Question: Compute for dividend per share in each case. Case 1 - Non-cumulative and non-participating preference shares Case 2 - Cumulative and non-participating preference shares Case

Compute for dividend per share in each case.

Case 1 - Non-cumulative and non-participating preference shares

Case 2 - Cumulative and non-participating preference shares

Case 3 - Non-cumulative and participating preference shares

Case 4 - Cumulative and participating preference shares

Compute for the book value per preference share and per ordinary share if liquidation value on preference share is P75.

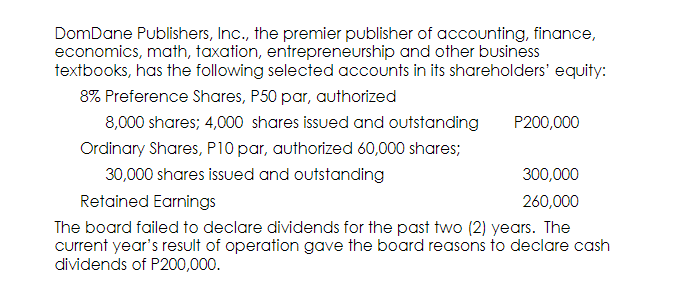

DomDane Publishers, Inc., the premier publisher of accounting, finance, economics, math, taxation, entrepreneurship and other business textbooks, has the following selected accounts in its shareholders' equity: 8% Preference Shares, P50 par, authorized 8,000 shares; 4,000 shares issued and outstanding P200,000 Ordinary Shares, P10 par, authorized 60,000 shares; 30,000 shares issued and outstanding 300,000 Retained Earnings 260,000 The board failed to declare dividends for the past two (2) years. The current year's result of operation gave the board reasons to declare cash dividends of P200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts