Question: Compute the following for each project: a. The net present value. Use a rate of 6% and the present value of an annuity table

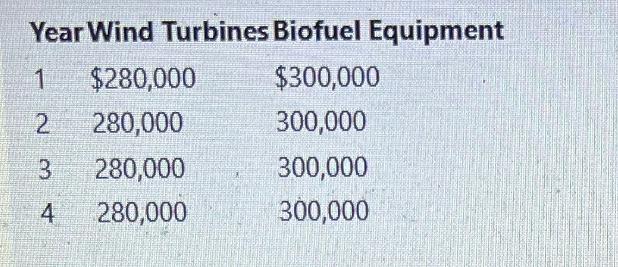

Compute the following for each project: a. The net present value. Use a rate of 6% and the present value of an annuity table appearing in Exhibit 5 of this chapter. TOE N b. A present value index. Round to two decimal places. 2. Determine the internal rate of return for each project by (a) computing a present value factor for an annuity of $1 and (b) using the present value of an annuity of $1 table appearing in Exhibit 5 of this chapter. 3. What advantage does the internal rate of return method have over the net present value method in comparing projects? Year Wind Turbines Biofuel Equipment 1 $300,000 2 300,000 $280,000 280,000 3 280,000 4 280,000 300,000 300,000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV present value index PVI and internal rate of return IRR for e... View full answer

Get step-by-step solutions from verified subject matter experts