Question: Compute operating cash flows using the indirect method. Operativo Colow Endirect Method Statement Prowsindirect method tutions Sy Cory Pa Copa Chat At Das BOX 2X

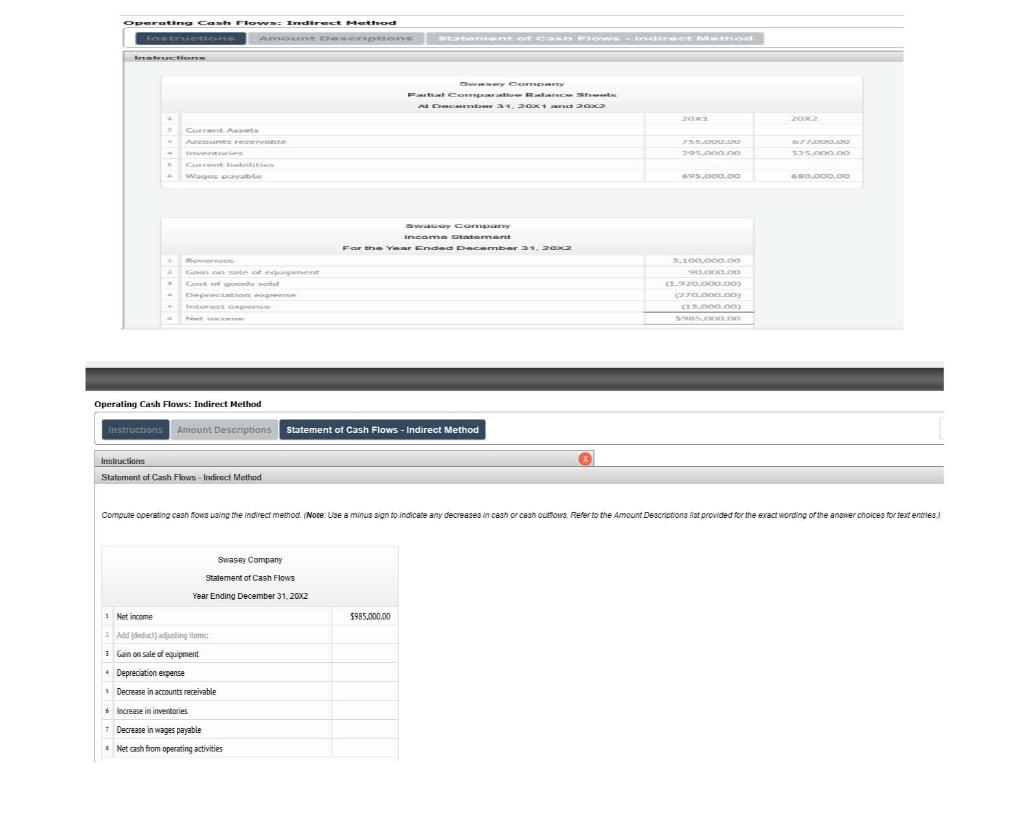

Compute operating cash flows using the indirect method.

Operativo Colow Endirect Method Statement Prowsindirect method tutions Sy Cory Pa Copa Chat At Das BOX 2X CA MOCOU Cente SO OS DOG OG DOGO SOOOOO - Wages parte 59.DDD.CO RO.COD.00 SOY CO Income statement For the Year Ended December 21, 2010 Gosto 3100,000.00 SOLO 19DCD.00) DOGO CAS.000.00) weest Operating Cash Flows: Indirect Method Instructions Amount Descriptions Statement of Cash Flows - Indirect Method Instructions Statement of Cash Flows - Indirect Method Compute operating cash flows using the Indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions flat prowided for the exact wording of the answer choices for text entries) indirect . ( Swasey Company Statement of Cash Flows Year Ending December 31, 20X2 5985.000.00 1 Net income ad deduct) adjusting en Gain on sale of equipment + Depreciation expense Decrease in accounts receivable 6 Increase in inventories 7 Decrease in wages payable Net cash from operating activities Operativo Colow Endirect Method Statement Prowsindirect method tutions Sy Cory Pa Copa Chat At Das BOX 2X CA MOCOU Cente SO OS DOG OG DOGO SOOOOO - Wages parte 59.DDD.CO RO.COD.00 SOY CO Income statement For the Year Ended December 21, 2010 Gosto 3100,000.00 SOLO 19DCD.00) DOGO CAS.000.00) weest Operating Cash Flows: Indirect Method Instructions Amount Descriptions Statement of Cash Flows - Indirect Method Instructions Statement of Cash Flows - Indirect Method Compute operating cash flows using the Indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions flat prowided for the exact wording of the answer choices for text entries) indirect . ( Swasey Company Statement of Cash Flows Year Ending December 31, 20X2 5985.000.00 1 Net income ad deduct) adjusting en Gain on sale of equipment + Depreciation expense Decrease in accounts receivable 6 Increase in inventories 7 Decrease in wages payable Net cash from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts