Question: Compute the net cash flows on the payment dates. Include the date, 3M rates, the fixed cash flow received, floating cash flow paid and the

Compute the net cash flows on the payment dates. Include the date, 3M rates, the fixed cash flow received, floating cash flow paid and the net cash flow in a table. Show detailed workings of how you calculated the floating and fixed payments at each date. Provide explanations where necessary.

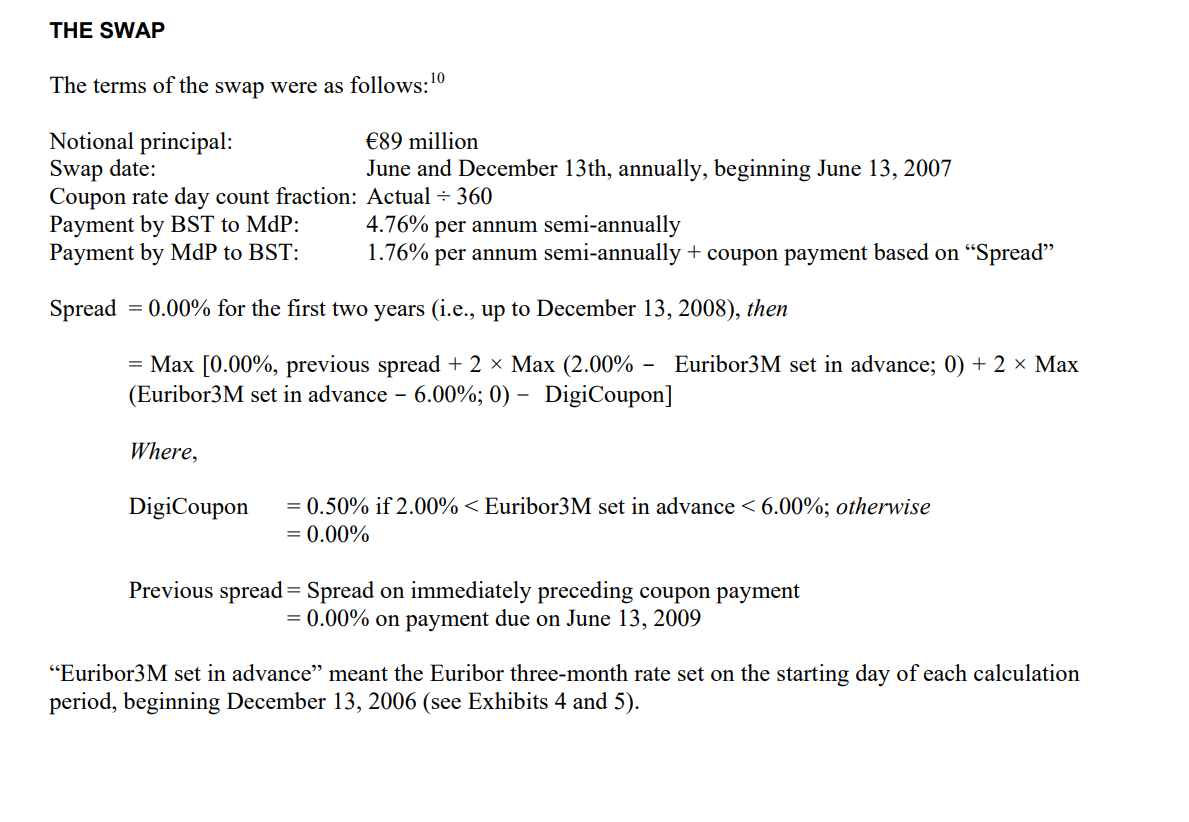

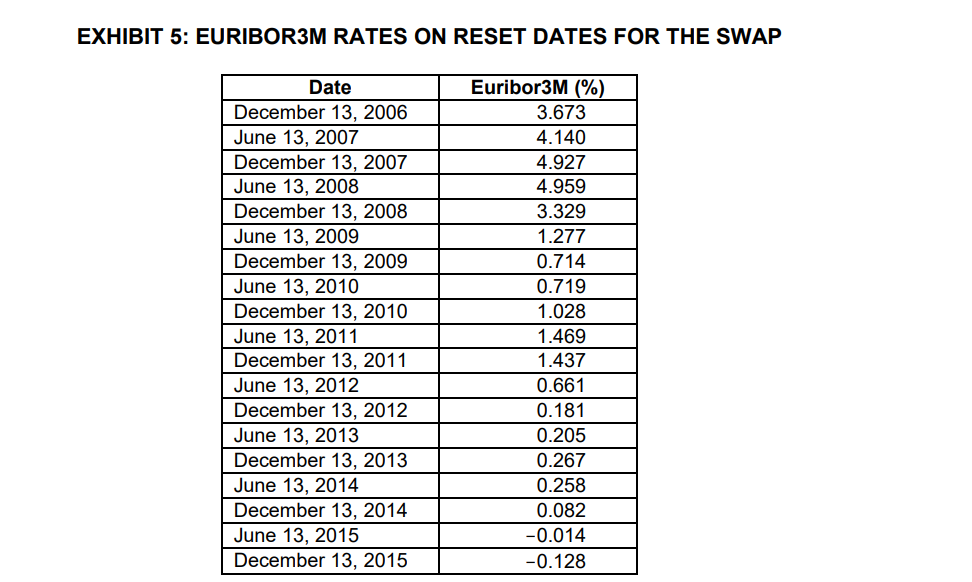

The terms of the swap were as follows: 10 Notional principal 89 million Swap date: June and December 13th, annually, beginning June 13, 2007 Coupon rate day count fraction: Actual 360 Payment by BST to MdP: 4.76% per annum semi-annually Payment by MdP to BST: 1.76% per annum semi-annually + coupon payment based on "Spread" Spread =0.00% for the first two years (i.e., up to December 13, 2008), then =Max[0.00%, previous spread +2Max(2.00% Euribor 3M set in advance; 0)+2 Max (Euribor3M set in advance 6.00%; 0) - DigiCoupon] Where, DigiCoupon =0.50% if 2.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts