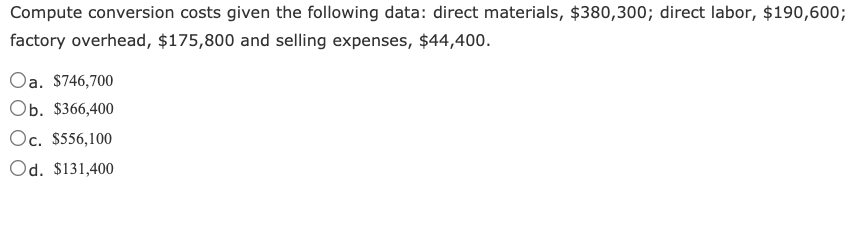

Question: Compute conversion costs given the following data: direct materials, $380,300; direct labor, $190,600; factory overhead, $175,800 and selling expenses, $44,400. Oa. $746,700 Ob. $366,400 Oc.

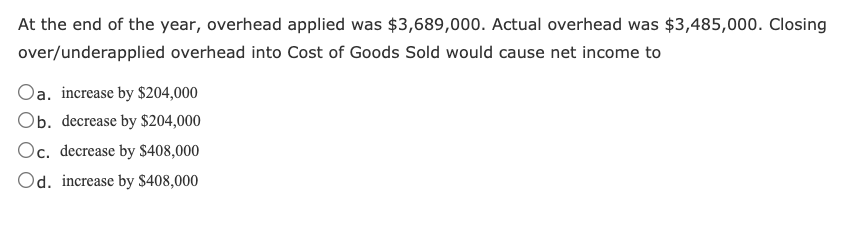

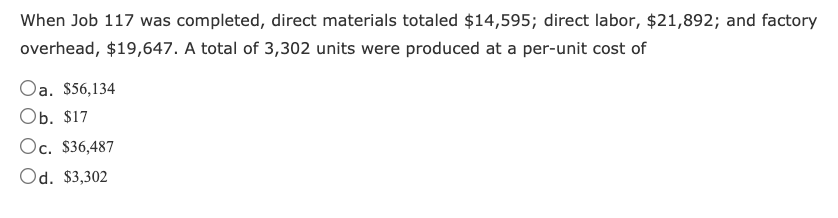

Compute conversion costs given the following data: direct materials, $380,300; direct labor, $190,600; factory overhead, $175,800 and selling expenses, $44,400. Oa. $746,700 Ob. $366,400 Oc. $556,100 Od. $131,400 At the end of the year, overhead applied was $3,689,000. Actual overhead was $3,485,000. Closing over/underapplied overhead into Cost of Goods Sold would cause net income to Oa. increase by $204,000 Ob. decrease by $204,000 Oc. decrease by $408,000 Od. increase by $408,000 When Job 117 was completed, direct materials totaled $14,595; direct labor, $21,892; and factory overhead, $19,647. A total of 3,302 units were produced at a per-unit cost of Oa. $56,134 Ob. $17 Oc. $36,487 Od. $3,302

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts