Question: Compute the contribution margin under each of the alternative courses of action. Contribution margin for alternative 1 % Contribution margin for alternative 2 % Compute

Compute the contribution margin under each of the alternative courses of action.

| Contribution margin for alternative 1 |

| |

| Contribution margin for alternative 2 |

|

Compute the break-even point in dollars under each of the alternative courses of action.

| Break-even point for alternative 1 | $

| |

| Break-even point for alternative 2 | $

|

Which course of action do you recommend?

Alternative 1Alternative 2

Alternative 1Alternative 2

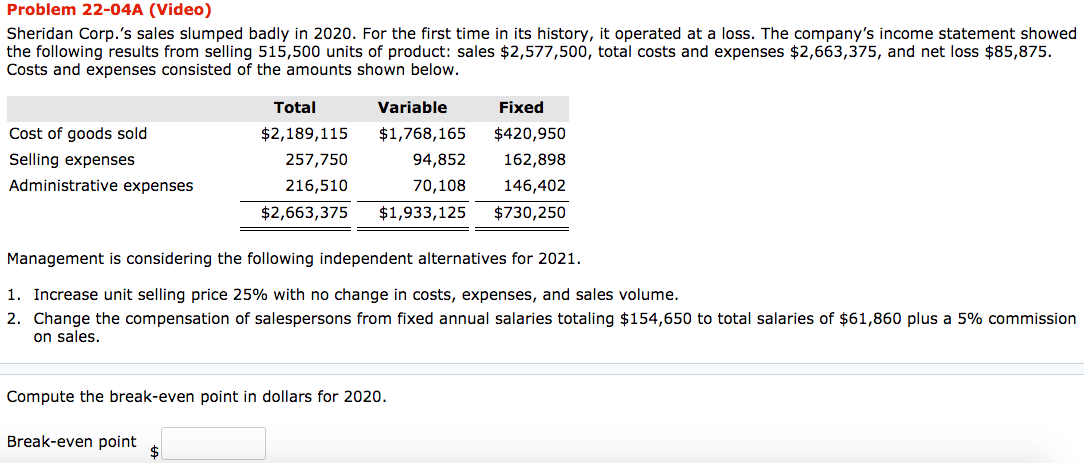

Problem 22-04A (Video) Sheridan Corp.'s sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 515,500 units of product: sales $2,577,500, total costs and expenses $2,663,375, and net loss $85,875. Costs and expenses consisted of the amounts shown below. Cost of goods sold Selling expenses Administrative expenses Total $2,189,115 257,750 216,510 $2,663,375 Variable $1,768,165 94,852 70,108 $1,933,125 Fixed $420,950 162,898 146,402 $730,250 Management is considering the following independent alternatives for 2021. 1. Increase unit selling price 25% with no change in costs, expenses, and sales volume. 2. Change the compensation of salespersons from fixed annual salaries totaling $154,650 to total salaries of $61,860 plus a 5% commission on sales. Compute the break-even point in dollars for 2020. Break-even point &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts