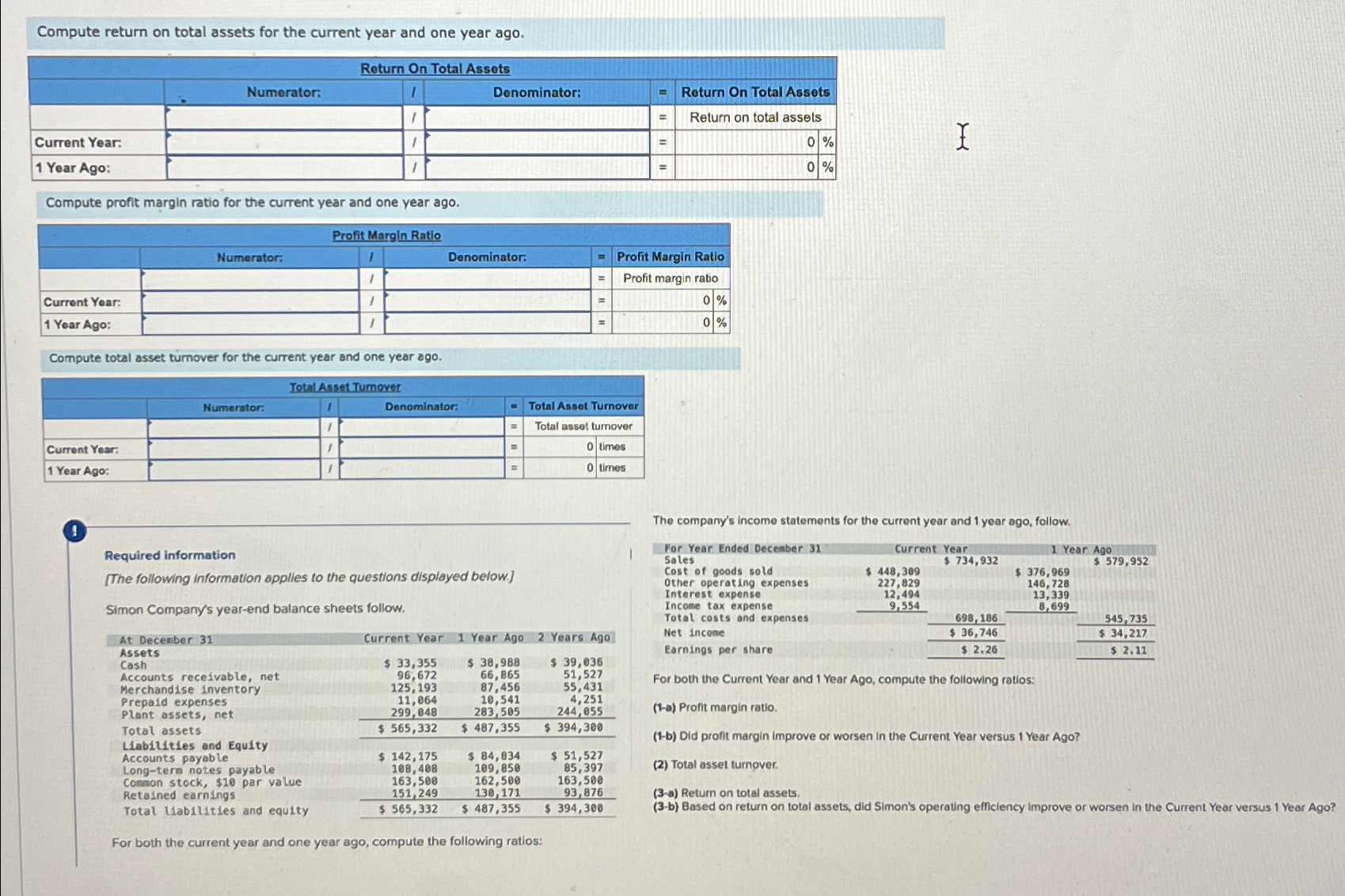

Question: Compute return on total assets for the current year and one year ago. Current Year: 1 Year Ago: Numerator: Return On Total Assets Denominator:

Compute return on total assets for the current year and one year ago. Current Year: 1 Year Ago: Numerator: Return On Total Assets Denominator: R Return On Total Assets = Return on total assets 1 == 0% I = 0% Compute profit margin ratio for the current year and one year ago. Current Year: 1 Year Ago: Numerator: Profit Margin Ratio I Denominator: 1 1 Profit Margin Ratio Profit margin ratio 0% 0% Compute total asset turnover for the current year and one year ago. Current Year: 1 Year Ago: Total Asset Turnover Numerator: Denominator: Total Asset Turnover Total asset turover 0 times ' 0 times Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Other operating expenses Total costs and expenses At December 31 Current Year 1 Year Ago 2 Years Ago Net income Assets Cash $ 33,355 $ 38,988 $ 39,036 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 96,672 125,193 11,064 299,048 66,865 51,527 87,456 55,431 10,541 283,505 4,251 244,055 Total assets $ 565,332 $ 487,355 Liabilities and Equity $ 394,300 Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? The company's income statements for the current year and 1 year ago, follow. For Year Ended December 31 Sales Cost of goods sold Interest expense Income tax expense 1 Year Ago $ 376,969 146,728 13,339 $579,952 Current Year $ 734,932 $ 448,309 227,829 12,494 9,554 8,699 698,186 $ 36,746 545,735 $ 34,217 $2.26 $ 2.11 Accounts payable $ 142,175 $ 84,834 $ 51,527 Long-term notes payable 108,408 Common stock, $10 par value 163,500 Retained earnings Total liabilities and equity For both the current year and one year ago, compute the following ratios: 151,249 109,850 162,500 130,171 85,397 163,500 (2) Total asset turnover. 93,876 $ 565,332 $ 487,355 $ 394,300 (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts