Question: Compute the amount of charitable contribution deduction for the current year for the following taxpayers. Ignore any percentage limitations. a. Pritizo Corporation owns inventory

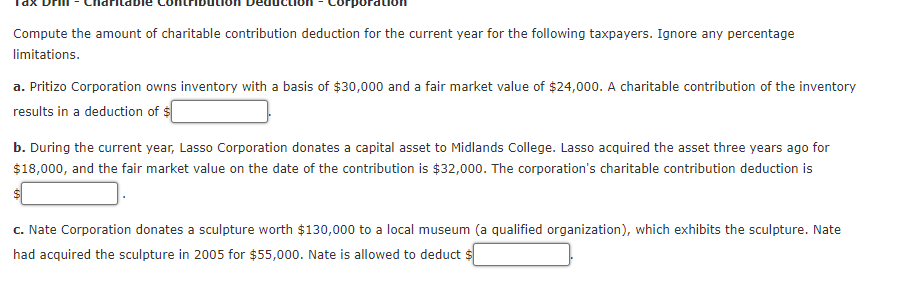

Compute the amount of charitable contribution deduction for the current year for the following taxpayers. Ignore any percentage limitations. a. Pritizo Corporation owns inventory with a basis of $30,000 and a fair market value of $24,000. A charitable contribution of the inventory results in a deduction of $ b. During the current year, Lasso Corporation donates a capital asset to Midlands College. Lasso acquired the asset three years ago for $18,000, and the fair market value on the date of the contribution is $32,000. The corporation's charitable contribution deduction is c. Nate Corporation donates a sculpture worth $130,000 to a local museum (a qualified organization), which exhibits the sculpture. Nate had acquired the sculpture in 2005 for $55,000. Nate is allowed to deduct $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts