Question: Comprehensive Project 1 v2 Using Excel Boyd Corporation is a manufacturer that uses job order costing. On January 1, 2024, the company's inventory balances were

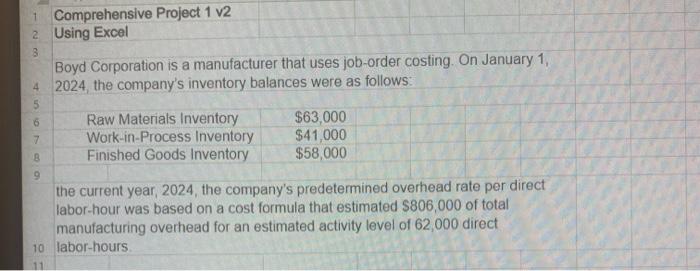

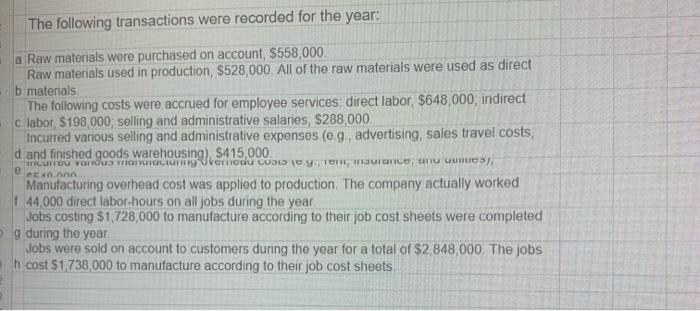

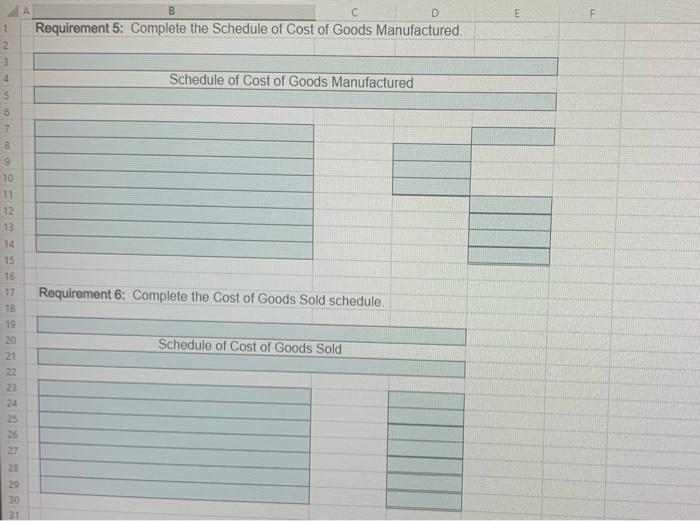

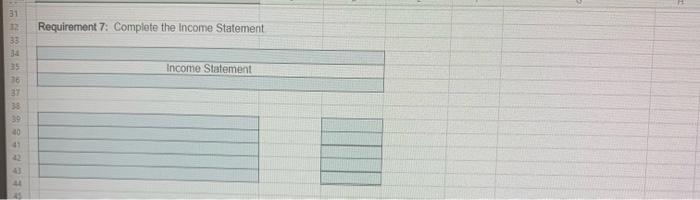

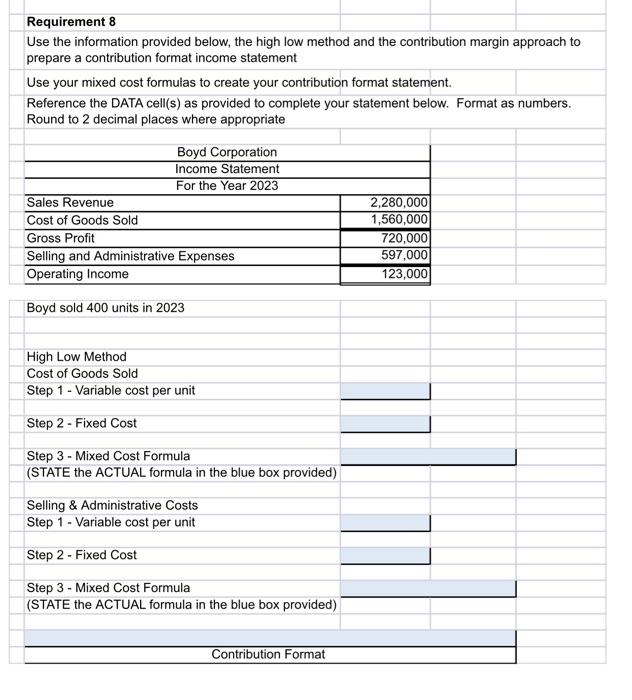

1 Comprehensive Project 1 V2 2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 4 2024, the company's inventory balances were as follows: 6 7 8 9 Raw Materials Inventory Work-in-Process Inventory Finished Goods Inventory $63,000 $41,000 $58,000 the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $806,000 of total manufacturing overhead for an estimated activity level of 62,000 direct 10 labor-hours The following transactions were recorded for the year: . a Raw materials were purchased on account, $558,000. Raw materials used in production, $528,000. All of the raw materials were used as direct b materials The following costs were accrued for employee services: direct labor, $648,000, indirect c labor $198.000, selling and administrative salaries, $288,000 Incurred various selling and administrative expenses (eg, advertising, sales travel costs, d and finished goods warehousing $415000 TUTTO Vanida ICICI Uveriodu COLD TOWULO 3 Manufacturing overhead cost was applied to production. The company actually worked 1 44.000 direct labor hours on all jobs during the year Jobs costing $1,728,000 to manufacture according to their job cost sheets were completed g during the year Jobs were sold on account to customers during the year for a total of $2,848,000. The jobs h cost $1,738,000 to manufacture according to their job cost sheets 0 AAN D E F F B C Requirement 5: Complete the Schedule of Cost of Goods Manufactured. Schedule of Cost of Goods Manufactured 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Requirement 6: Complete the cost of Goods Sold schedule. Schedule of Cost of Goods Sold 23 24 25 26 27 20 29 30 31 31 Requirement 7: Complete the income Statement Income Statement 33 3 35 36 37 38 39 10 41 BO Requirement 8 Use the information provided below, the high low method and the contribution margin approach to prepare a contribution format income statement Use your mixed cost formulas to create your contribution format statement Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Round to 2 decimal places where appropriate Boyd Corporation Income Statement For the Year 2023 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income 2,280,000 1,560,000 720,000 597,000 123,000 Boyd sold 400 units in 2023 High Low Method Cost of Goods Sold Step 1 - Variable cost per unit Step 2 - Fixed Cost - Step 3 - Mixed Cost Formula (STATE the ACTUAL formula in the blue box provided) Selling & Administrative Costs Step 1 - Variable cost per unit Step 2 - Fixed Cost Step 3 - Mixed Cost Formula (STATE the ACTUAL formula in the blue box provided) Contribution Format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts