Question: COMPUTATION: Make sure to show all necessary computations and label your answers. 1. Veronica Valentine works as a financial consultant as her sideline which earns

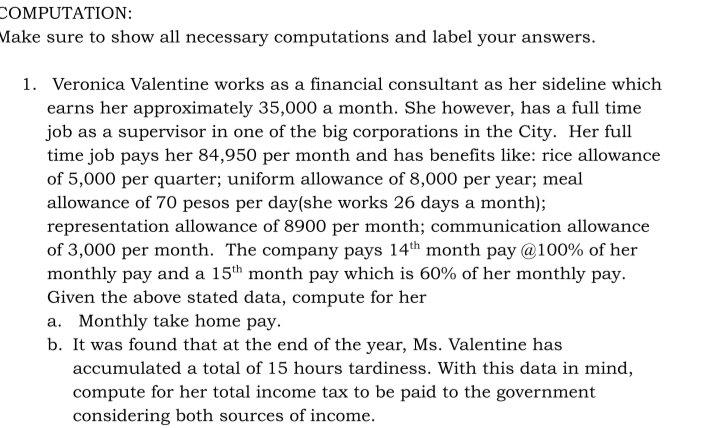

COMPUTATION: Make sure to show all necessary computations and label your answers. 1. Veronica Valentine works as a financial consultant as her sideline which earns her approximately 35,000 a month. She however, has a full time job as a supervisor in one of the big corporations in the City. Her full time job pays her 84,950 per month and has benefits like: rice allowance of 5,000 per quarter; uniform allowance of 8,000 per year; meal allowance of 70 pesos per day(she works 26 days a month); representation allowance of 8900 per month; communication allowance of 3,000 per month. The company pays 14 th month pay @100% of her monthly pay and a 15 th month pay which is 60% of her monthly pay. Given the above stated data, compute for her a. Monthly take home pay. b. It was found that at the end of the year, Ms. Valentine has accumulated a total of 15 hours tardiness. With this data in mind, compute for her total income tax to be paid to the government considering both sources of income.

COMPUTATION: Make sure to show all necessary computations and label your answers. 1. Veronica Valentine works as a financial consultant as her sideline which earns her approximately 35,000 a month. She however, has a full time job as a supervisor in one of the big corporations in the City. Her full time job pays her 84,950 per month and has benefits like: rice allowance of 5,000 per quarter; uniform allowance of 8,000 per year; meal allowance of 70 pesos per day(she works 26 days a month); representation allowance of 8900 per month; communication allowance of 3,000 per month. The company pays 14th month pay @100% of her monthly pay and a 15th month pay which is 60% of her monthly pay. Given the above stated data, compute for her a. Monthly take home pay. b. It was found that at the end of the year, Ms. Valentine has accumulated a total of 15 hours tardiness. With this data in mind, compute for her total income tax to be paid to the government considering both sources of income. COMPUTATION: Make sure to show all necessary computations and label your answers. 1. Veronica Valentine works as a financial consultant as her sideline which earns her approximately 35,000 a month. She however, has a full time job as a supervisor in one of the big corporations in the City. Her full time job pays her 84,950 per month and has benefits like: rice allowance of 5,000 per quarter; uniform allowance of 8,000 per year; meal allowance of 70 pesos per day(she works 26 days a month); representation allowance of 8900 per month; communication allowance of 3,000 per month. The company pays 14th month pay @100% of her monthly pay and a 15th month pay which is 60% of her monthly pay. Given the above stated data, compute for her a. Monthly take home pay. b. It was found that at the end of the year, Ms. Valentine has accumulated a total of 15 hours tardiness. With this data in mind, compute for her total income tax to be paid to the government considering both sources of income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts