Question: COMPUTE and interpret Wolff's a. THE OPERATING CASH FLOWS to CURRENT LIABILIRTIES RATIO AND b. OPERATING CASH FLOW TO Capital expenditure RATIO Preparing a Statement

COMPUTE and interpret Wolff's

a. THE OPERATING CASH FLOWS to CURRENT LIABILIRTIES RATIO AND

b. OPERATING CASH FLOW TO Capital expenditure RATIO

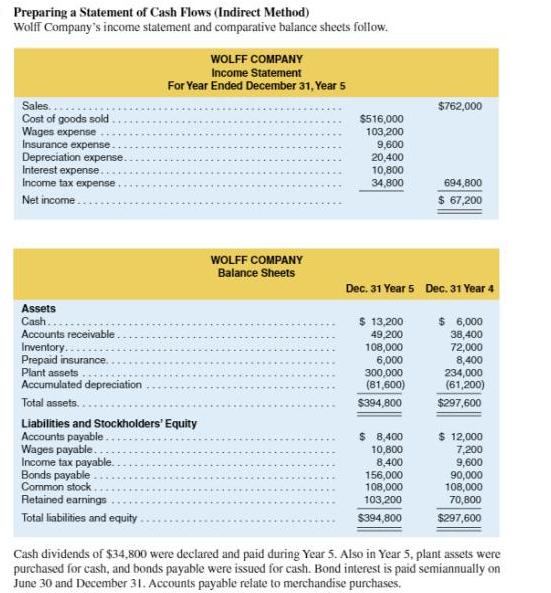

Preparing a Statement of Cash Flows (Indirect Method) Wolff Company's income statement and comparative balance sheets follow. Sales. Cost of goods sold Wages expense Insurance expense. Depreciation expense. Interest expense. Income tax expense. Net income. Assets Cash. Accounts receivable Inventory. Prepaid insurance. Plant assets Accumulated depreciation Total assets.. Liabilities and Stockholders' Equity Accounts payable.. Wages payable.. Income tax payable.. WOLFF COMPANY Income Statement For Year Ended December 31, Year 5 Bonds payable. Common stock Retained earnings Total liabilities and equity WOLFF COMPANY Balance Sheets $516,000 103,200 9,600 20,400 10,800 34,800 $ 13,200 49,200 108,000 6,000 300,000 (81,600) $394,800 $ Dec. 31 Year 5 Dec. 31 Year 4 10,800 8,400 $762,000 156,000 108,000 103,200 $394,800 694,800 $ 67,200 $ 6,000 38,400 72,000 8,400 234,000 (61,200) $297,600 $ 12,000 7,200 9,600 90,000 108,000 70,800 $297,600 Cash dividends of $34,800 were declared and paid during Year 5. Also in Year 5, plant assets were purchased for cash, and bonds payable were issued for cash. Bond interest is paid semiannually on June 30 and December 31. Accounts payable relate to merchandise purchases.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

a The Operating Cash Flows to Current Liabilities ratio can be computed as Operating Cash Flows Curr... View full answer

Get step-by-step solutions from verified subject matter experts