Question: Comprehensive ProblemComplete the comprehensive problem which includes calculation of Division B income, taxable incomeand calculation of the federal taxes owing after taking into account the

Comprehensive ProblemComplete the comprehensive problem which includes calculation of Division B income, taxable incomeand calculation of the federal taxes owing after taking into account the refundable and non-refundable taxcredits available.

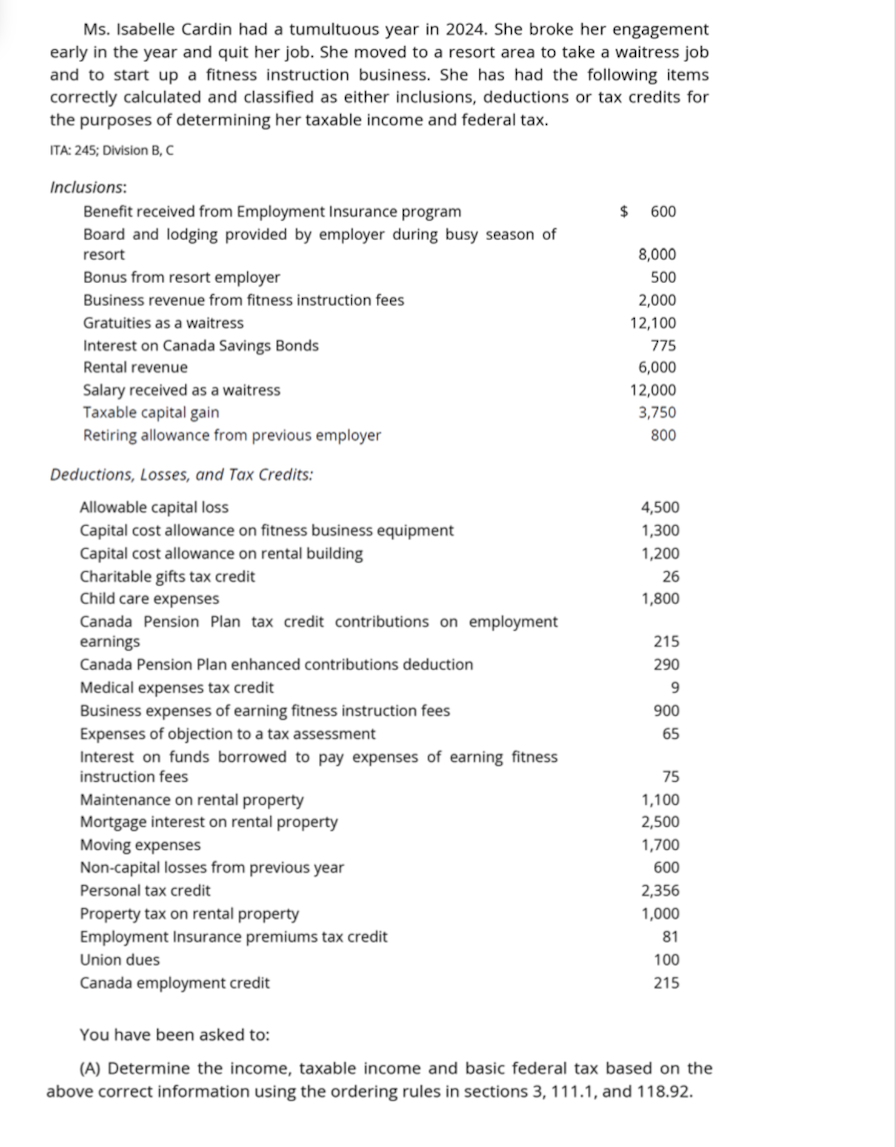

Ms. Isabelle Cardin had a tumultuous year in 2024. She broke her engagement early in the year and quit her job. She moved to a resort area to take a waitress job and to start up a fitness instruction business. She has had the following items correctly calculated and classified as either inclusions, deductions or tax credits for the purposes of determining her taxable income and federal tax, ITA: 245; Division B, C Inclusions: Benefit received from Employment Insurance program $ 600 Board and lodging provided by employer during busy season of resort 8,000 Bonus from resort employer 500 Business revenue from fitness instruction fees 2,000 Gratuities as a waitress 12,100 Interest on Canada Savings Bonds 775 Rental revenue 6,000 Salary received as a waitress 12,000 Taxable capital gain 3,750 Retiring allowance from previous employer 800 Deductions, Losses, and Tax Credits: Allowable capital loss 4,500 Capital cost allowance on fitness business equipment 1,300 Capital cost allowance on rental building 1,200 Charitable gifts tax credit 26 Child care expenses 1,800 Canada Pension Plan tax credit contributions on employment earnings 215 Canada Pension Plan enhanced contributions deduction 290 Medical expenses tax credit 9 Business expenses of earning fitness instruction fees 900 Expenses of objection to a tax assessment 65 Interest on funds borrowed to pay expenses of earning fitness instruction fees 75 Maintenance on rental property 1,100 Mortgage interest on rental property 2,500 Moving expenses 1,700 Non-capital losses from previous year 600 Personal tax credit 2,356 Property tax on rental property 1,000 Employment Insurance premiums tax credit 81 Union dues 100 Canada employment credit 215 You have been asked to: (A) Determine the income, taxable income and basic federal tax based on the above correct information using the ordering rules in sections 3, 111.1, and 118.92