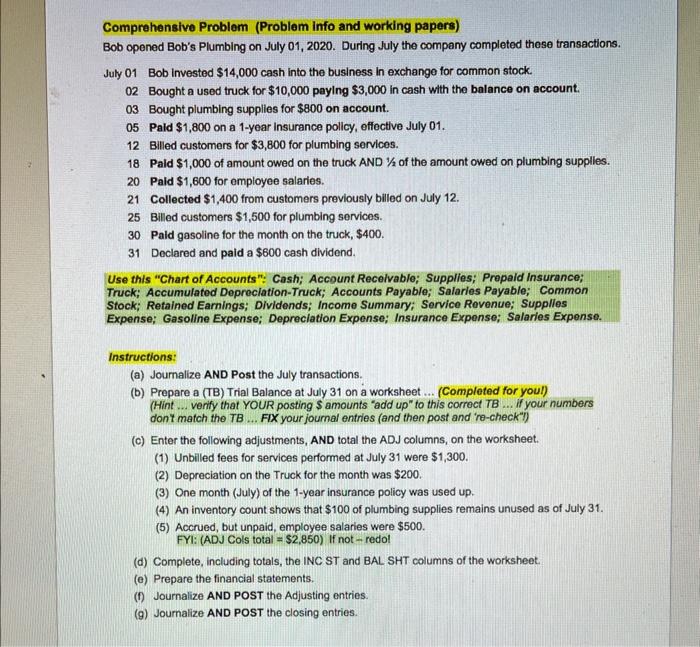

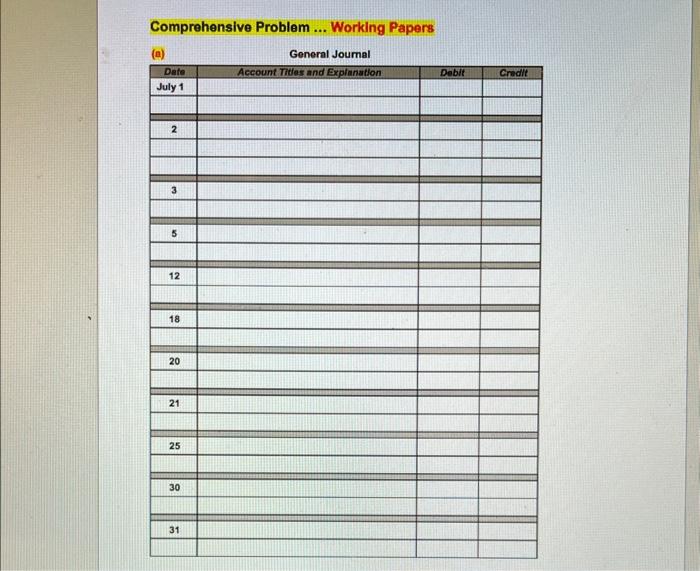

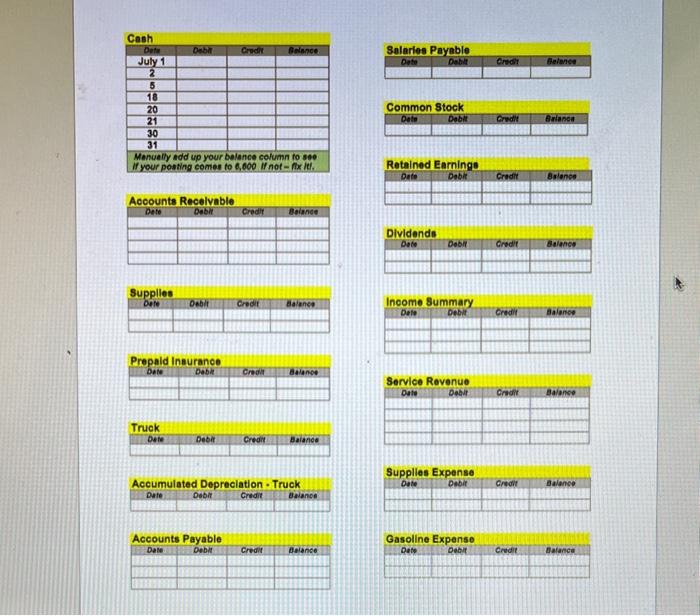

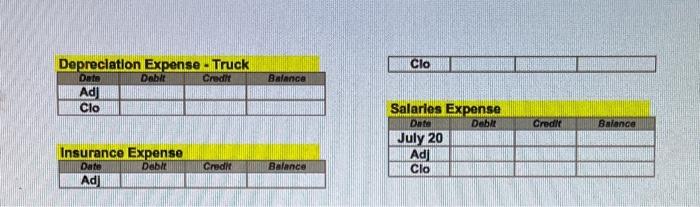

Comprehensive Problem (Problem info and working papers) Bob opened Bob's Plumbing on July 01, 2020. During July the company completed these transactions. July 01 Bob invested $14,000 cash into the business in exchange for common stock. 02 Bought a used truck for $10,000 paying $3,000 in cash with the balance on account. 03 Bought plumbing supplies for $800 on account. 05 Paid $1,800 on a 1-year insurance policy, effectlve July 01. 12 Billed customers for $3,800 for plumbing services. 18 Paid $1,000 of amount owed on the truck AND 1/2 of the amount owed on plumbing supples. 20 Paid $1,600 for employee salaries. 21 Collected $1,400 from customers previously billed on July 12 . 25 Billed customers $1,500 for plumbing services. 30 Paid gasoline for the month on the truck, $400. 31 Declared and paid a $600 cash dividend. Use this "Chart of Accounts": Cash; Account Recelvable; Supplies; Prepaid Insurance; Truck; Accumulated Depreclation-Truck; Accounts Payable; Salaries Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue; Supplles Expense; Gasoline Expense; Depreciation Expense; Insurance Expense; Salaries Expense. Instructions: (a) Joumalize AND Post the July transactions. (b) Prepare a (TB) Trial Balance at July 31 on a worksheet... (Completed for youl) (Hint ... verify that YOUR posting $ amounts "add up" to this correct TB ... If your numbers dont match the TB ... FIX your journal entries (and then post and 're-check"') (c) Enter the following adjustments, AND total the ADJ columns, on the worksheet. (1) Unbiled fees for services performed at July 31 were $1,300. (2) Depreciation on the Truck for the month was $200. (3) One month (July) of the 1-year insurance policy was used up. (4) An inventory count shows that $100 of plumbing supplies remains unused as of July 31. (5) Accrued, but unpaid, employee salaries were $500. FYl: (ADJ Cols total =$2,850 ) If not redol (d) Complete, including totals, the INC ST and BAL SHT columns of the worksheet. (e) Prepare the financial statements. (f) Journalize AND POST the Adjusting entries. (g) Journalize AND POST the closing entries. Comprehensive Problem ... Working Papers (a) Gonaral Inumal Cash \begin{tabular}{|c|c|c|c|} \hline Acoounte Recelvable \\ \begin{tabular}{|c|c|c|c|} \hline Dete & Debli & credit elanet \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \end{tabular} Common Stock \begin{tabular}{|c|c|c|c|} \hline Dote & Debk & Credit & Erranea \\ \hline & & & \\ \hline \end{tabular} Dlvidands \begin{tabular}{|c|c|c|c|} \hline Dete & Debit & Gredit & Bainhse \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Truck Accumulated Depreclation - Truck Servlee Revenue \begin{tabular}{|l|l|l|l|} \hline Date Beat Besolit Balanse \\ \hline & & & \\ \hline & & & \\ \hline & & \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|c|c|c|c|} \hline Oute cosolit Galence \\ \hline \end{tabular} Gasoline Expense Salarios Expense \begin{tabular}{|c|c|c|c|} \hline Dute & Dobli & Credil & Batance \\ \hline July 20 & & & \\ \hline Adj & & & \\ \hline Clo & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts