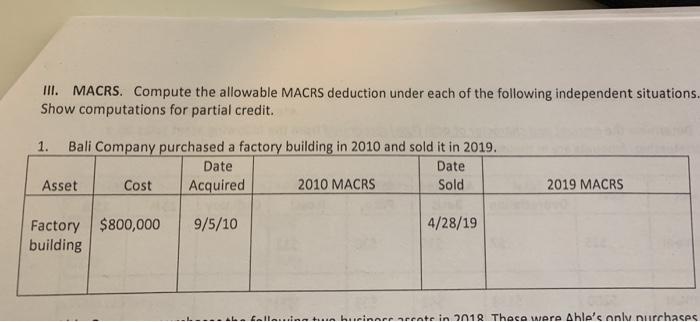

Question: II. MACRS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. Bali Company purchased a

II. MACRS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. Bali Company purchased a factory building in 2010 and sold it in 2019. Date Sold Date Asset Cost Acquired 2010 MACRS 2019 MACRS Factory $800,000 building 9/5/10 4/28/19 tallaina...n hurinore arcete in 2018 Theca were Able's onlu nurchases

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Answer As per the MACRS Method Building ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock