Question: Computational The large, consistently profitable firm you work for is considering a small project. Your firm is financed by 60% equity and 40% debt. The

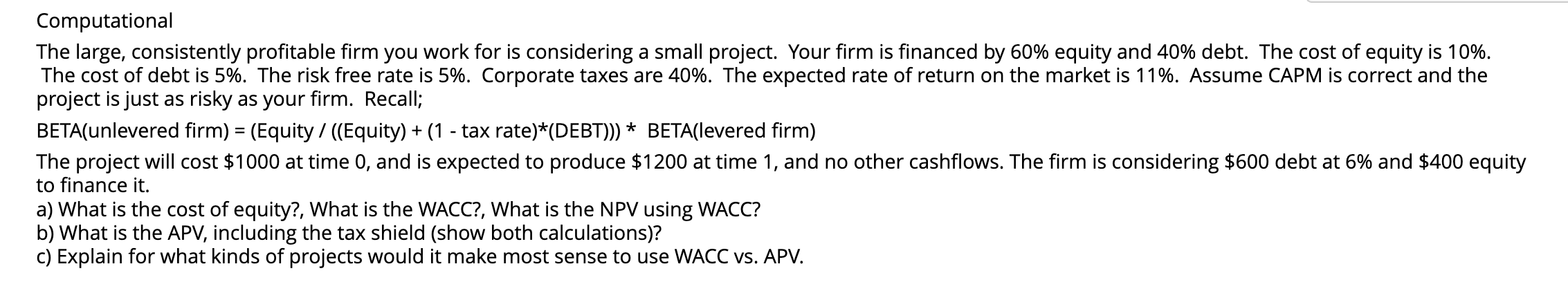

Computational The large, consistently profitable firm you work for is considering a small project. Your firm is financed by 60% equity and 40% debt. The cost of equity is 10%. The cost of debt is 5%. The risk free rate is 5%. Corporate taxes are 40%. The expected rate of return on the market is 11%. Assume CAPM is correct and the project is just as risky as your firm. Recall; BETA(unlevered firm) = (Equity / ((Equity) + (1 - tax rate)*(DEBT))) * BETA(levered firm) The project will cost $1000 at time 0, and is expected to produce $1200 at time 1, and no other cashflows. The firm is considering $600 debt at 6% and $400 equity to finance it. a) What is the cost of equity?, What is the WACC?, What is the NPV using WACC? b) What is the APV, including the tax shield (show both calculations)? c) Explain for what kinds of projects would it make most sense to use WACC vs. APV. Computational The large, consistently profitable firm you work for is considering a small project. Your firm is financed by 60% equity and 40% debt. The cost of equity is 10%. The cost of debt is 5%. The risk free rate is 5%. Corporate taxes are 40%. The expected rate of return on the market is 11%. Assume CAPM is correct and the project is just as risky as your firm. Recall; BETA(unlevered firm) = (Equity / ((Equity) + (1 - tax rate)*(DEBT))) * BETA(levered firm) The project will cost $1000 at time 0, and is expected to produce $1200 at time 1, and no other cashflows. The firm is considering $600 debt at 6% and $400 equity to finance it. a) What is the cost of equity?, What is the WACC?, What is the NPV using WACC? b) What is the APV, including the tax shield (show both calculations)? c) Explain for what kinds of projects would it make most sense to use WACC vs. APV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts