Question: Compute the missing amounts in the contribution income statement shown below: Note: Round Per Unit answers to 2 decimal places. Assume Hudson has a target

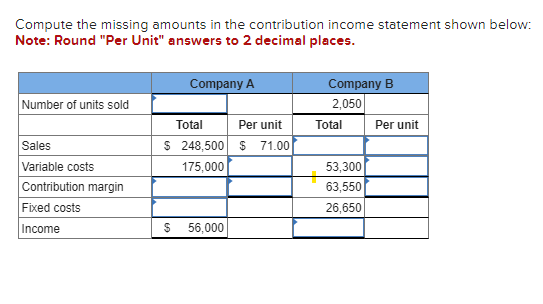

Compute the missing amounts in the contribution income statement shown below:

Note: Round "Per Unit" answers to 2 decimal places.

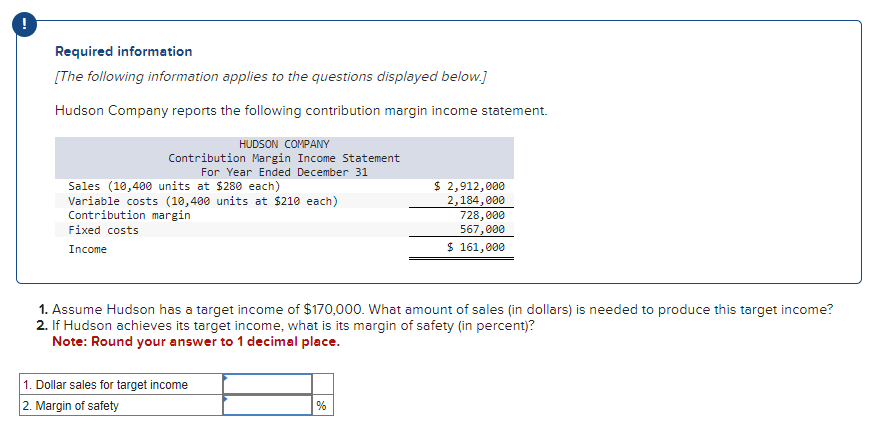

- Assume Hudson has a target income of $170,000. What amount of sales (in dollars) is needed to produce this target income?

If Hudson achieves its target income, what is its margin of safety (in percent)?

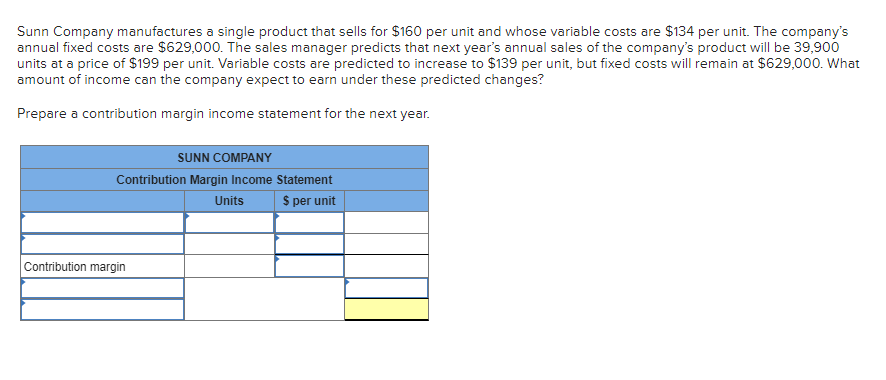

Sunn Company manufactures a single product that sells for $160 per unit and whose variable costs are $134 per unit. The companys annual fixed costs are $629,000. The sales manager predicts that next years annual sales of the companys product will be 39,900 units at a price of $199 per unit. Variable costs are predicted to increase to $139 per unit, but fixed costs will remain at $629,000. What amount of income can the company expect to earn under these predicted changes?

Prepare a contribution margin income statement for the next year.

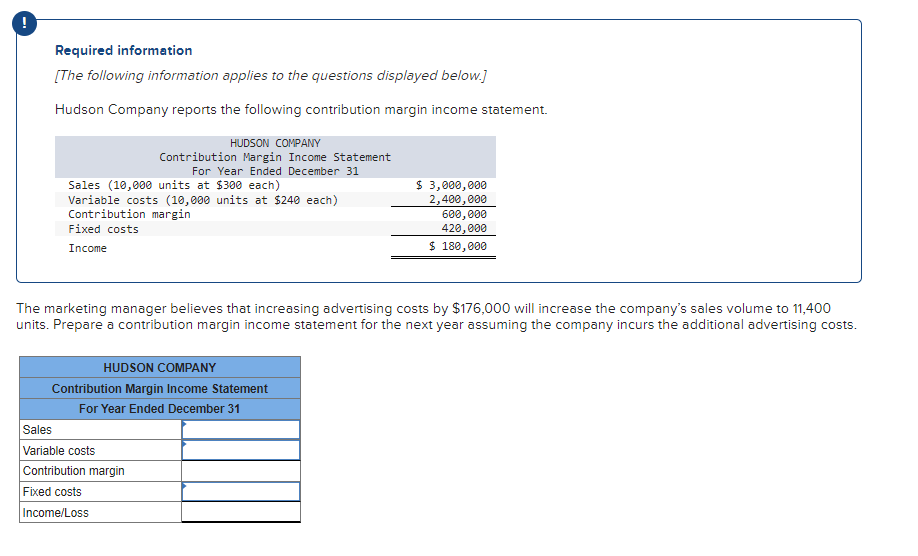

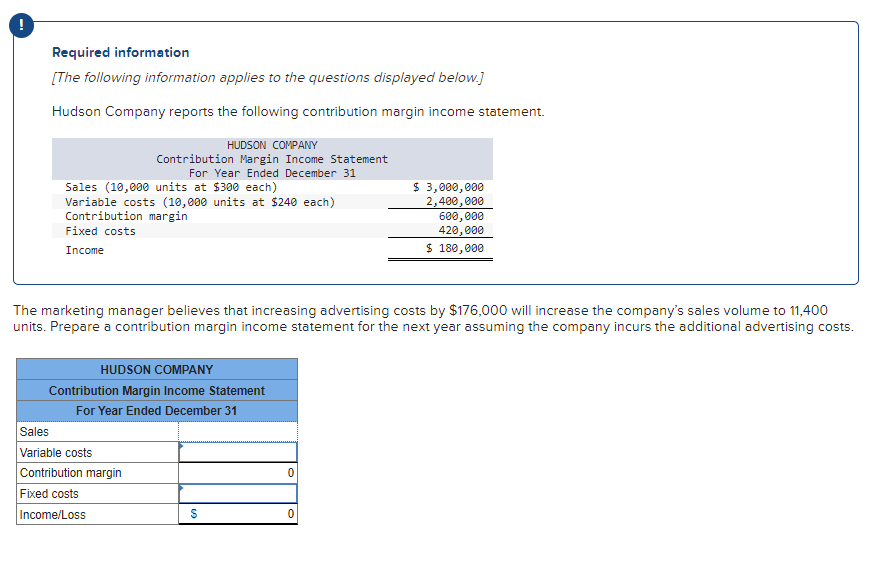

The marketing manager believes that increasing advertising costs by $176,000 will increase the companys sales volume to 11,400 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs.

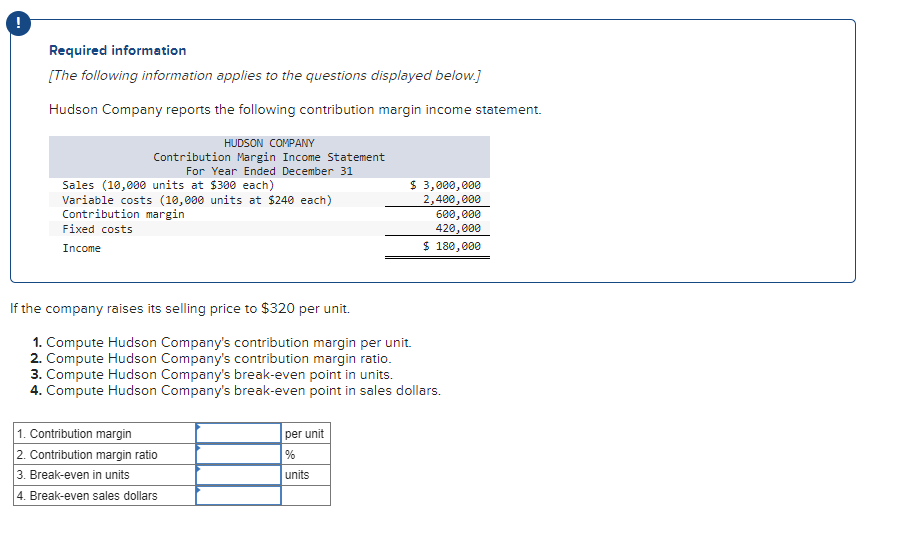

If the company raises its selling price to $320 per unit.

- Compute Hudson Company's contribution margin per unit.

- Compute Hudson Company's contribution margin ratio.

- Compute Hudson Company's break-even point in units.

- Compute Hudson Company's break-even point in sales dollars.

The marketing manager believes that increasing advertising costs by $176,000 will increase the companys sales volume to 11,400 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs.

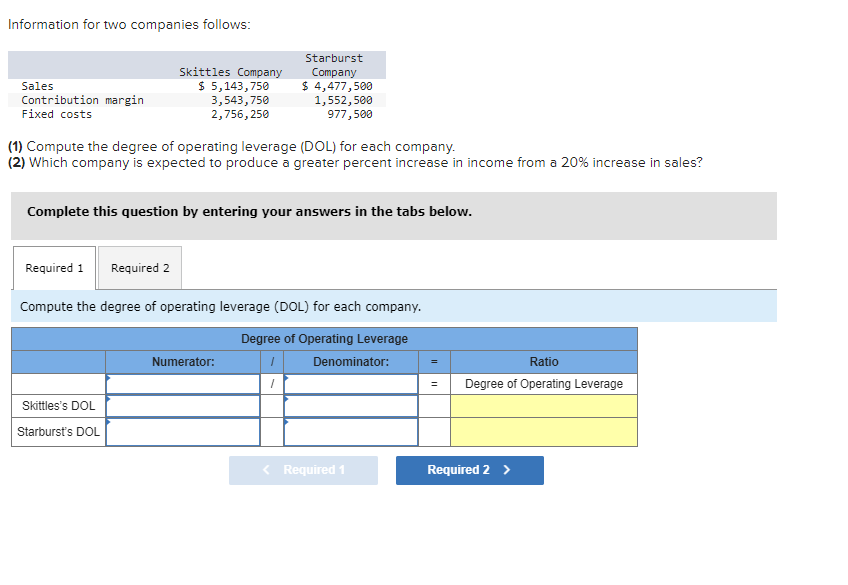

Information for two companies follows:

| Skittles Company | Starburst Company | |

|---|---|---|

| Sales | $ 5,143,750 | $ 4,477,500 |

| Contribution margin | 3,543,750 | 1,552,500 |

| Fixed costs | 2,756,250 | 977,500 |

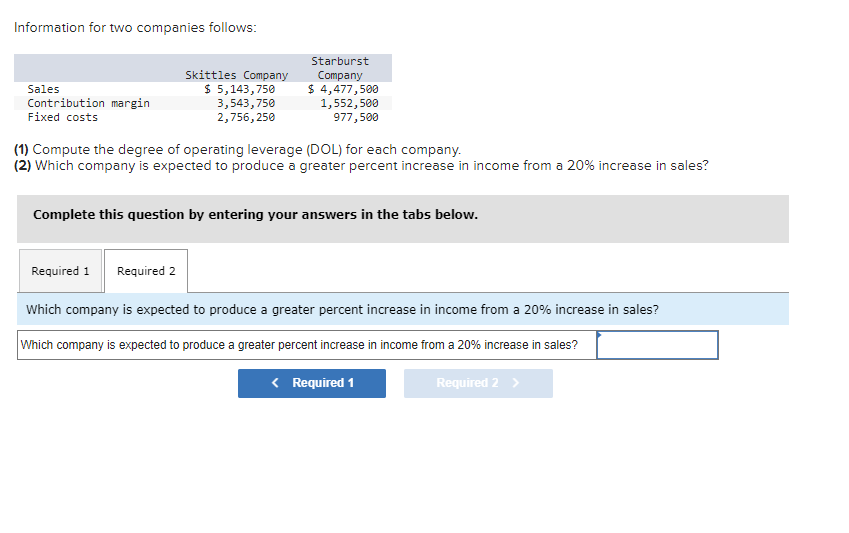

(1) Compute the degree of operating leverage (DOL) for each company.

(2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales?

Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The marketing manager believes that increasing advertising costs by $176,000 will increase the company's sales volume to 11,400 nits. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales Complete this question by entering your answers in the tabs below. Compute the degree of operating leverage (DOL) for each company. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The marketing manager believes that increasing advertising costs by $176,000 will increase the company's sales volume to 11,400 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Compute the missing amounts in the contribution income statement shown below: Note: Round "Per Unit" answers to 2 decimal places. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. . Assume Hudson has a target income of $170,000. What amount of sales (in dollars) is needed to produce this target income? . If Hudson achieves its target income, what is its margin of safety (in percent)? Note: Round your answer to 1 decimal place. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Complete this question by entering your answers in the tabs below. Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. If the company raises its selling price to $320 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. Sunn Company manufactures a single product that sells for $160 per unit and whose variable costs are $134 per unit. The company's annual fixed costs are $629,000. The sales manager predicts that next year's annual sales of the company's product will be 39,900 units at a price of $199 per unit. Variable costs are predicted to increase to $139 per unit, but fixed costs will remain at $629,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The marketing manager believes that increasing advertising costs by $176,000 will increase the company's sales volume to 11,400 nits. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales Complete this question by entering your answers in the tabs below. Compute the degree of operating leverage (DOL) for each company. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. The marketing manager believes that increasing advertising costs by $176,000 will increase the company's sales volume to 11,400 units. Prepare a contribution margin income statement for the next year assuming the company incurs the additional advertising costs. Compute the missing amounts in the contribution income statement shown below: Note: Round "Per Unit" answers to 2 decimal places. Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. . Assume Hudson has a target income of $170,000. What amount of sales (in dollars) is needed to produce this target income? . If Hudson achieves its target income, what is its margin of safety (in percent)? Note: Round your answer to 1 decimal place. Information for two companies follows: (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Complete this question by entering your answers in the tabs below. Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. If the company raises its selling price to $320 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. Sunn Company manufactures a single product that sells for $160 per unit and whose variable costs are $134 per unit. The company's annual fixed costs are $629,000. The sales manager predicts that next year's annual sales of the company's product will be 39,900 units at a price of $199 per unit. Variable costs are predicted to increase to $139 per unit, but fixed costs will remain at $629,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts