Question: Compte, Incorporated ( a U . S . - based company ) , establishes a subsidiary in Croatia on January 1 , 2 0 2

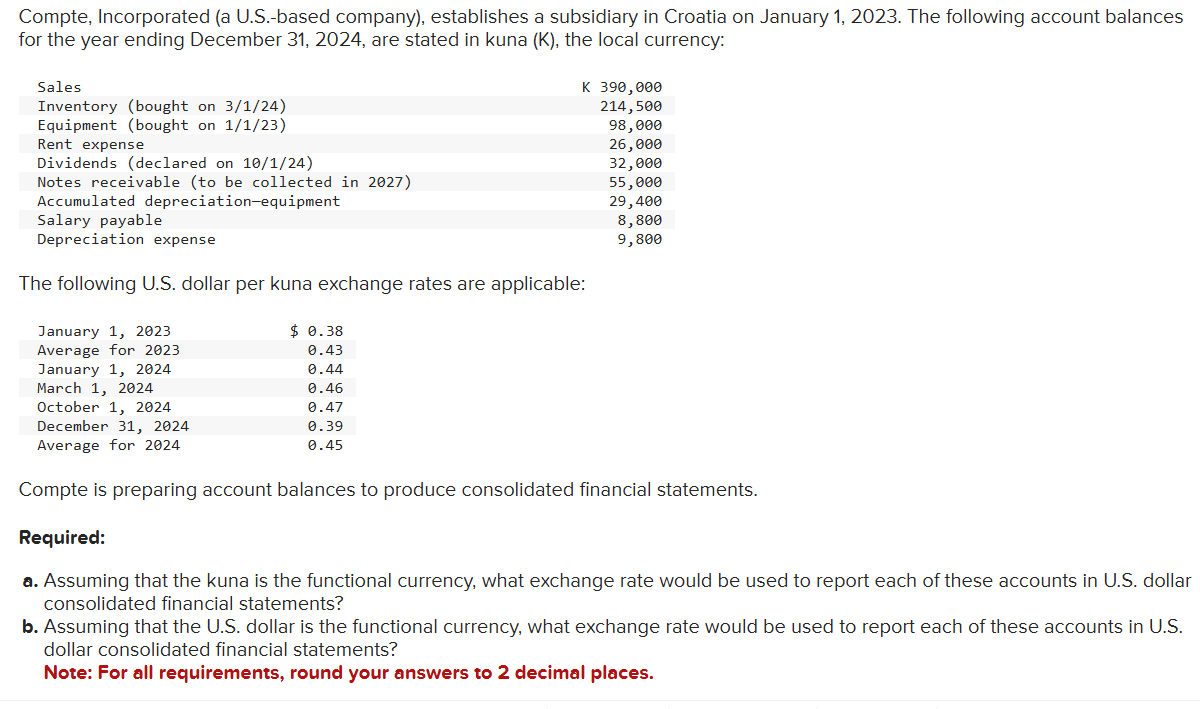

Compte, Incorporated a USbased company establishes a subsidiary in Croatia on January The following account balances for the year ending December are stated in kuna K the local currency:SalesK Inventory bought on Equipment bought on Rent expenseDividends declared on Notes receivable to be collected in Accumulated depreciationequipmentSalary payableDepreciation expenseThe following US dollar per kuna exchange rates are applicable:January $ Average for January March October December Average for Compte is preparing account balances to produce consolidated financial statements. Compte, Incorporated a USbased company establishes a subsidiary in Croatia on January The following account balances for the year ending December are stated in kuna K the local currency:

The following US dollar per kuna exchange rates are applicable:

Compte is preparing account balances to produce consolidated financial statements.

Required:

a Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in US dollar consolidated financial statements?

b Assuming that the US dollar is the functional currency, what exchange rate would be used to report each of these accounts in US dollar consolidated financial statements?

Note: For all requirements, round your answers to mathbf decimal places. begintabularll

hline multicolumnc Account & Exchange Rate

hline a Sales &

hline a Inventory &

hline a Equipment &

hline a Rent expense &

hline a Dividends &

hline a Notes receivable &

hline a Accumulated depreciationequipment &

hline a Salary payable &

hline a Depreciation expense &

hline b Sales &

hline b Inventory &

hline b Equipment &

hline b Rent expense &

hline b Dividends &

hline b Notes receivable &

hline b Accumulated depreciationequipment &

hline b Salary payable &

hline b Depreciation expense &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock