Question: Compute the Net Present Value (NPV) for the best and the worst case! Compute the expected value for the uncertain parameters price per tonne-kilometer and

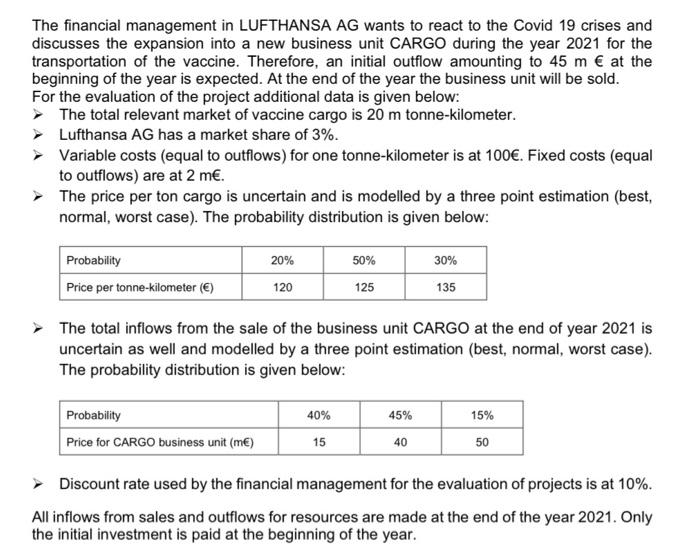

The financial management in LUFTHANSA AG wants to react to the Covid 19 crises and discusses the expansion into a new business unit CARGO during the year 2021 for the transportation of the vaccine. Therefore, an initial outflow amounting to 45 m at the beginning of the year is expected. At the end of the year the business unit will be sold. For the evaluation of the project additional data is given below: The total relevant market of vaccine cargo is 20 m tonne-kilometer. Lufthansa AG has a market share of 3%. Variable costs (equal to outflows) for one tonne-kilometer is at 100. Fixed costs (equal to outflows) are at 2 m. The price per ton cargo is uncertain and is modelled by a three point estimation (best, normal, worst case). The probability distribution is given below: 20% 50% 30% Probability Price per tonne-kilometer () 120 125 135 The total inflows from the sale of the business unit CARGO at the end of year 2021 is uncertain as well and modelled by a three point estimation (best, normal, worst case). The probability distribution is given below: 40% 45% 15% Probability Price for CARGO business unit (m) 15 40 50 Discount rate used by the financial management for the evaluation of projects is at 10%. All inflows from sales and outflows for resources are made at the end of the year 2021. Only the initial investment is paid at the beginning of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts