Question: compute the ending inventory using fifo In today's class, your job is to do the following problem and upload it in Blackboard before the class

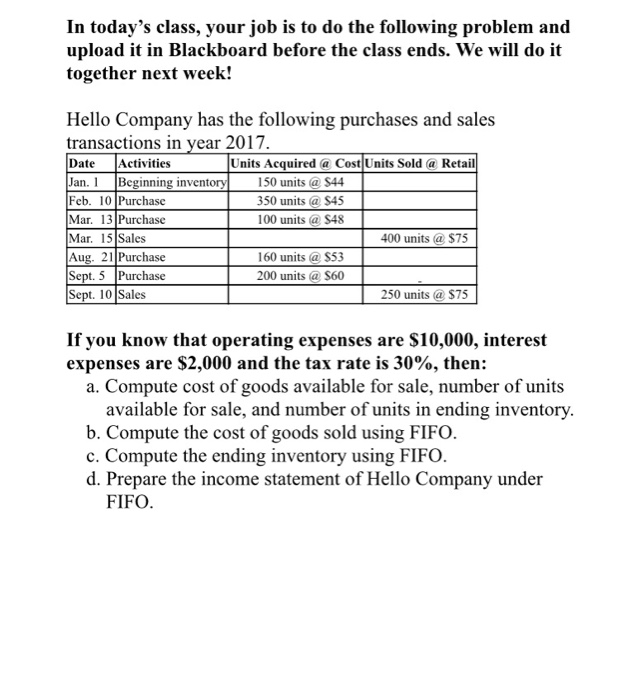

In today's class, your job is to do the following problem and upload it in Blackboard before the class ends. We will do it together next week! Hello Company has the following purchases and sales transactions in year 2017. Date Activities Units Acquired @ Cost Units Sold @ Retail Jan. 1 Beginning inventory 150 units @ $44 Feb. 10 Purchase 350 units @ $45 Mar. 13 Purchase 100 units @ $48 Mar. 15 Sales 400 units @ $75 Aug. 21 Purchase 160 units @ $53 Sept. 5 Purchase 200 units @ $60 Sept. 10 Sales 250 units @ $75 If you know that operating expenses are $10,000, interest expenses are $2,000 and the tax rate is 30%, then: a. Compute cost of goods available for sale, number of units available for sale, and number of units in ending inventory. b. Compute the cost of goods sold using FIFO. c. Compute the ending inventory using FIFO. d. Prepare the income statement of Hello Company under FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts