Question: Compute T1-return 2022 DUE DATE; See Announcement for date, at 11 pm EDT in Blackboard Assignments JERRY AND MARY BELL ARE MARRIED AND LIVE WITH

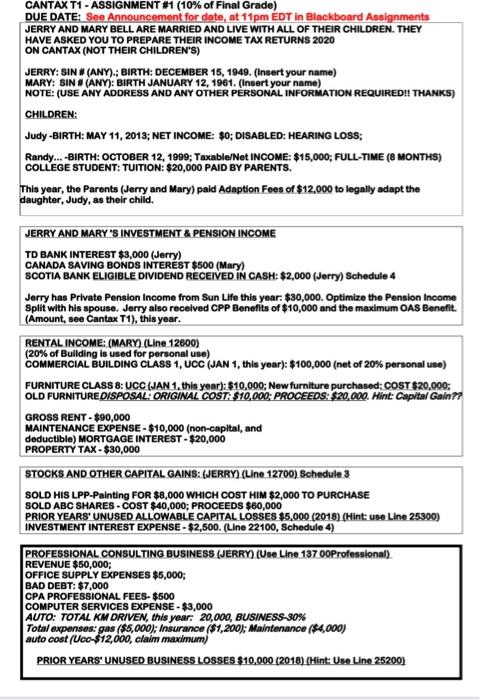

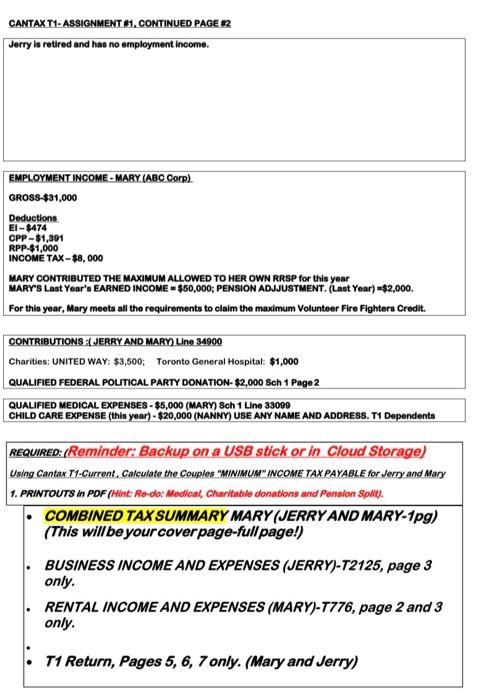

DUE DATE; See Announcement for date, at 11 pm EDT in Blackboard Assignments JERRY AND MARY BELL ARE MARRIED AND LIVE WITH ALL OF THEIR CHILDREN. THEY HAVE ASKED YOU TO PREPARE THEIR INCOME TAX RETURNS 2020 ON CANTAX (NOT THEIR CHILDREN'S) JERRY: SIN # (ANY).; BIRTH: DECEMBER 15, 1949. (Insert your name) MARY: SIN A (ANY): BIRTH JANUARY 12, 1961. (Insert your name) NOTE: (USE ANY ADDRESS AND ANY OTHER PERSONAL. INFORMATION REQUIREDII THANKS) CHILDREN: Judy -BIRTH: MAY 11, 2013; NET INCOME: \$0; DISABLED; HEARING LOSS; Randy... -BIRTH: OCTOBER 12, 1999; Taxable/Net INCOME: \$15,000; FULL-TIME (8 MONTHS) COLLEGE STUDENT: TUITION: $20,000 PAID BY PARENTS. This year, the Parents (Jerry and Mary) paid Adaption Fees of $12,000 to legally adapt the daughter, Judy, as their child. JERRY AND MARY'S INVESTMENT \& PENSION INCOME TD BANK INTEREST $3,000 (Jerry) CANADA SAVING BONDS INTEREST \$500 (Mary) SCOTIA BANK ELIGIBLE DIVIDEND RECEIVED IN CASH: $2,000 (Jerry) Schedule 4 Jerry has Private Pension Income from Sun Life this year: $30,000. Optimize the Pension Income Split with his spouse. Jerry also recelved CPP Benefits of $10,000 and the maximum OAS Benefit. (Amount, see Cantax T1), this year. RENTAL INCOME: (MARY) (Line 12600) (20\% of Bullding is used for personal use) COMMERCIAL BUILDING CLASS 1, UCC (JAN 1, this year): $100,000 (net of 20% personal use) FURNITURE CLASS B: UCC (JAN 1, this year): $10,000; New furniture purchased: COST $20,000; OLD FURNITUREDISPOSAL. ORIGINAL COST, $10,000; PROCEEDS: $20,000. Hint: Capital Galn? GROSS RENT - $90,000 MAINTENANCE EXPENSE - $10,000 (non-capital, and deductible) MORTGAGE INTEREST - $20,000 PROPERTY TAX - \$30,000 STOCKS AND OTHER CAPITAL GAINS: (JERRY) (Line 12700) Schedule 3 SOLD HIS LPP-Painting FOR \$8,000 WHICH COST HIM \$2,000 TO PURCHASE SOLD ABC SHARES - COST $40,000; PROCEEDS $60,000 PRIOR YEARS' UNUSED ALLOWABLE CAPITALLOSSES \$5,000 (2018) (Hint: use Line 25300) INVESTMENT INTEREST EXPENSE - \$2,500. (Line 22100, Schedule 4) PROFESSIONAL CONSULTING BUSINESS (JERRY) (Use Line 137 00Professional). REVENUE $50,000; OFFICE SUPPLY EXPENSES $5,000; BAD DEBT: $7,000 CPA PROFESSIONAL. FEES- $500 COMPUTER SERVICES EXPENSE - $3,000 AUTO: TOTAL KM DRIVEN, this yoar: 20,000, BUSNESS-30\% Total expenses: gas ($5,000); Insurance ($1,200); Maintenance ($4,000) auto cost (Uoo-512,000, claim maximum) PRIOR YEARS UNUSED BUSINESS LOSSES $10,000 (2018) (Hint: Use Ling 25200) CANTAX T1-ASSIGNMENT #1, CONTINUED PAGE 82 Jerry is retired and has no employment income. EMPLOYMENT INCOME - MARY (ABC Corp) GROSS-\$31,000 Deductions El $474 CPP $1,391 RPP-\$1,000 INCOME TAX $8,000 MARY CONTRIBUTED THE MAXIMUM ALLOWED TO HER OWN RRSP for this year MARY'S Last Year's EARNED INCOME = \$50,000; PENSION ADJJUSTMENT. (LAat Year) =$2,000. For this year, Mary meets all the requirements to claim the maximum Volunteer Fire Fightera Credit. CONTRIBUTIONS \&( JERRY AND MARY) LIn 34900 Charities: UNITED WAY: $3,500; Toronto General Hospital: $1,000 QUALIFIED FEDERAL POUTICAL PARTY DONATION-\$2,000 Sch 1 Page 2 QUALIFIED MEDICAL EXPENSES - $5,000 (MARY) Sch 1 Line 33099 CHILD CARE EXPENSE (this year) - \$20,000 (NANNY) USE ANY NAME AND ADDRESS. T1 Dependents REQUIRED: (Reminder: Backup on a USB stick or in Cloud Storage) Using Cantax T1-Current, Calculate the Couples "MINMUM" INCOME TAXPA YABLE for Jerry and Mary 1. PRINTOUTS in PDF (Hint: Ro-do: Medical, Charitable donations and Pension Split. - COMBINED TAXSUMMARY MARY (JERRY AND MARY-1pg) (This will beyourcoverpage-full page!) - BUSINESS INCOME AND EXPENSES (JERRY)-T2125, page 3 only. - RENTAL INCOME AND EXPENSES (MARY)-T776, page 2 and 3 only. - T1Return, Pages 5, 6, 7 only. (Mary and Jerry) DUE DATE; See Announcement for date, at 11 pm EDT in Blackboard Assignments JERRY AND MARY BELL ARE MARRIED AND LIVE WITH ALL OF THEIR CHILDREN. THEY HAVE ASKED YOU TO PREPARE THEIR INCOME TAX RETURNS 2020 ON CANTAX (NOT THEIR CHILDREN'S) JERRY: SIN # (ANY).; BIRTH: DECEMBER 15, 1949. (Insert your name) MARY: SIN A (ANY): BIRTH JANUARY 12, 1961. (Insert your name) NOTE: (USE ANY ADDRESS AND ANY OTHER PERSONAL. INFORMATION REQUIREDII THANKS) CHILDREN: Judy -BIRTH: MAY 11, 2013; NET INCOME: \$0; DISABLED; HEARING LOSS; Randy... -BIRTH: OCTOBER 12, 1999; Taxable/Net INCOME: \$15,000; FULL-TIME (8 MONTHS) COLLEGE STUDENT: TUITION: $20,000 PAID BY PARENTS. This year, the Parents (Jerry and Mary) paid Adaption Fees of $12,000 to legally adapt the daughter, Judy, as their child. JERRY AND MARY'S INVESTMENT \& PENSION INCOME TD BANK INTEREST $3,000 (Jerry) CANADA SAVING BONDS INTEREST \$500 (Mary) SCOTIA BANK ELIGIBLE DIVIDEND RECEIVED IN CASH: $2,000 (Jerry) Schedule 4 Jerry has Private Pension Income from Sun Life this year: $30,000. Optimize the Pension Income Split with his spouse. Jerry also recelved CPP Benefits of $10,000 and the maximum OAS Benefit. (Amount, see Cantax T1), this year. RENTAL INCOME: (MARY) (Line 12600) (20\% of Bullding is used for personal use) COMMERCIAL BUILDING CLASS 1, UCC (JAN 1, this year): $100,000 (net of 20% personal use) FURNITURE CLASS B: UCC (JAN 1, this year): $10,000; New furniture purchased: COST $20,000; OLD FURNITUREDISPOSAL. ORIGINAL COST, $10,000; PROCEEDS: $20,000. Hint: Capital Galn? GROSS RENT - $90,000 MAINTENANCE EXPENSE - $10,000 (non-capital, and deductible) MORTGAGE INTEREST - $20,000 PROPERTY TAX - \$30,000 STOCKS AND OTHER CAPITAL GAINS: (JERRY) (Line 12700) Schedule 3 SOLD HIS LPP-Painting FOR \$8,000 WHICH COST HIM \$2,000 TO PURCHASE SOLD ABC SHARES - COST $40,000; PROCEEDS $60,000 PRIOR YEARS' UNUSED ALLOWABLE CAPITALLOSSES \$5,000 (2018) (Hint: use Line 25300) INVESTMENT INTEREST EXPENSE - \$2,500. (Line 22100, Schedule 4) PROFESSIONAL CONSULTING BUSINESS (JERRY) (Use Line 137 00Professional). REVENUE $50,000; OFFICE SUPPLY EXPENSES $5,000; BAD DEBT: $7,000 CPA PROFESSIONAL. FEES- $500 COMPUTER SERVICES EXPENSE - $3,000 AUTO: TOTAL KM DRIVEN, this yoar: 20,000, BUSNESS-30\% Total expenses: gas ($5,000); Insurance ($1,200); Maintenance ($4,000) auto cost (Uoo-512,000, claim maximum) PRIOR YEARS UNUSED BUSINESS LOSSES $10,000 (2018) (Hint: Use Ling 25200) CANTAX T1-ASSIGNMENT #1, CONTINUED PAGE 82 Jerry is retired and has no employment income. EMPLOYMENT INCOME - MARY (ABC Corp) GROSS-\$31,000 Deductions El $474 CPP $1,391 RPP-\$1,000 INCOME TAX $8,000 MARY CONTRIBUTED THE MAXIMUM ALLOWED TO HER OWN RRSP for this year MARY'S Last Year's EARNED INCOME = \$50,000; PENSION ADJJUSTMENT. (LAat Year) =$2,000. For this year, Mary meets all the requirements to claim the maximum Volunteer Fire Fightera Credit. CONTRIBUTIONS \&( JERRY AND MARY) LIn 34900 Charities: UNITED WAY: $3,500; Toronto General Hospital: $1,000 QUALIFIED FEDERAL POUTICAL PARTY DONATION-\$2,000 Sch 1 Page 2 QUALIFIED MEDICAL EXPENSES - $5,000 (MARY) Sch 1 Line 33099 CHILD CARE EXPENSE (this year) - \$20,000 (NANNY) USE ANY NAME AND ADDRESS. T1 Dependents REQUIRED: (Reminder: Backup on a USB stick or in Cloud Storage) Using Cantax T1-Current, Calculate the Couples "MINMUM" INCOME TAXPA YABLE for Jerry and Mary 1. PRINTOUTS in PDF (Hint: Ro-do: Medical, Charitable donations and Pension Split. - COMBINED TAXSUMMARY MARY (JERRY AND MARY-1pg) (This will beyourcoverpage-full page!) - BUSINESS INCOME AND EXPENSES (JERRY)-T2125, page 3 only. - RENTAL INCOME AND EXPENSES (MARY)-T776, page 2 and 3 only. - T1Return, Pages 5, 6, 7 only. (Mary and Jerry)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts