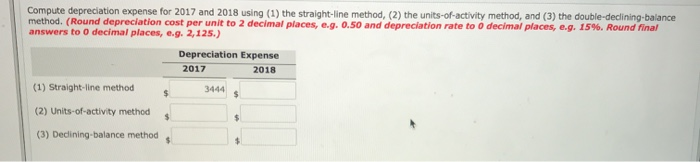

Question: Compute depreciation expense for 2017 and 2018 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining balance method. (Round depreciation cost

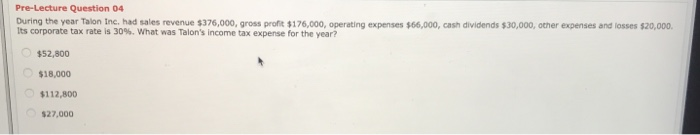

Compute depreciation expense for 2017 and 2018 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to o decimal places, e.g. 15%. Round final answers to o decimal places, e.g. 2,125.) Depreciation Expense 2017 2018 (1) Straight-line method 3444 (2) Units-of-activity method (3) Declining balance method Pre-Lecture Question 04 During the year Talon Inc. had sales revenue $376,000, gross profit $176,000, operating expenses $66,000, cash dividends $30,000, other expenses and losses $20,000. Its corporate tax rate is 30%. What was Talon's income tax expense for the year? $52,800 $18,000 $112,800 $27,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts