Question: Compute for 2013 and 2012 the (1) return on common stockholders equity. Note: Must show equations and detailed calculations for each ratio. Equation that should

Compute for 2013 and 2012 the (1) return on common stockholders equity. Note: Must show equations and detailed calculations for each ratio.

Equation that should be used:

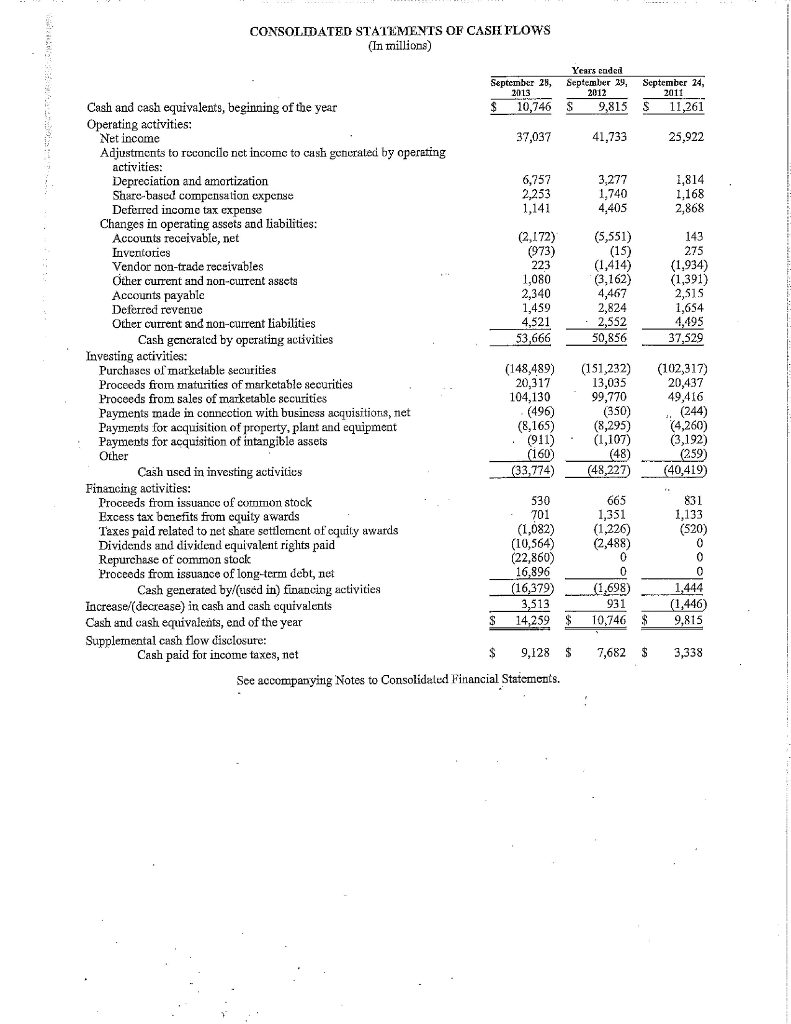

Return on common stockholders equity (ROCE) = (Net income - preferred dividends)/(average stockholders equity average preferred equity)

Information not available in financial statements below

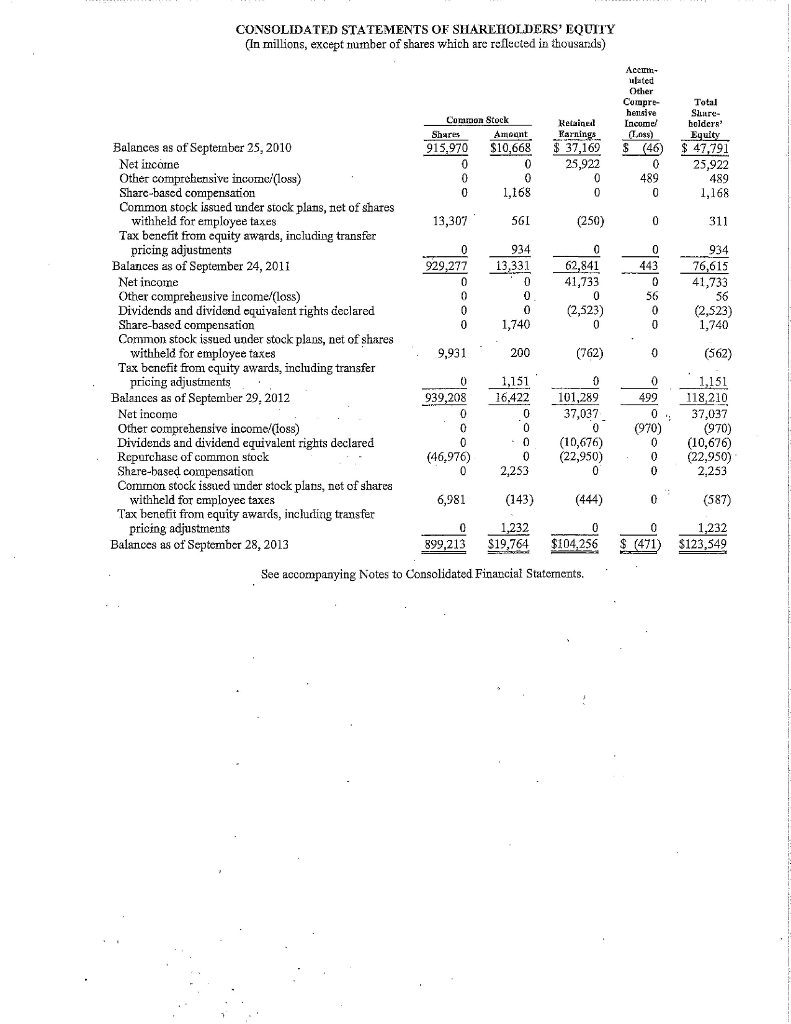

stockholders equity (in millions) fiscal year end september 2011 = $76,615

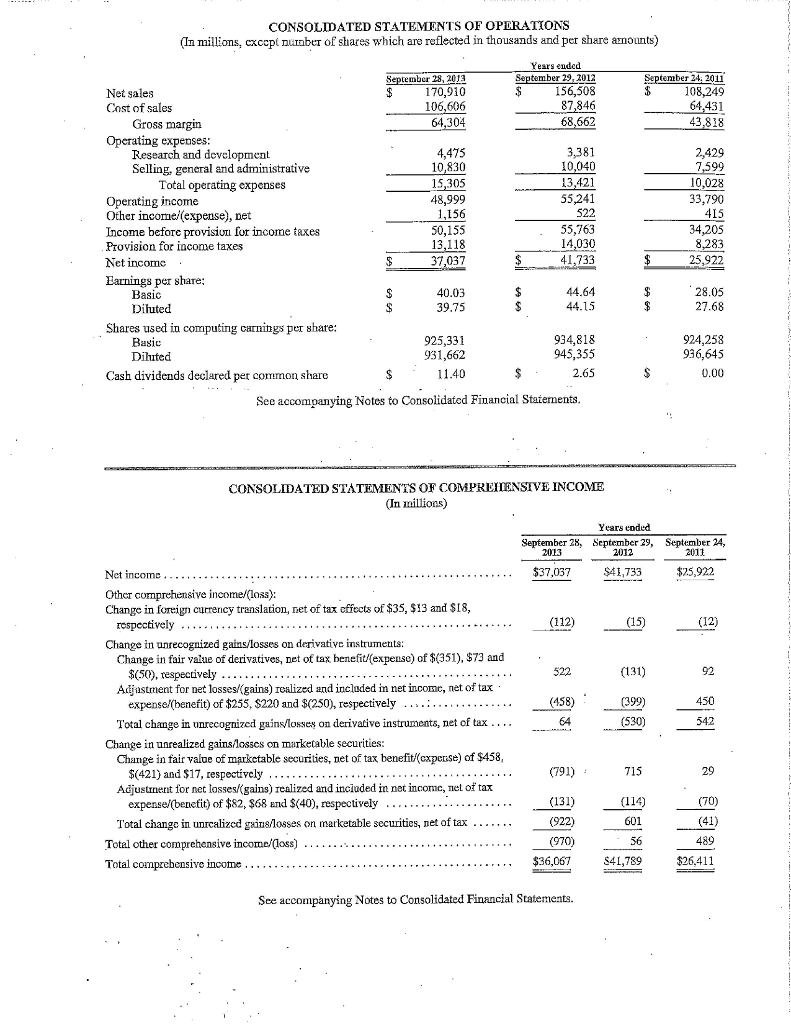

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, cxccpt number of shares which are reflected in thousands and per share amounts) Years ended September 28, 2013 170,910 106,606 64,304 September 29. 2012 156,508 87,846 68,662 tember 24. 2011 108,249 64,431 Net sales Cost of sales Gross margin Operating expenses 4,475 10,830 15,305 48,999 1,156 50,155 13,118 37,037 2,429 Research and development Selling, general and administrative 10,040 13,421 55,241 522 55,763 14,030 1.733 10,028 33,790 Total operating expenses Operating income Other income(expense), net Income before provisiun for income taxes Provision for income taxes Net income Earnings per s 34,205 8,283 25,922 44.64 44.15 28.05 Basic Diluted 40.03 39.75 Shares used in computing carnings per share: Basic Diluted 925,331 931,662 934,818 945,355 2.65 924,258 936,645 0.00 Cash dividends declared pet common share See accompanying Notes to Consolidated Financial Staterments CONSOLIDATED STATEMENTS OF COMPREIIENSIVE INCOME (In millions) Years ended September 28, September 29, 2012 September 24, 2011 Net incomc ..$370317 S41,733 $25,922 . Othcr comprehensive income/(loss): Change in foeccy translation, net of tax effects of $35, $13 and SI8, Change in unrecognized gains/losses on derivative instrumetits: Change in fair value of derivatives, net of tax benefit/ expense) of $(351), $73 and 522 41) 92 $(50), respectively Adjustment for net losses/(gains) realized and included in net incomc, net of tax expense/(benefit) of $255, $220 and S(250), respectively Total change in unrecognized gains/losses on derivative instruments, net of tax (458) 64 (530) Change in unrealized gainslosscs on marketable securities: Change in fair value of marketable securities, net of tax benefit(cxpeise) of $458 (791)- 29 $(421) and $17, respectively . Adjustment for net losses/(gains) realized and inciuded in net incomc, net of tax expense/(benetit) of $82, $68 end $(40), respectively Total change in unrcalized gainslosses on marketable securities, net of tax (922)00 41) 489 Total other comprehensive incomeAoss) Total comprebensive income. . .. $36,067 $41,789 $26,411 See accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts