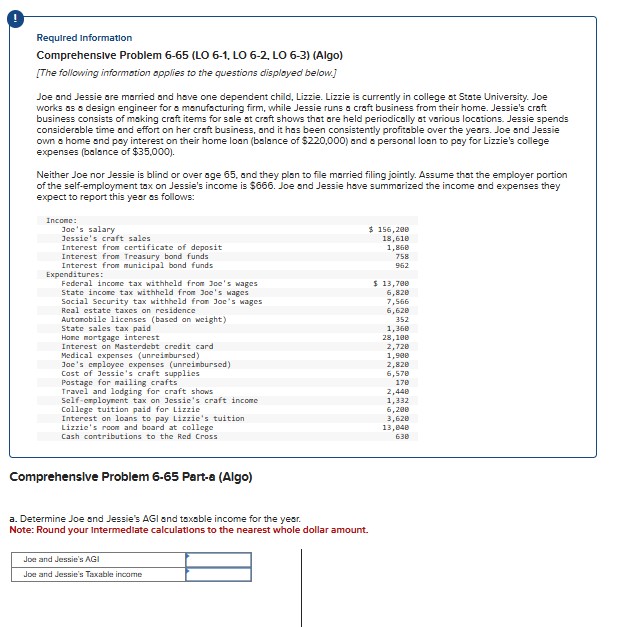

Question: Comprehenslve Problem 6 - 6 5 Part - a ( Algo ) a . Determine Joe and Jessie's AGI and taxable income for the year.

Comprehenslve Problem Parta Algo

a Determine Joe and Jessie's AGI and taxable income for the year.

Note: Round your Intermedlate calculations to the nearest whole dollar amount. b Complete page of Form through taxable income, line Schedule and Schedule A

Round your Intermediate computations to the nearest whole dollar amount. Input all the values as positive numbers. Enter any nonfinanclal Information, eg Names, Addresses, soclal security numbers EXACTLY as they appear In any glven Information or Problem Statement. Use tax rules regardless of year on form. Joe and Jessie does not wish to contribute to the Presidential Election Campalgn fund or did not have any virtual currency transactions or Interests.

Joe and Jessie's address is NWth Street, Miami, FL

Focial security numbers:

Joe: Jessie: Lizzie:

Form for a Married filing jointly

Form Page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock