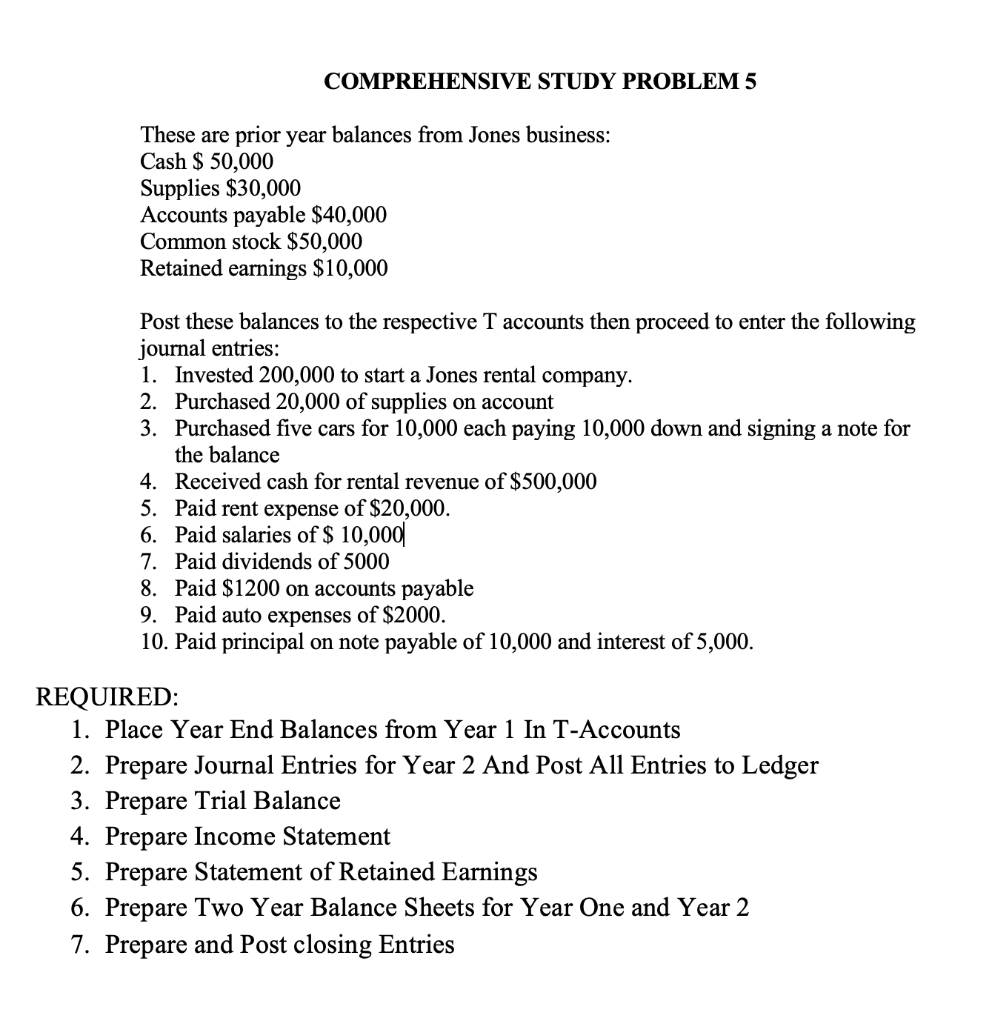

Question: COMPREHENSIVE STUDY PROBLEM 5 These are prior year balances from Jones business: Cash $ 50,000 Supplies $30,000 Accounts payable $40,000 Common stock $50,000 Retained earnings

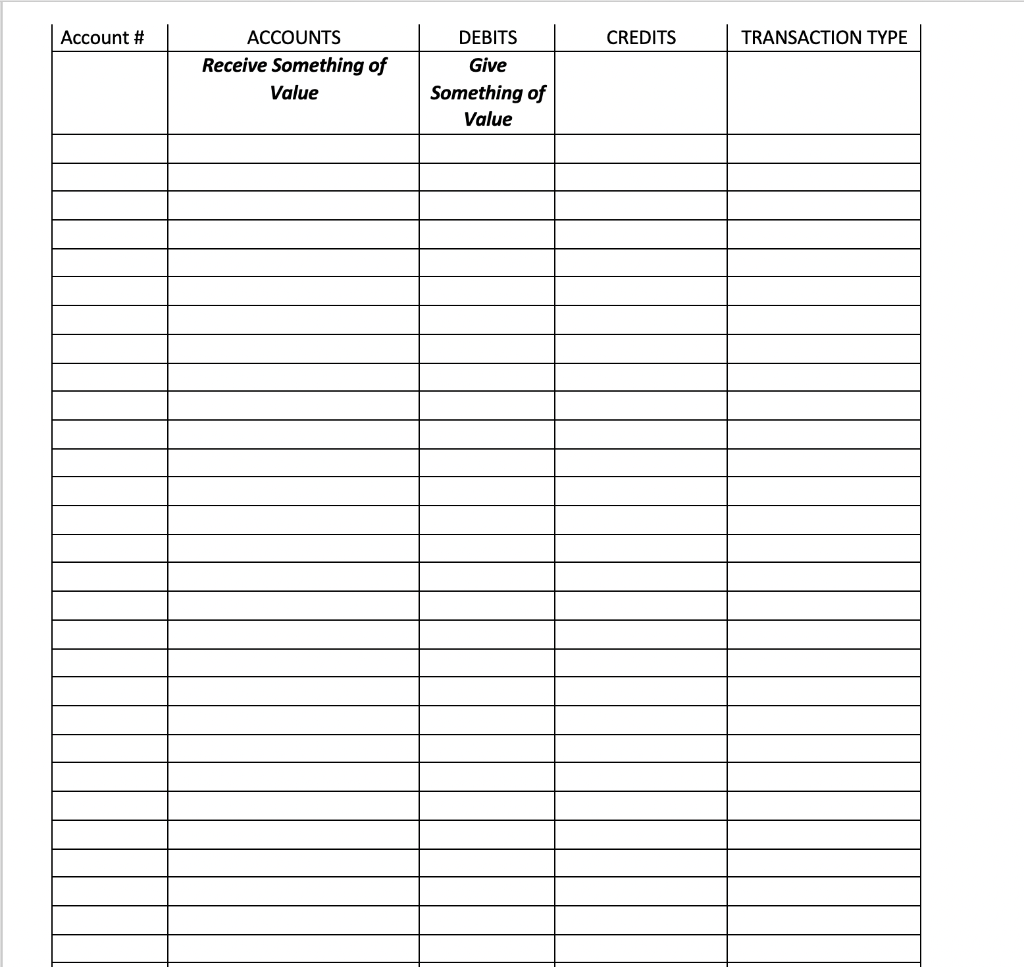

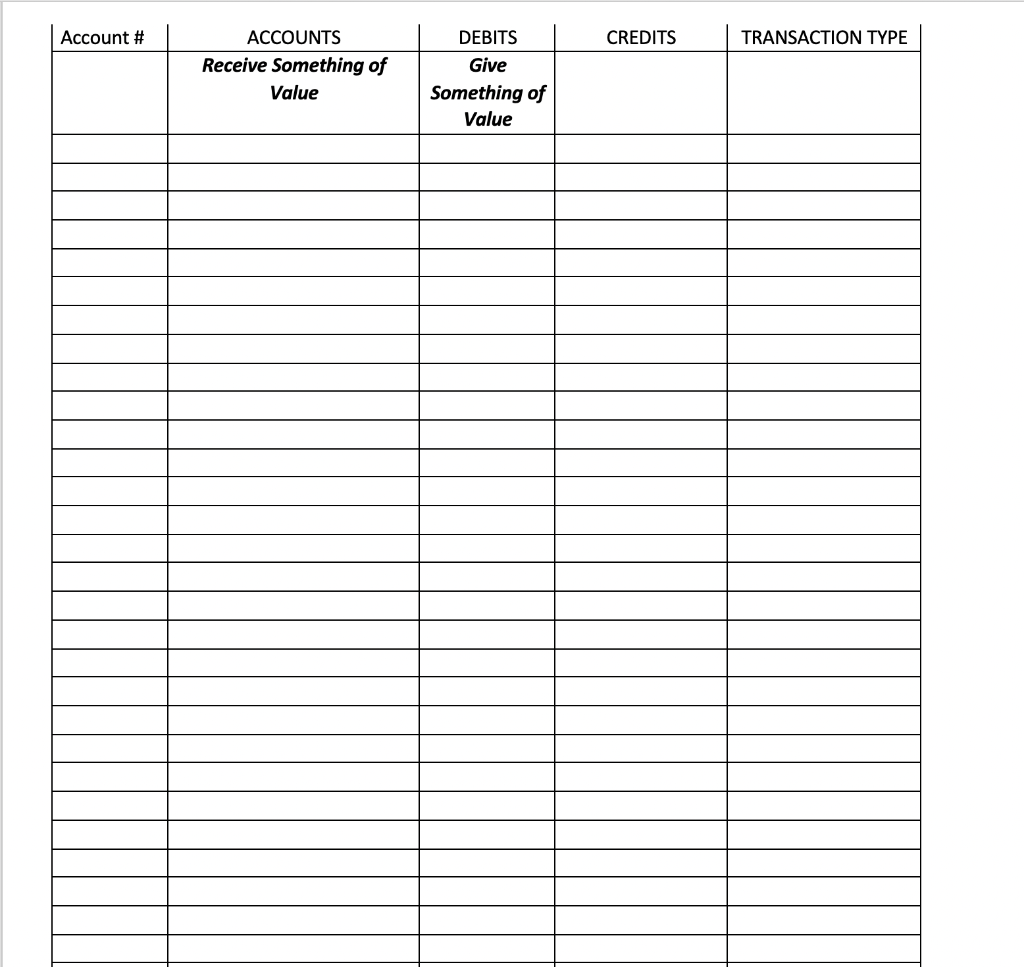

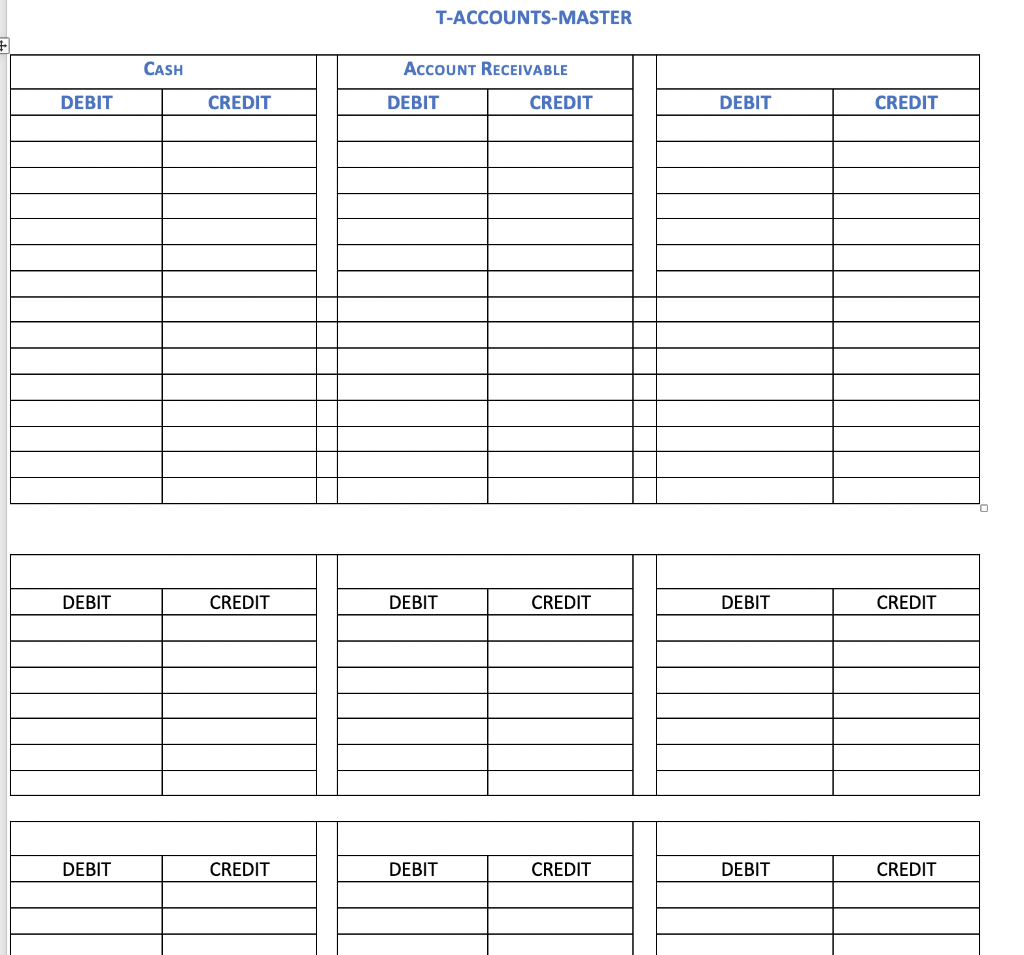

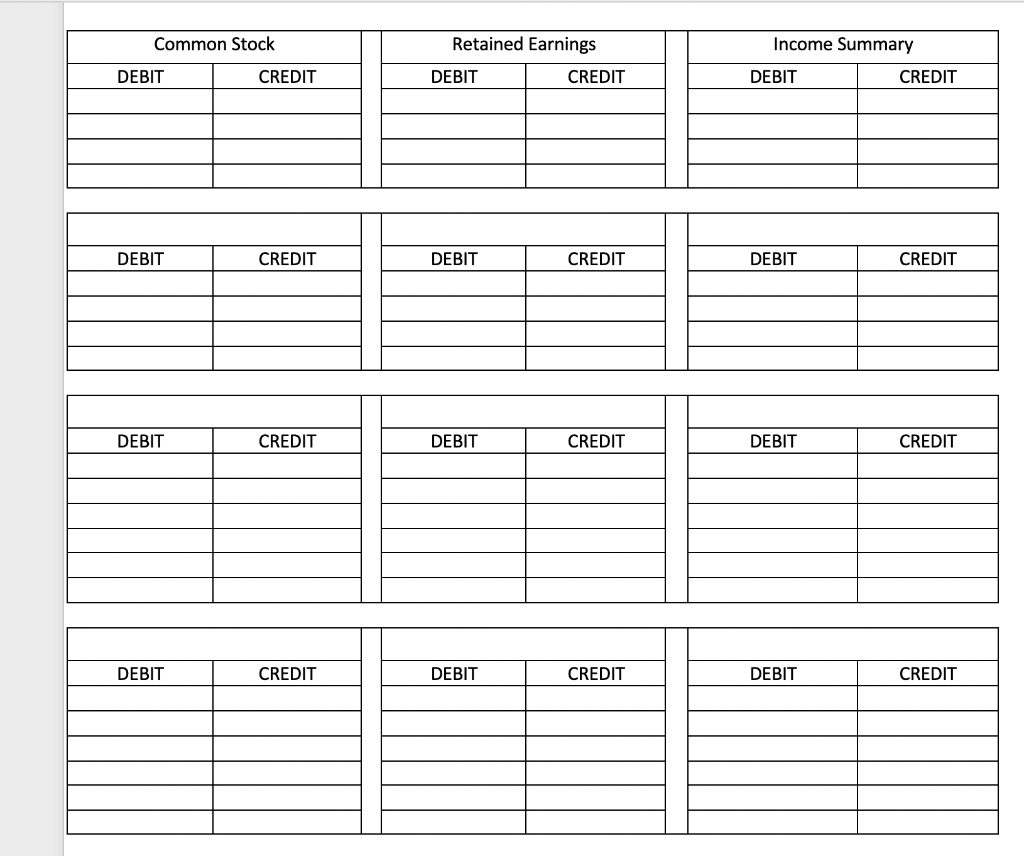

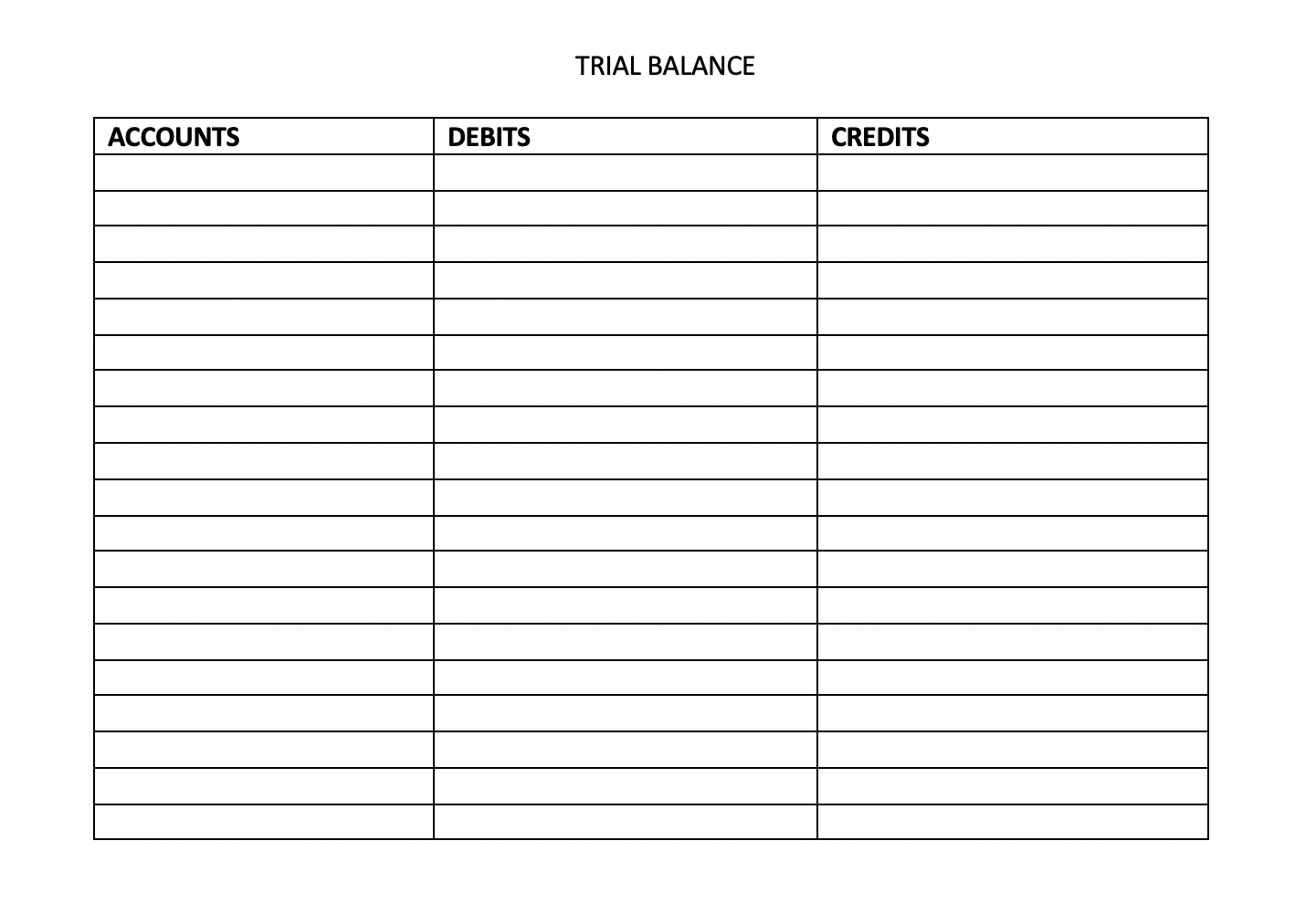

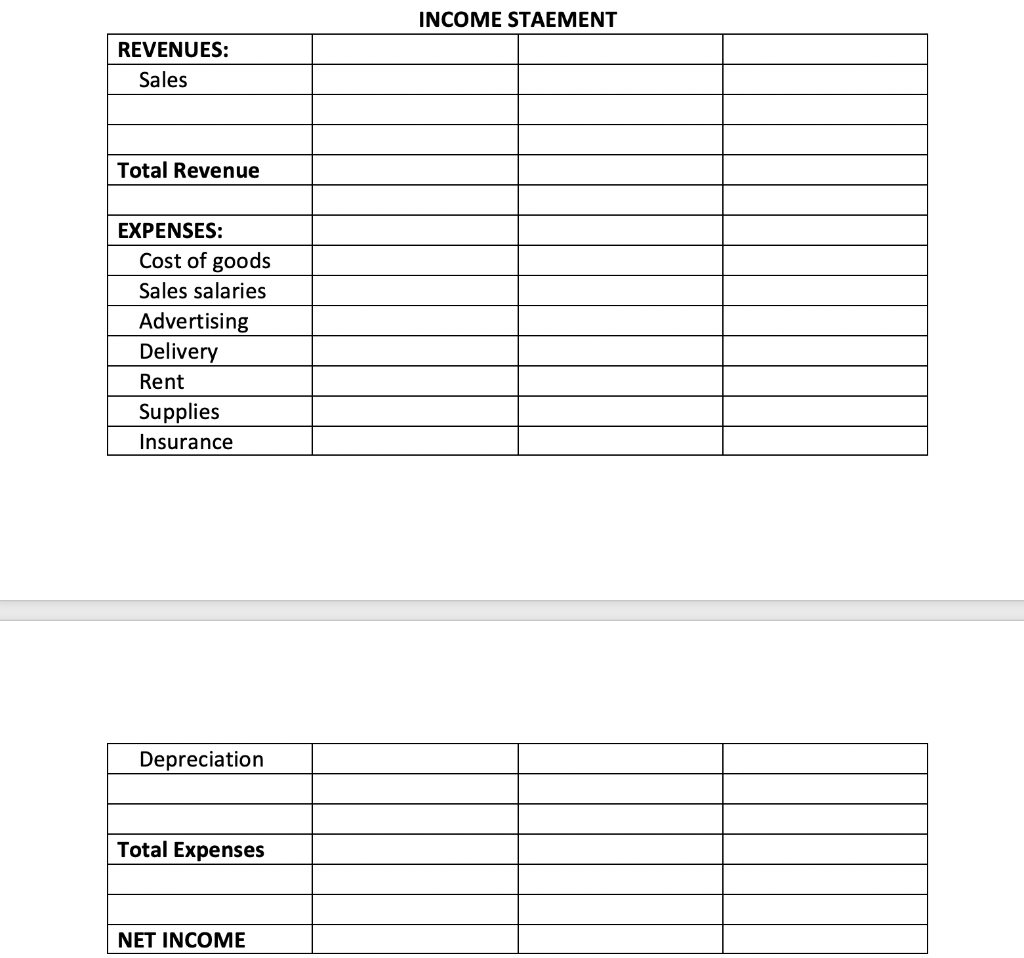

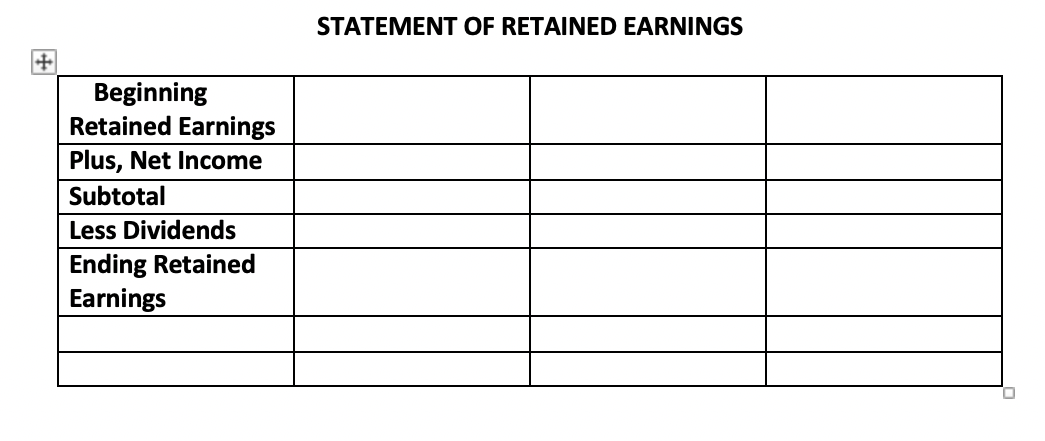

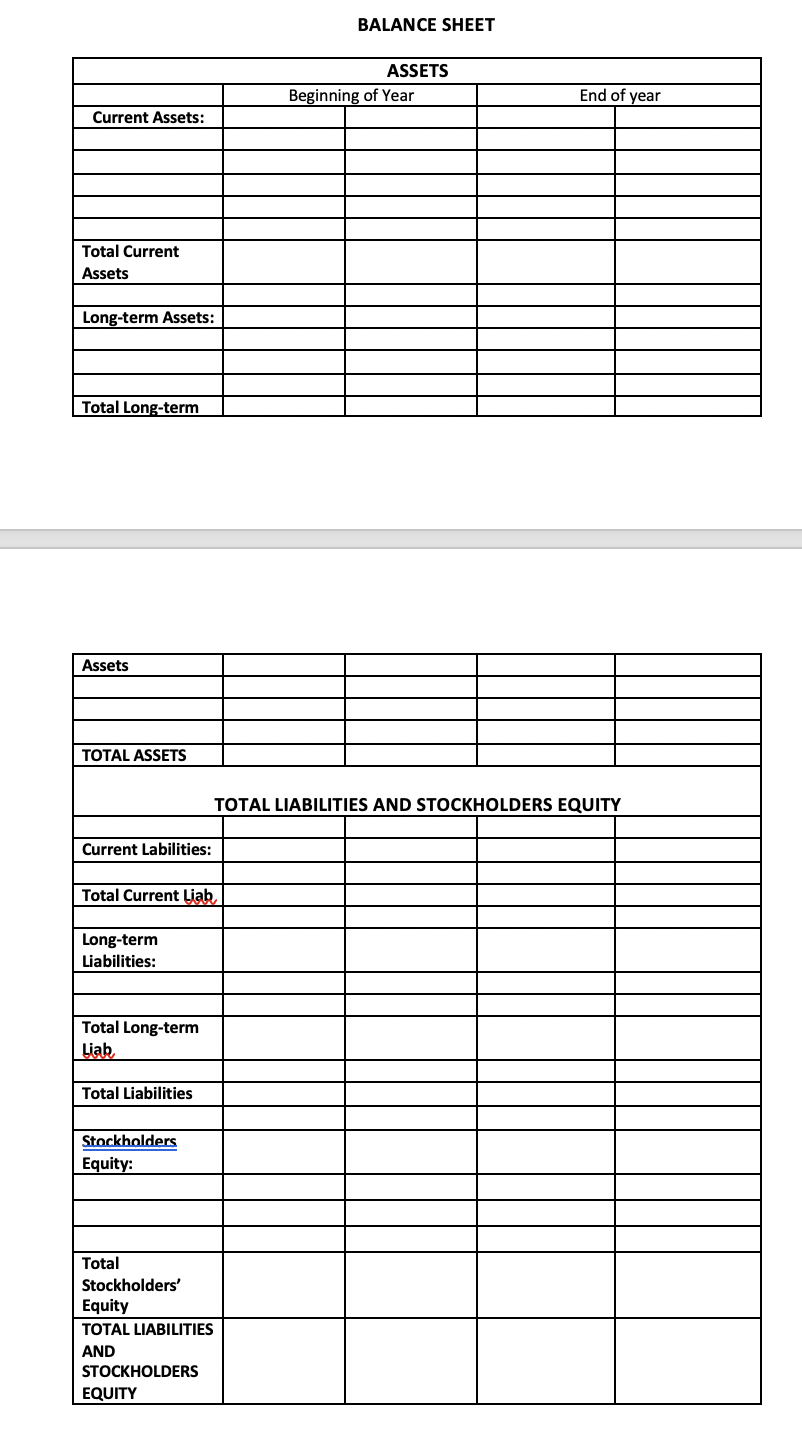

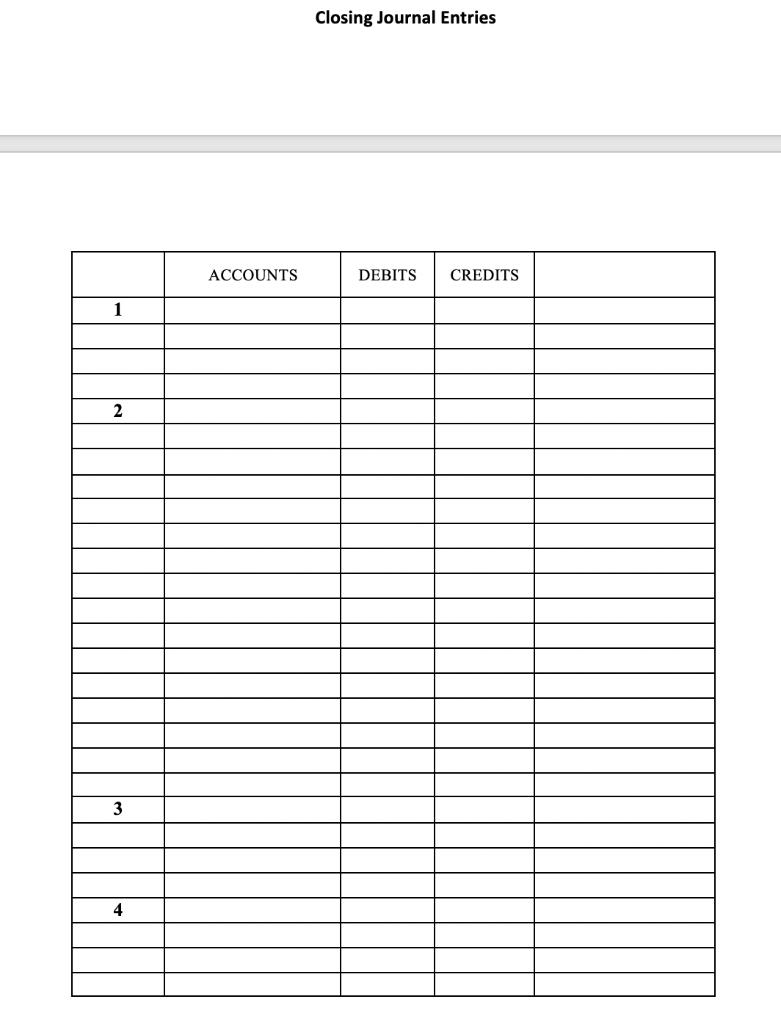

COMPREHENSIVE STUDY PROBLEM 5 These are prior year balances from Jones business: Cash $ 50,000 Supplies $30,000 Accounts payable $40,000 Common stock $50,000 Retained earnings $10,000 Post these balances to the respective T accounts then proceed to enter the following journal entries: 1. Invested 200,000 to start a Jones rental company. 2. Purchased 20,000 of supplies on account 3. Purchased five cars for 10,000 each paying 10,000 down and signing a note for the balance 4. Received cash for rental revenue of $500,000 5. Paid rent expense of $20,000. 6. Paid salaries of $ 10,000|| 7. Paid dividends of 5000 8. Paid $1200 on accounts payable 9. Paid auto expenses of $2000. 10. Paid principal on note payable of 10,000 and interest of 5,000. REQUIRED: 1. Place Year End Balances from Year 1 In T-Accounts 2. Prepare Journal Entries for Year 2 And Post All Entries to Ledger 3. Prepare Trial Balance 4. Prepare Income Statement 5. Prepare Statement of Retained Earnings 6. Prepare Two Year Balance Sheets for Year One and Year 2 7. Prepare and Post closing Entries Account # CREDITS TRANSACTION TYPE ACCOUNTS Receive Something of Value DEBITS Give Something of Value Account # CREDITS TRANSACTION TYPE ACCOUNTS Receive Something of Value DEBITS Give Something of Value T-ACCOUNTS-MASTER CASH ACCOUNT RECEIVABLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Common Stock Retained Earnings Income Summary DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT TRIAL BALANCE ACCOUNTS DEBITS CREDITS INCOME STAEMENT REVENUES: Sales Total Revenue EXPENSES: Cost of goods Sales salaries Advertising Delivery Rent Supplies Insurance Depreciation Total Expenses NET INCOME STATEMENT OF RETAINED EARNINGS Beginning Retained Earnings Plus, Net Income Subtotal Less Dividends Ending Retained Earnings BALANCE SHEET ASSETS Beginning of Year End of year Current Assets: Total Current Assets Long-term Assets: Total Long-term Assets TOTAL ASSETS TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Current Labilities: Total Current liab Long-term Liabilities: Total Long-term Liab Total Liabilities Stockholders Equity: Total Stockholders' Equity TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Closing Journal Entries ACCOUNTS DEBITS CREDITS 1 2 3 4 COMPREHENSIVE STUDY PROBLEM 5 These are prior year balances from Jones business: Cash $ 50,000 Supplies $30,000 Accounts payable $40,000 Common stock $50,000 Retained earnings $10,000 Post these balances to the respective T accounts then proceed to enter the following journal entries: 1. Invested 200,000 to start a Jones rental company. 2. Purchased 20,000 of supplies on account 3. Purchased five cars for 10,000 each paying 10,000 down and signing a note for the balance 4. Received cash for rental revenue of $500,000 5. Paid rent expense of $20,000. 6. Paid salaries of $ 10,000|| 7. Paid dividends of 5000 8. Paid $1200 on accounts payable 9. Paid auto expenses of $2000. 10. Paid principal on note payable of 10,000 and interest of 5,000. REQUIRED: 1. Place Year End Balances from Year 1 In T-Accounts 2. Prepare Journal Entries for Year 2 And Post All Entries to Ledger 3. Prepare Trial Balance 4. Prepare Income Statement 5. Prepare Statement of Retained Earnings 6. Prepare Two Year Balance Sheets for Year One and Year 2 7. Prepare and Post closing Entries Account # CREDITS TRANSACTION TYPE ACCOUNTS Receive Something of Value DEBITS Give Something of Value Account # CREDITS TRANSACTION TYPE ACCOUNTS Receive Something of Value DEBITS Give Something of Value T-ACCOUNTS-MASTER CASH ACCOUNT RECEIVABLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Common Stock Retained Earnings Income Summary DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT TRIAL BALANCE ACCOUNTS DEBITS CREDITS INCOME STAEMENT REVENUES: Sales Total Revenue EXPENSES: Cost of goods Sales salaries Advertising Delivery Rent Supplies Insurance Depreciation Total Expenses NET INCOME STATEMENT OF RETAINED EARNINGS Beginning Retained Earnings Plus, Net Income Subtotal Less Dividends Ending Retained Earnings BALANCE SHEET ASSETS Beginning of Year End of year Current Assets: Total Current Assets Long-term Assets: Total Long-term Assets TOTAL ASSETS TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Current Labilities: Total Current liab Long-term Liabilities: Total Long-term Liab Total Liabilities Stockholders Equity: Total Stockholders' Equity TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Closing Journal Entries ACCOUNTS DEBITS CREDITS 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts