Question: Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9

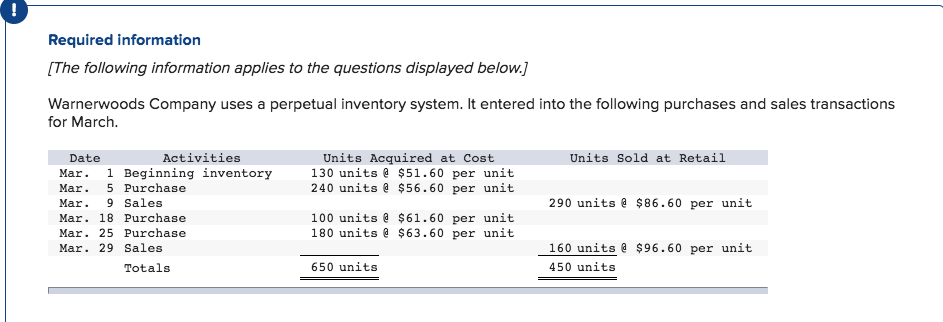

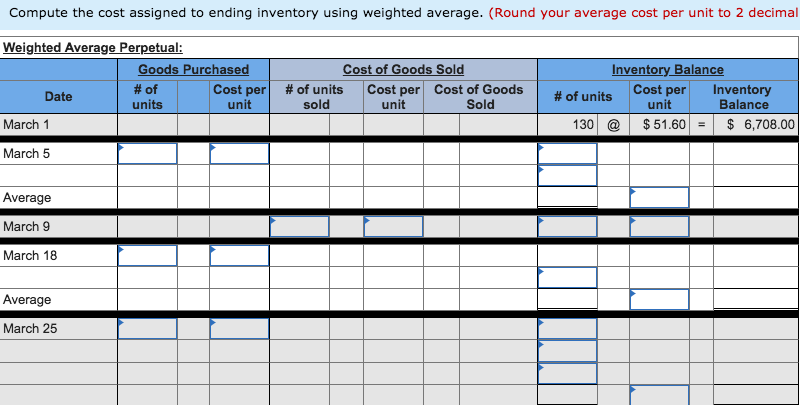

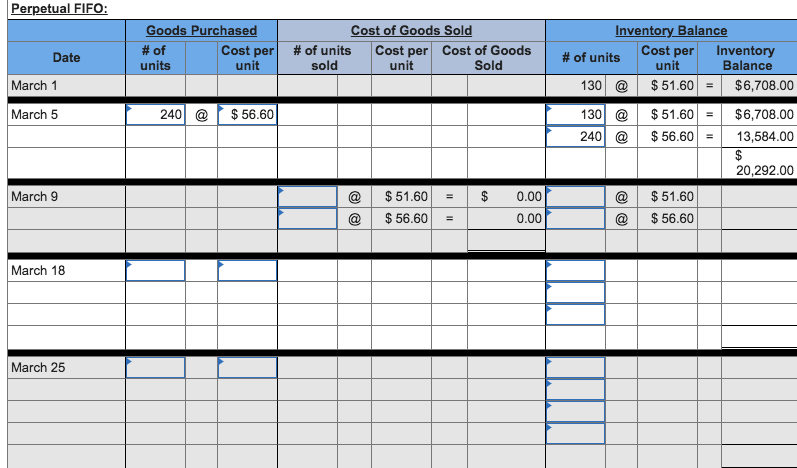

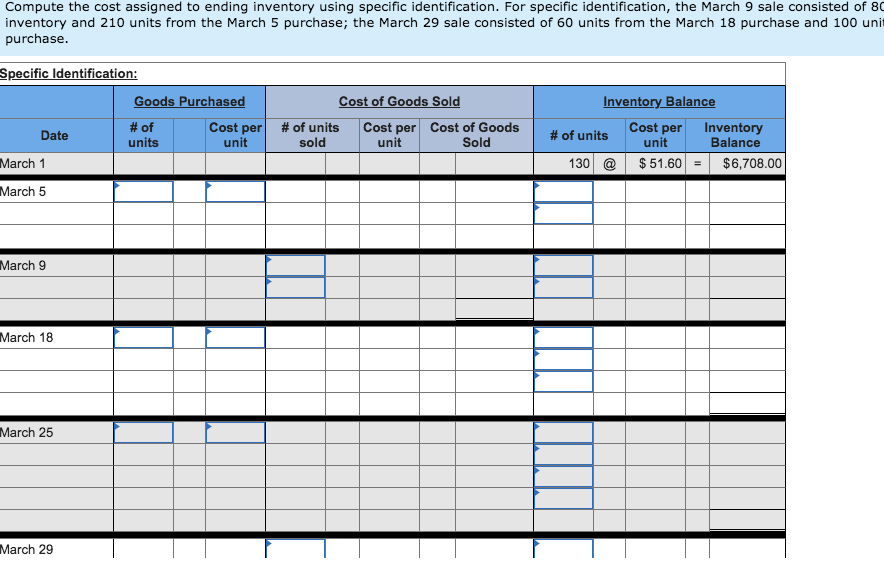

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 210 units from the March 5 purchase; the March 29 sale consisted of 60 units from the March 18 purchase and 100 units from the March 25 purchase.

Required informatio [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Activities Units Sold at Retail Units Acquired at Cost 130 units $51.60 per unit 240 units $56.60 per unit Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 290 units $86.60 per unit 100 units $61.60 per unit 180 units $63.60 per unit 160 units a $96.60 per unit 450 units Totals 650 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts