Question: Comprehensive Problems 6 Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21-3434) have a 19-year-old son (born

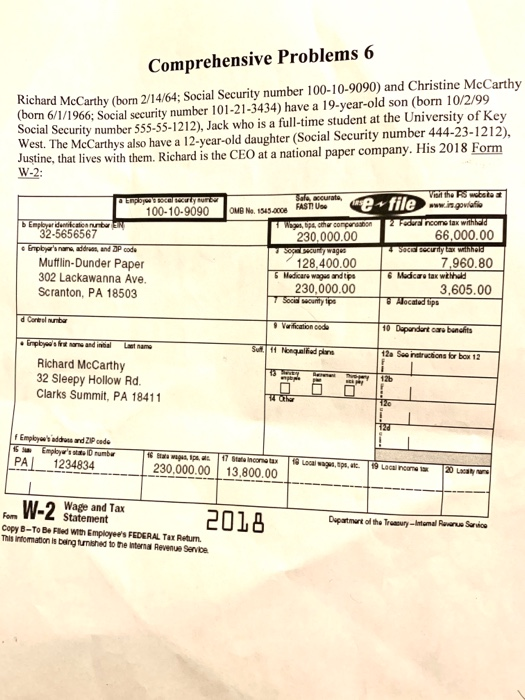

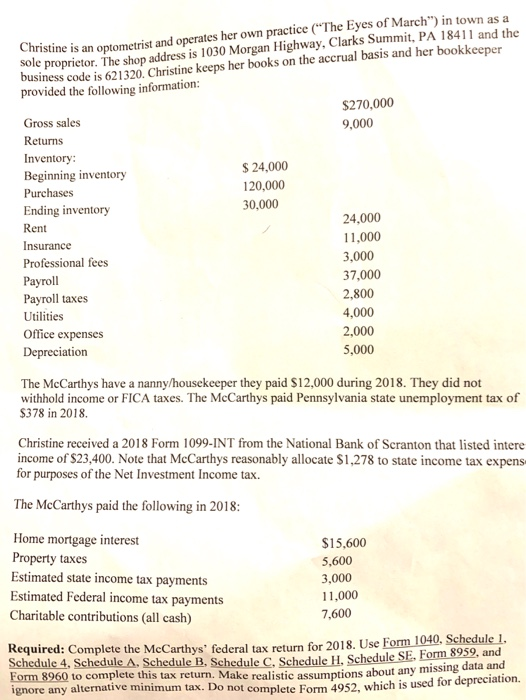

Comprehensive Problems 6 Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21-3434) have a 19-year-old son (born 10/2/99 Social Security number 555-55-1212), Jack who is a full-time student at the University of Key West. The McCarthys also have a 12-year-old daughter (Social Security number 444-23-1212), Justine, that lives with them. Richard is the CEO at a national paper company. His 2018 Form W-2: DE BURO 100-10-9090 Employer delicata 32-5656567 Erbjar's name, address, and BP code Mufflin-Dunder Paper 302 Lackawanna Ave. Scranton, PA 18503 OMB No 1545.200 FASTI U U 11 Wages, ops, che composition 230,000.00 Socecundy Wages 128,400.00 5 Medicare wages and tips 230,000.00 7 Social Security tips the water mewww.gofio F rencome tax with 66,000.00 2SCC a WINDIG 7,960.80 6 Medicare tax withold 3,605.00 Alocated tips cartela Verification code 10 Dependent care banchts 11 Nega led phone 12a See instructions for box 12 inpbyooshatare and intial frame Richard McCarthy 32 Sleepy Hollow Rd. Clarks Summit, PA 18411 Employhadu and ZIP code 15 Employe m be PAL_1234834 gas. 10. 230,000.00 Sincangu 13,800.00 LG 19 Locarne 20 L rom W-2 Wage and Tax 2018 Department of the Treasury-Intamal R ue Service Copy B-To Be Fled with Employee's FEDERAL Tax Return This information is bang mished to the internal Revenue Service Christine is an optometrist and operates her own practice ("The Eyes of March") in town as a Sole proprietor. The shop address is 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provided the following information: $270,000 9,000 $ 24,000 120,000 30,000 Gross sales Returns Inventory: Beginning inventory Purchases Ending inventory Rent Insurance Professional fees Payroll Payroll taxes Utilities Office expenses Depreciation 24,000 11,000 3,000 37,000 2,800 4,000 2,000 5,000 The McCarthys have a nanny/housekeeper they paid $12,000 during 2018. They did not withhold income or FICA taxes. The McCarthys paid Pennsylvania state unemployment tax of $378 in 2018. Christine received a 2018 Form 1099-INT from the National Bank of Scranton that listed intere income of $23,400. Note that McCarthys reasonably allocate $1,278 to state income tax expens for purposes of the Net Investment Income tax. The McCarthys paid the following in 2018: $15,600 5,600 Home mortgage interest Property taxes Estimated state income tax payments Estimated Federal income tax payments Charitable contributions (all cash) 3,000 11,000 7,600 Required: Complete the McCarthys' federal tax return for 2018. Use Form 1040. Schedule 1, Schedule 4. Schedule A. Schedule B, Schedule C, Schedule H, Schedule SEE B Schedule Schedule H Schedule SE. Form 8959, and Form 8960 to complete this tax return. Make realistic assumptions about any mis ignore any alternative minimum tax. Do not complete Form 4952 which is used for depreciation. Comprehensive Problems 6 Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21-3434) have a 19-year-old son (born 10/2/99 Social Security number 555-55-1212), Jack who is a full-time student at the University of Key West. The McCarthys also have a 12-year-old daughter (Social Security number 444-23-1212), Justine, that lives with them. Richard is the CEO at a national paper company. His 2018 Form W-2: DE BURO 100-10-9090 Employer delicata 32-5656567 Erbjar's name, address, and BP code Mufflin-Dunder Paper 302 Lackawanna Ave. Scranton, PA 18503 OMB No 1545.200 FASTI U U 11 Wages, ops, che composition 230,000.00 Socecundy Wages 128,400.00 5 Medicare wages and tips 230,000.00 7 Social Security tips the water mewww.gofio F rencome tax with 66,000.00 2SCC a WINDIG 7,960.80 6 Medicare tax withold 3,605.00 Alocated tips cartela Verification code 10 Dependent care banchts 11 Nega led phone 12a See instructions for box 12 inpbyooshatare and intial frame Richard McCarthy 32 Sleepy Hollow Rd. Clarks Summit, PA 18411 Employhadu and ZIP code 15 Employe m be PAL_1234834 gas. 10. 230,000.00 Sincangu 13,800.00 LG 19 Locarne 20 L rom W-2 Wage and Tax 2018 Department of the Treasury-Intamal R ue Service Copy B-To Be Fled with Employee's FEDERAL Tax Return This information is bang mished to the internal Revenue Service Christine is an optometrist and operates her own practice ("The Eyes of March") in town as a Sole proprietor. The shop address is 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provided the following information: $270,000 9,000 $ 24,000 120,000 30,000 Gross sales Returns Inventory: Beginning inventory Purchases Ending inventory Rent Insurance Professional fees Payroll Payroll taxes Utilities Office expenses Depreciation 24,000 11,000 3,000 37,000 2,800 4,000 2,000 5,000 The McCarthys have a nanny/housekeeper they paid $12,000 during 2018. They did not withhold income or FICA taxes. The McCarthys paid Pennsylvania state unemployment tax of $378 in 2018. Christine received a 2018 Form 1099-INT from the National Bank of Scranton that listed intere income of $23,400. Note that McCarthys reasonably allocate $1,278 to state income tax expens for purposes of the Net Investment Income tax. The McCarthys paid the following in 2018: $15,600 5,600 Home mortgage interest Property taxes Estimated state income tax payments Estimated Federal income tax payments Charitable contributions (all cash) 3,000 11,000 7,600 Required: Complete the McCarthys' federal tax return for 2018. Use Form 1040. Schedule 1, Schedule 4. Schedule A. Schedule B, Schedule C, Schedule H, Schedule SEE B Schedule Schedule H Schedule SE. Form 8959, and Form 8960 to complete this tax return. Make realistic assumptions about any mis ignore any alternative minimum tax. Do not complete Form 4952 which is used for depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts