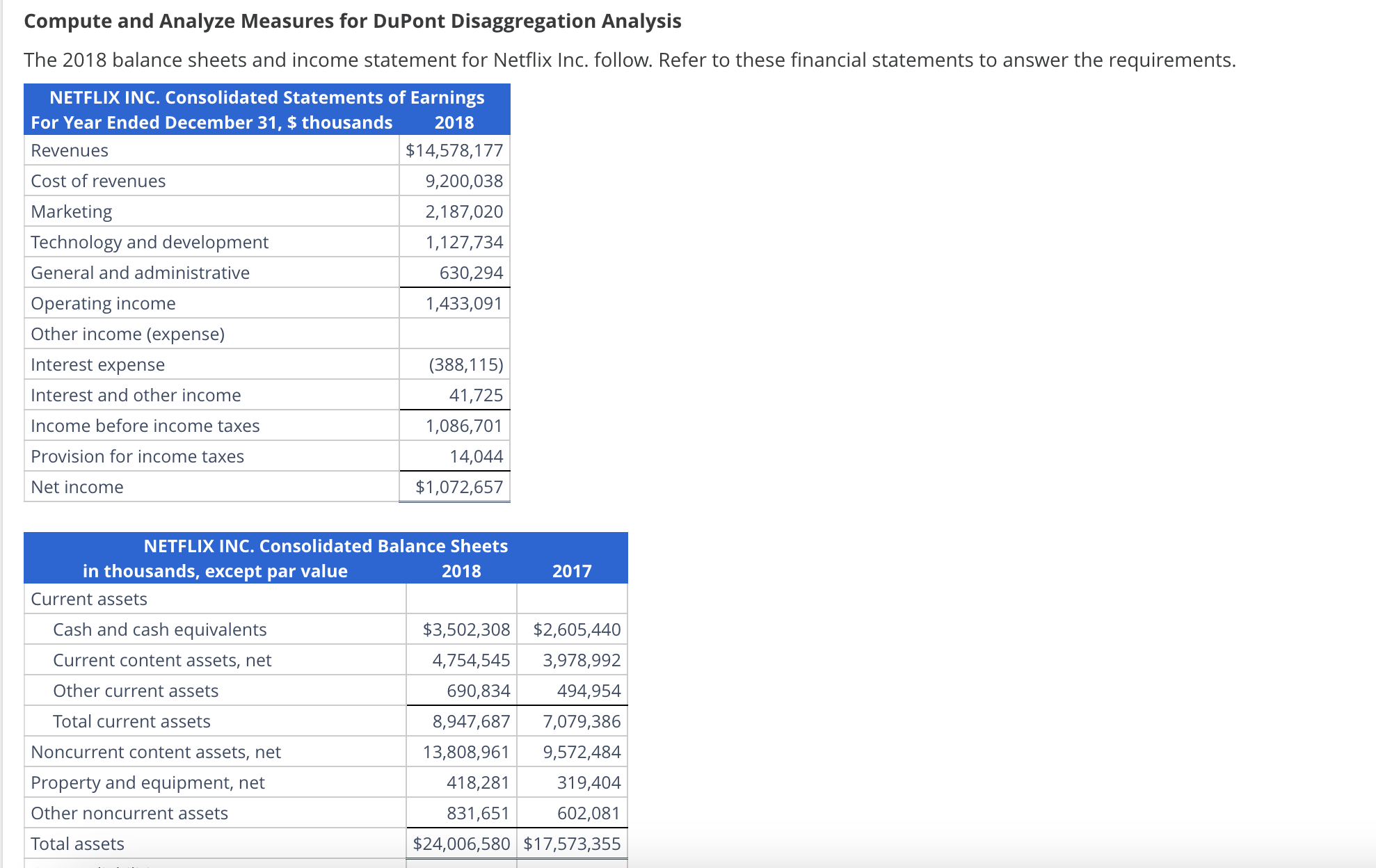

Question: Compute and Analyze Measures for DuPont Disaggregation Analysis a . Compute ROE and ROA for 2 0 1 8 . b . Confirm that ROE

Compute and Analyze Measures for DuPont Disaggregation Analysis a Compute ROE and ROA for

b Confirm that ROE equals ROE computed using the component measures for profit margin, assets turnover, and financial leverage: ROE ROE may be different due to rounding

c Compute adjusted ROA assume a statutory tax rate of tableNETFLIX INC. Consolidated Balance Sheetsin thousands, except par value,Current assetsCash and cash equivalents,$$Current content assets, net,Other current assets,Total current assets,Noncurrent content assets, net,Property and equipment, net,Other noncurrent assets,Total assets,$$Current liabilitiesCurrent content liabilities,$$Accounts payable,Accrued expenses,Deferred revenue,Total current liabilities,Noncurrent content liabilities,Longterm debt,Other noncurrent liabilities,Total liabilities,Stockholders equityPreferred stock, $ par value,Common stock, $ par value,Accumulated other comprehensive loss,Retained earnings,Total shareholders' equity,Total liabilities and shareholders' equity,$$

The balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock