Question: Compute the missing values P7-5 (Static) Evaluating the LIFO and FIFO Choice When Costs Are Rising and Falling L07-2, 7-3 [The following information applies to

Compute the missing values

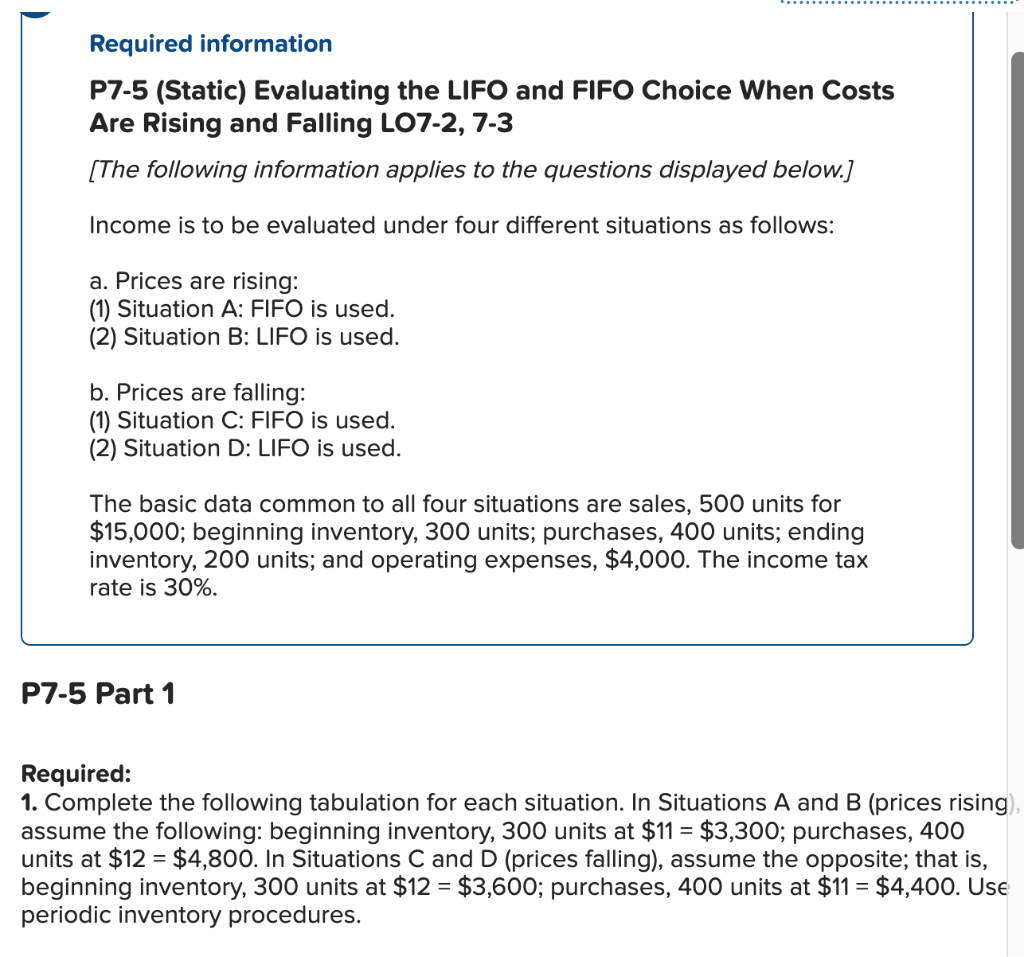

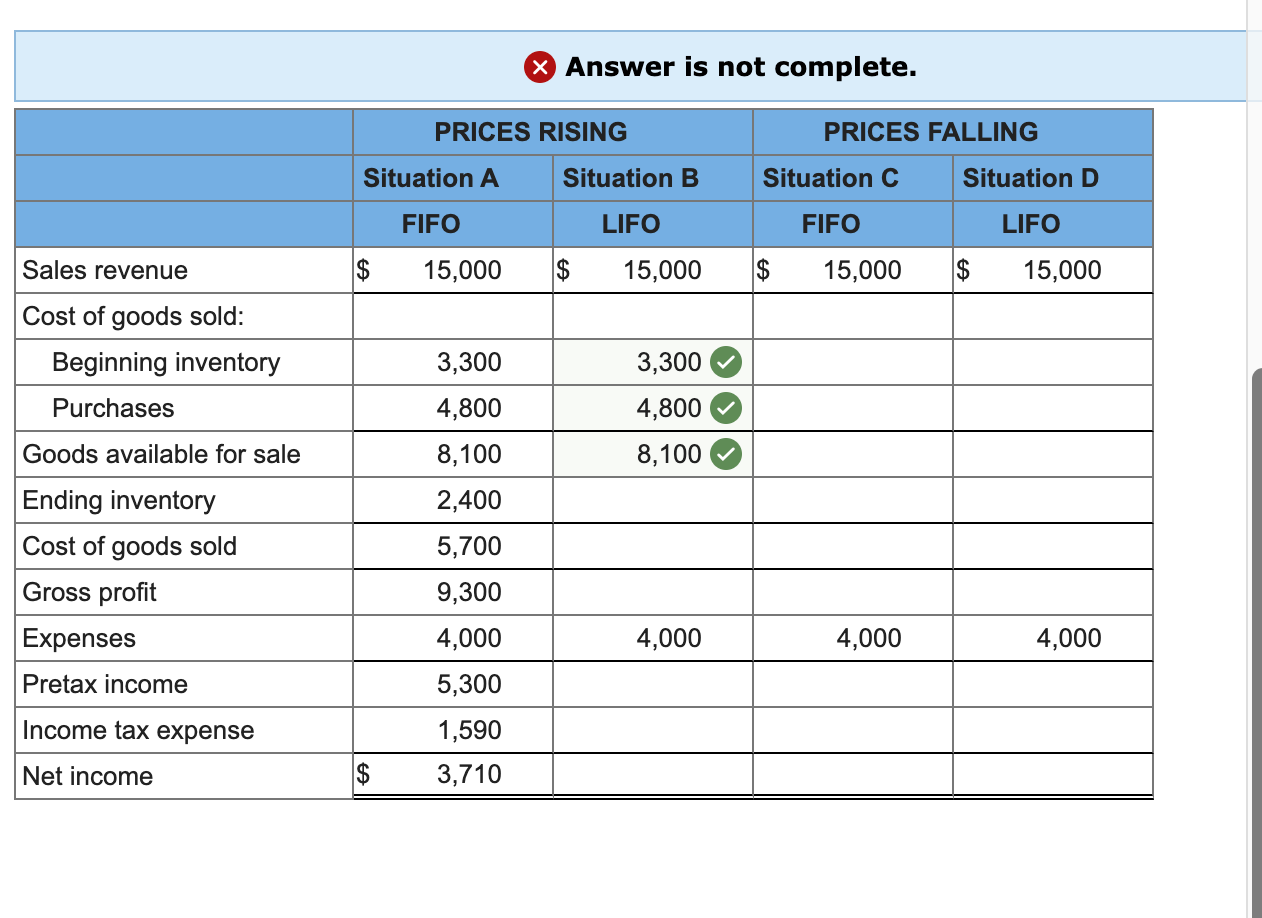

P7-5 (Static) Evaluating the LIFO and FIFO Choice When Costs Are Rising and Falling L07-2, 7-3 [The following information applies to the questions displayed below.] Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data common to all four situations are sales, 500 units for $15,000; beginning inventory, 300 units; purchases, 400 units; ending inventory, 200 units; and operating expenses, $4,000. The income tax rate is 30%. P7-5 Part 1 Required: 1. Complete the following tabulation for each situation. In Situations A and B (prices rising) assume the following: beginning inventory, 300 units at $11=$3,300; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 300 units at $12=$3,600; purchases, 400 units at $11=$4,400. Use periodic inventory procedures. Answer is not complete

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts