Question: Computation Question 1: (15 pts) NFL Co. is expected to generate $8 earnings per share next year, of which $4 will be paid out as

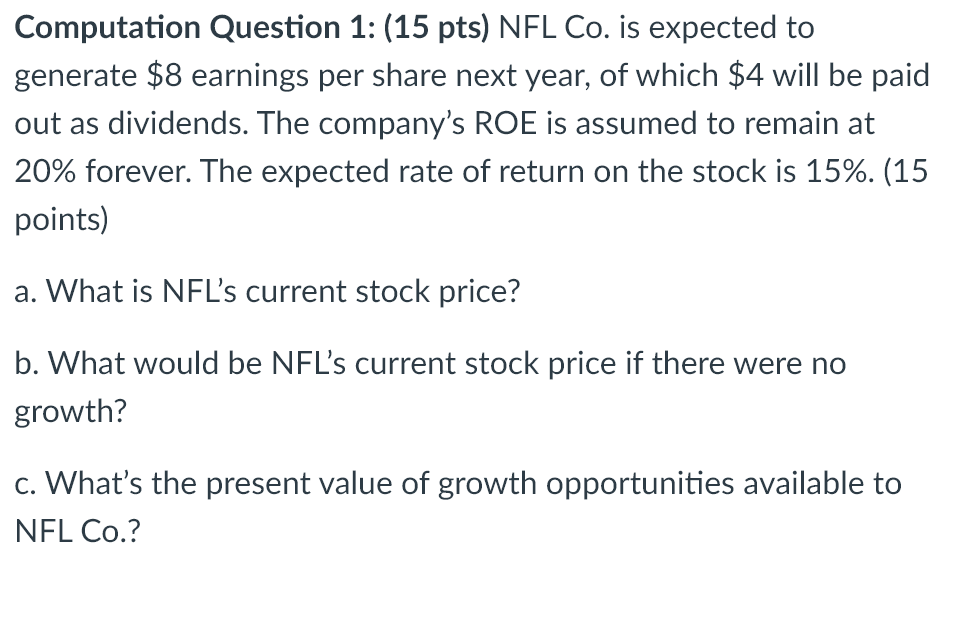

Computation Question 1: (15 pts) NFL Co. is expected to generate $8 earnings per share next year, of which $4 will be paid out as dividends. The company's ROE is assumed to remain at 20% forever. The expected rate of return on the stock is 15%. (15 points) a. What is NFL's current stock price? b. What would be NFL's current stock price if there were no growth? c. What's the present value of growth opportunities available to NEL CO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts