Question: Compute for the following problems. Show your solution. 5 points each. 1. A resident citizen employee provided the following data for the taxable year: P

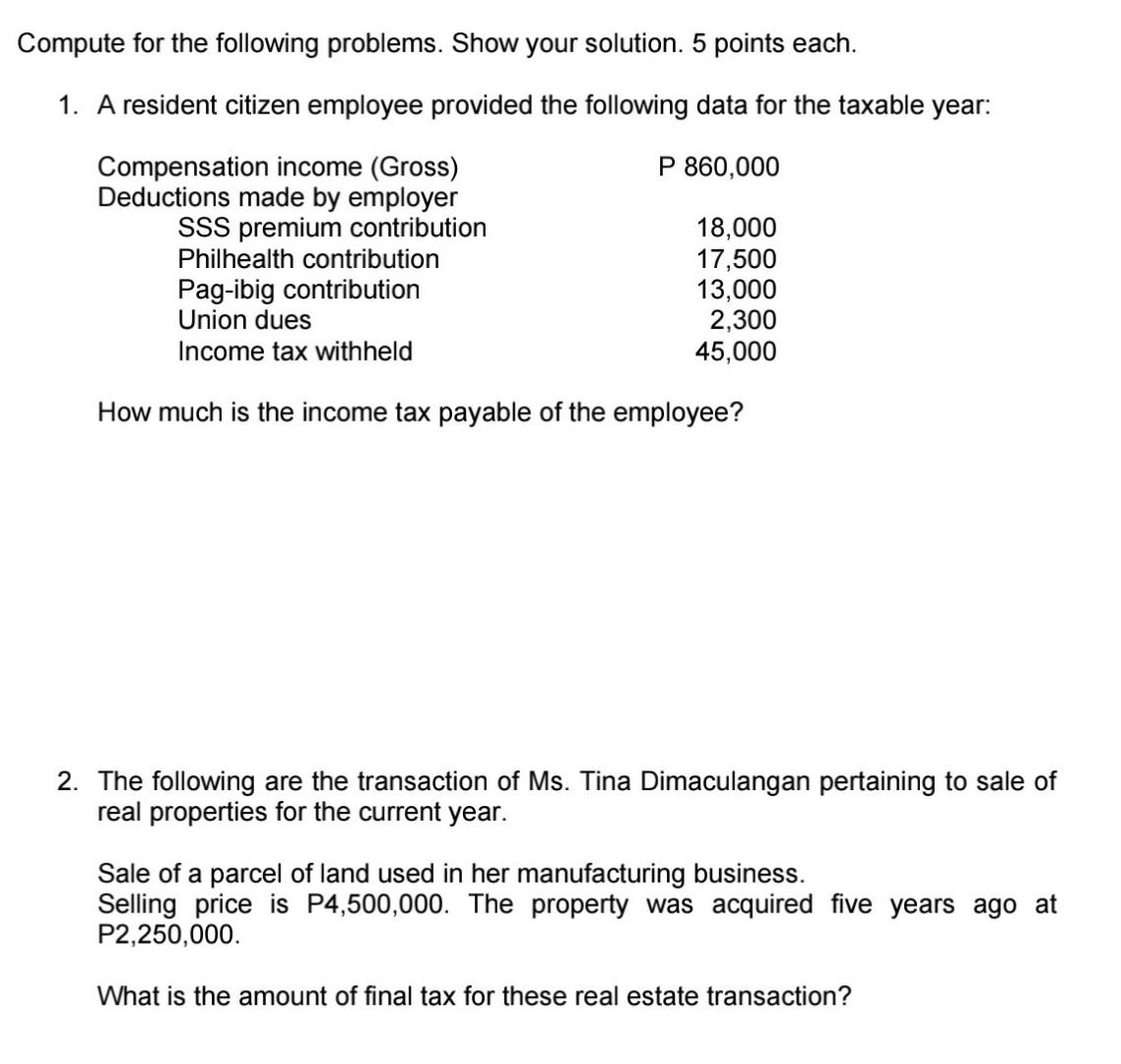

Compute for the following problems. Show your solution. 5 points each. 1. A resident citizen employee provided the following data for the taxable year: P 860,000 Compensation income (Gross) Deductions made by employer SSS premium contribution Philhealth contribution Pag-ibig contribution Union dues Income tax withheld 18,000 17,500 13,000 2,300 45,000 How much is the income tax payable of the employee? 2. The following are the transaction of Ms. Tina Dimaculangan pertaining to sale of real properties for the current year. Sale of a parcel of land used in her manufacturing business. Selling price is P4,500,000. The property was acquired five years ago at P2,250,000. What is the amount of final tax for these real estate transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts