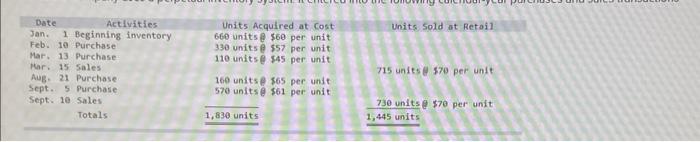

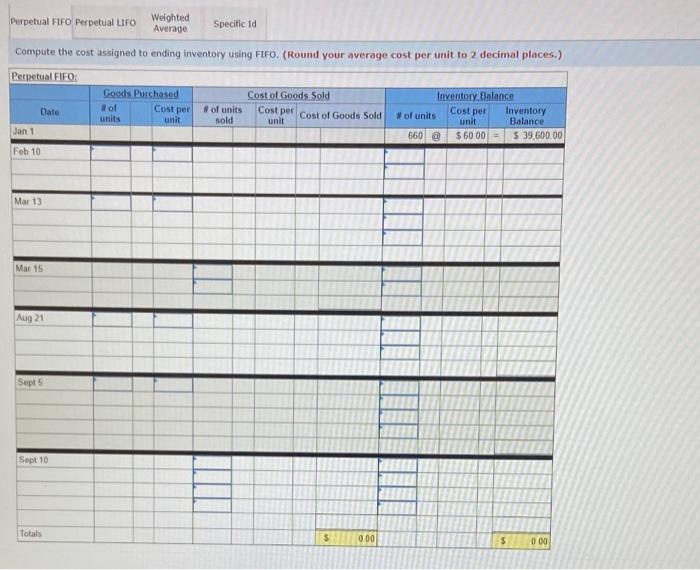

Question: Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) comnute the cost assianed to ending

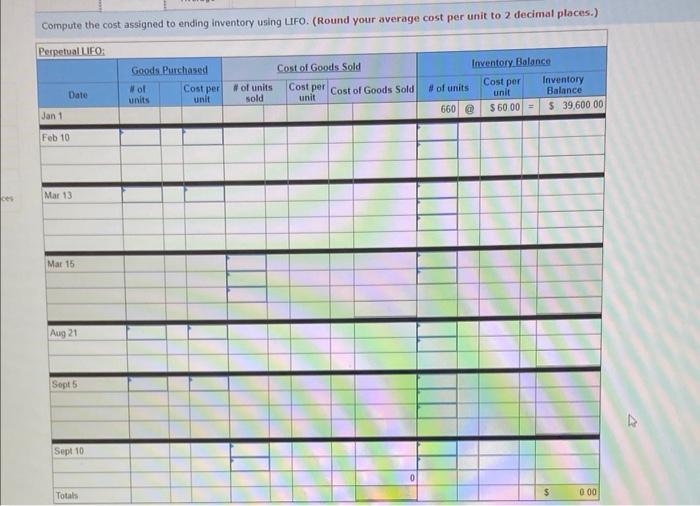

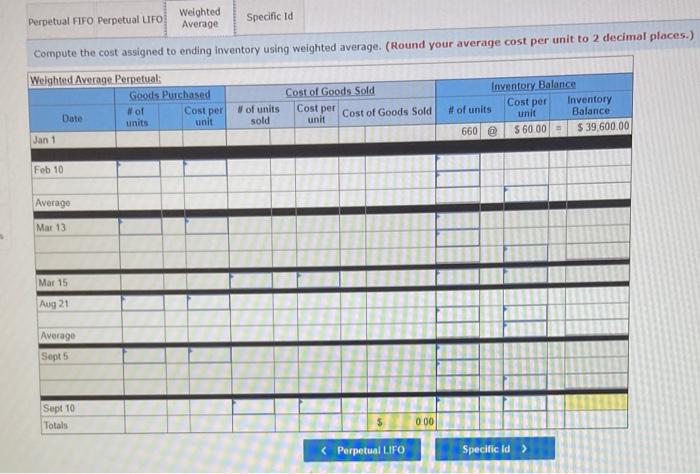

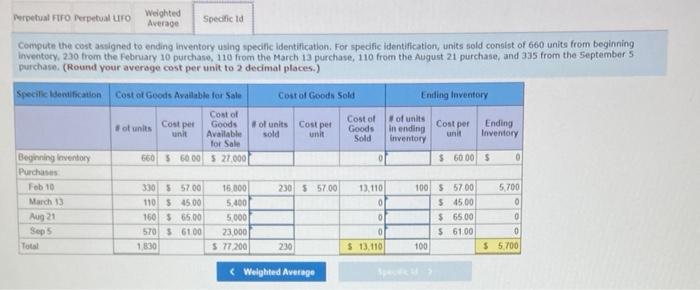

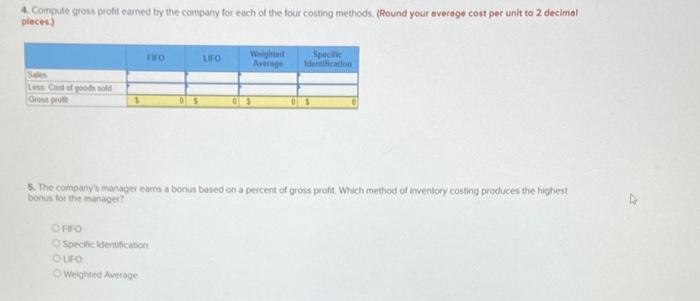

Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) comnute the cost assianed to ending inventory using LFO. (Round your average cost per unit to 2 decimal places.) Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal place Compute the cost assigned to ending inventory using specific ldentification. For specific identification, units sold consist of 660 units from beginning inventory, 230 from the february 10 purchase, 110 from the March 13 purchase, 110 from the August 21 purchase, and 335 from the September 5 purchase. (Round your average cost per unit to 2 decimal places.) A. Compute gross probit eained by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal plecest 5. The company w marager evins a bonus bosed on a percent of gross profit. Which method of inentory costing produces the highest bonus tor the manages? FiFo Soecificidentification LIEO Weighted Awerage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts