Question: Compute the following: a. Return on total equity b. Return on common equity MARY LOU SZABO CORPORATION Balance Sheets December 31, 2007, through December 31,

Compute the following: a. Return on total equity b. Return on common equity

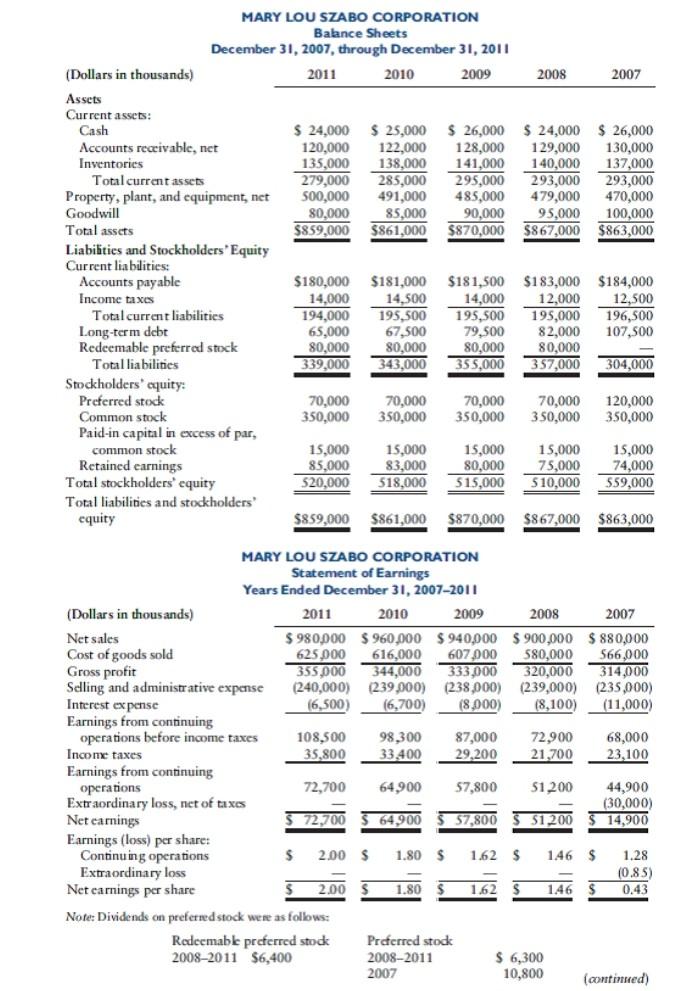

MARY LOU SZABO CORPORATION Balance Sheets December 31, 2007, through December 31, 2011 2011 2010 2009 (Dollars in thousands) 2008 2007 Assets Current assets: Cash $ 24,000 120,000 135,000 279,000 500,000 80,000 $859,000 $ 25,000 122,000 138,000 285,000 491,000 85,000 $861,000 $ 26,000 128,000 141,000 295,000 485,000 90,000 $870,000 $ 24,000 $ 26,000 129,000 130,000 140,000 137,000 293,000 293,000 479,000 470,000 95,000 100,000 $867,000 $863,000 Accounts receivable, net Inventories Total current assets Property, plant, and equipment, net Goodwill Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income taxes Total current liabilities Long-term debt Redeemable preferred stock Total liabilities Stockholders' equity: Preferred stock Common stock Paid-in capital in excess of par, Retained carnings Total stockholders' equity Total liabilities and stockholders' equity $180,000 14.000 194.000 65,000 80,000 339.000 $181,000 14,500 195,500 67,500 80,000 343,000 $181,500 14,000 195,500 79,500 80,000 35 5.000 $183,000 $184,000 12,000 12,500 195,000 196,500 82,000 107,500 80,000 357,000 304,000 70,000 350,000 70,000 350,000 70,000 350,000 70,000 350,000 120,000 350,000 common stock 15,000 85,000 520,000 15,000 83,000 518,000 15,000 80.000 515,000 15,000 75,000 510,000 15,000 74,000 559,000 $859,000 $861,000 $870,000 $867,000 $863,000 Interest expense Income taxes MARY LOU SZABO CORPORATION Statement of Earnings Years Ended December 31, 2007-2011 (Dollars in thousands) 2011 2010 2009 2008 2007 Net sales $ 980,000 $960,000 $940,000 $900,000 $ 880,000 Cost of goods sold 625.000 616,000 607.000 580,000 566,000 Gross profit 355 000 344,000 333,000 320,000 314,000 Selling and administrative expense (240,000) (239,000) (238,000) (239,000) (235,000) (6,500 (6,700) (8.000) (8,100) (11,000) Earnings from continuing operations before income taxes 108,500 98,300 87,000 72,900 68,000 35,800 33,400 29,200 21,700 23,100 Earnings from continuing operations 72,700 64,900 $1200 44,900 Extraordinary loss, net of taxes (30,000) Net carnings 72,700 64,900 57,800 51200 14,900 Earnings (loss) per share: Continuing operations $ 2.00 $ 1.80 $ 1.62 $ 146 $ 1.28 Extraordinary loss (0.85) Net camnings per share 2.00 1.80 1.62 1.46 0.43 Note: Dividends on preferred stock were as follows: Redeemable preferred stock Preferred stock 2008-2011 $6,400 2008-2011 $ 6,300 2007 10,800 (continued) 57,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts