Question: Compute the contribution margin for the company under variable costing. Required information Use the following information for the Quick Study below. (Algo) [The following information

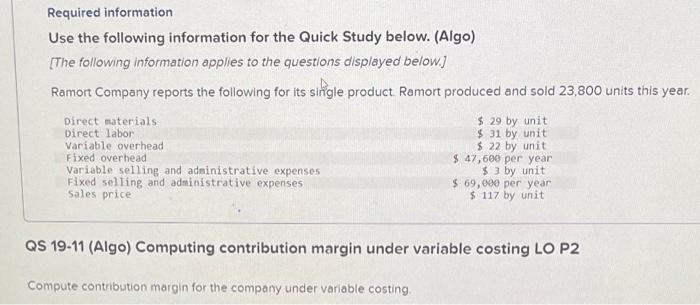

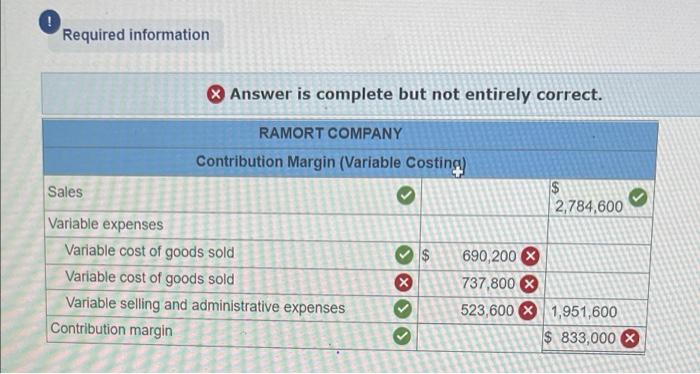

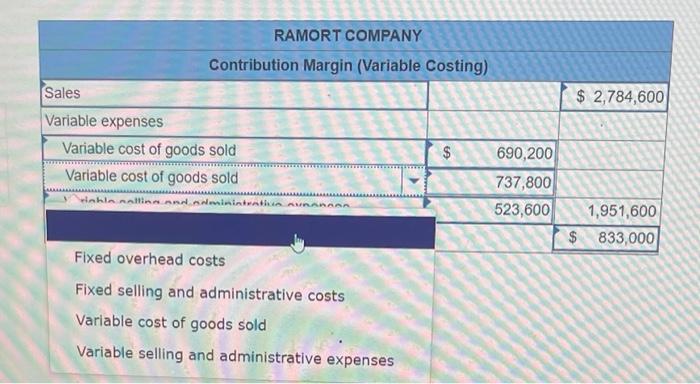

Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.) Ramon Company reports the following for its single product. Ramort produced and sold 23,800 units this year. Direct materials $ 29 by unit $ 31 by unit Variable overhead $ 22 by unit Fixed overhead $ 47,600 per year Variable selling and administrative expenses $ 3 by unit Fixed selling and administrative expenses $ 69,000 per year Sales price $ 117 by unit Direct labor QS 19-11 (Algo) Computing contribution margin under variable costing LO P2 Compute contribution margin for the company under variable costing, ! Required information & Answer is complete but not entirely correct. RAMORT COMPANY Contribution Margin (Variable Costing Sales 2,784,600 Variable expenses Variable cost of goods sold 690,200 X Variable cost of goods sold 737,800 X Variable selling and administrative expenses 523,600 X 1,951,600 Contribution margin $ 833,000 X $ on 2 L 1 ol X >> RAMORT COMPANY Contribution Margin (Variable Costing) Sales $ 2,784,600 Variable expenses Variable cost of goods sold Variable cost of goods sold $ 690,200 lahinnalla and adminintathi AURANDO 737,800 523,600 1,951,600 $ 833,000 Fixed overhead costs Fixed selling and administrative costs Variable cost of goods sold Variable selling and administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts