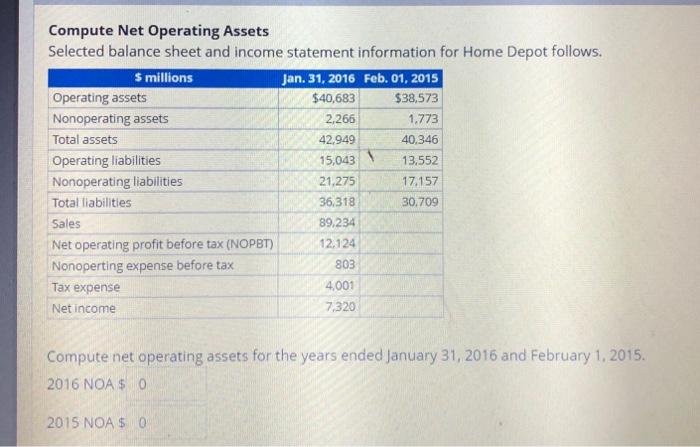

Question: Compute Net Operating Assets Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31, 2016 Feb. 01, 2015 Operating assets

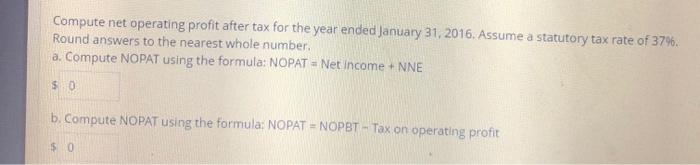

Compute Net Operating Assets Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31, 2016 Feb. 01, 2015 Operating assets $40,683 $38,573 Nonoperating assets 2,266 1,773 Total assets 42.949 40,346 Operating liabilities 15,043 13,552 Nonoperating liabilities 21,275 17.157 Total liabilities 36,318 30.709 Sales 89,234 Net operating profit before tax (NOPBT) 12.124 Nonoperting expense before tax 803 Tax expense 4,001 Net income 7,320 Compute net operating assets for the years ended January 31, 2016 and February 1, 2015. 2016 NOA $0 2015 NOA $ 0 Compute net operating profit after tax for the year ended January 31, 2016. Assume a statutory tax rate of 379. Round answers to the nearest whole number a. Compute NOPAT using the formula: NOPAT = Net Income + NNE 50 b. Compute NOPAT using the formula: NOPAT = NOPBT - Tax on operating profit $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts