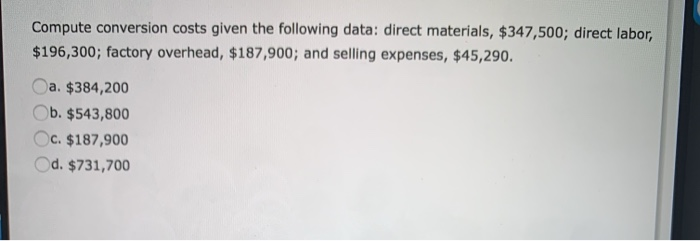

Question: Compute conversion costs given the following data: direct materials, $347,500; direct labor, $196,300; factory overhead, $187,900; and selling expenses, $45,290. a. $384,200 b. $543,800 c.

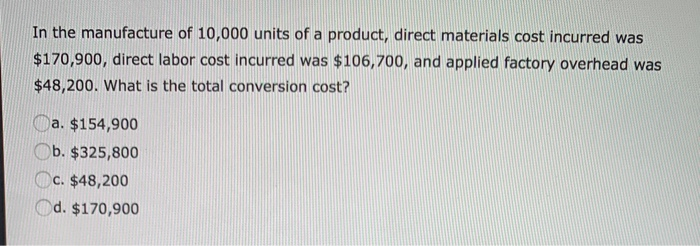

Compute conversion costs given the following data: direct materials, $347,500; direct labor, $196,300; factory overhead, $187,900; and selling expenses, $45,290. a. $384,200 b. $543,800 c. $187,900 d. $731,700 In the manufacture of 10,000 units of a product, direct materials cost incurred was $170,900, direct labor cost incurred was $106,700, and applied factory overhead was $48,200. What is the total conversion cost? a. $154,900 b. $325,800 c. $48,200 d. $170,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts