Question: Compute the net trade cycle for the group for Year 2020 and 2019. (Use end-of-year values for computations requiring average) (4 Marks) Note: Use trade

- Compute the net trade cycle for the group for Year 2020 and 2019.

(Use end-of-year values for computations requiring average) (4 Marks)

Note:

-

- Use trade receivables.

-

- Use trade payables.

-

- Use depreciation of property, plant and equipment.

- Inventory for Year 2018 was RM103,468,000.

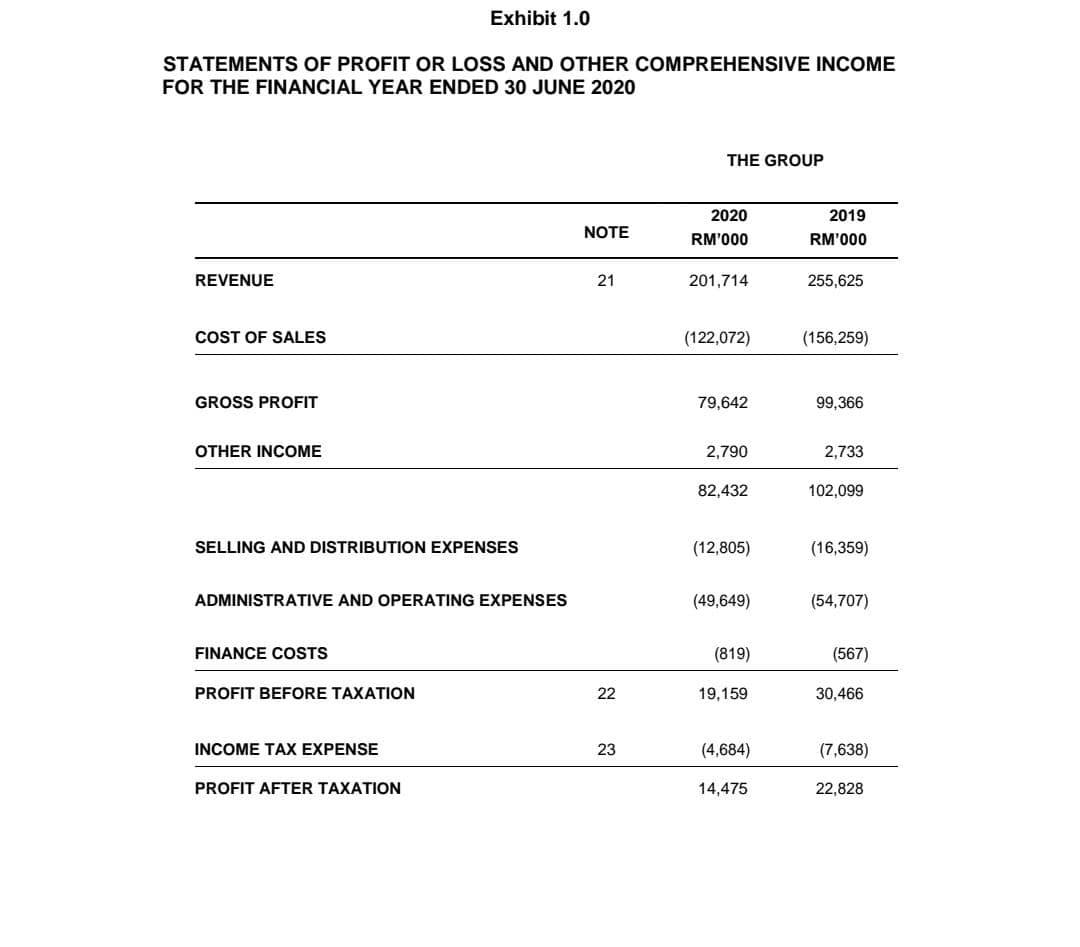

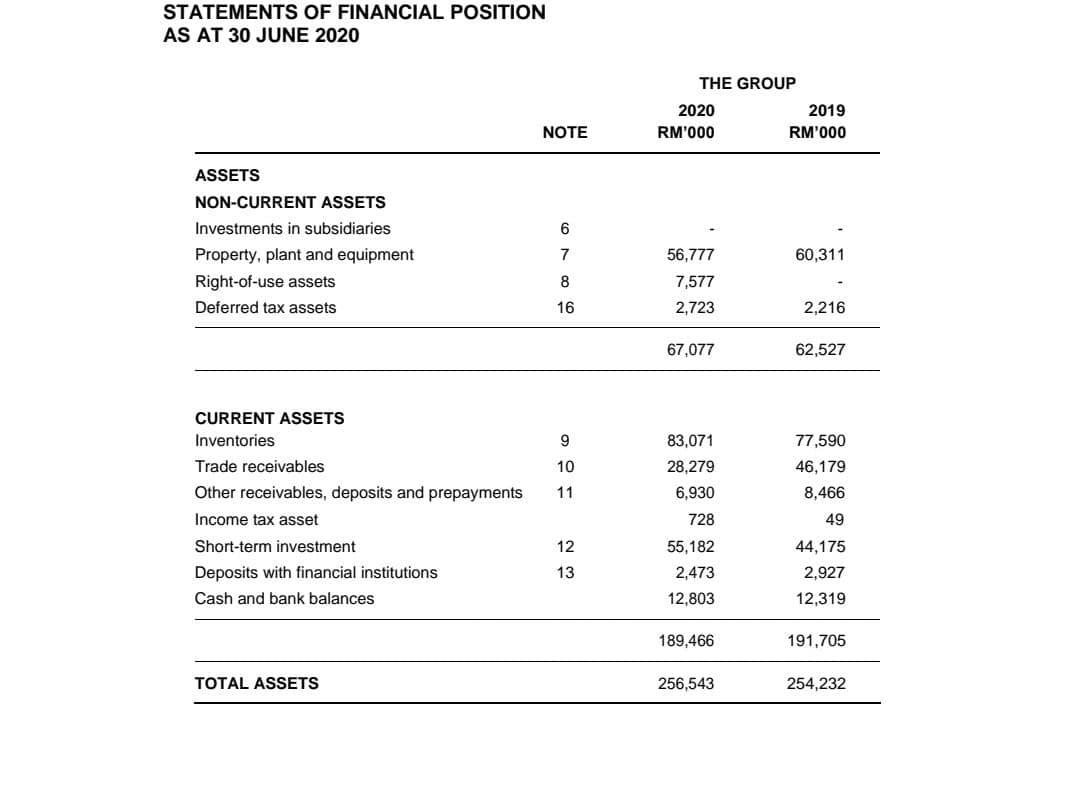

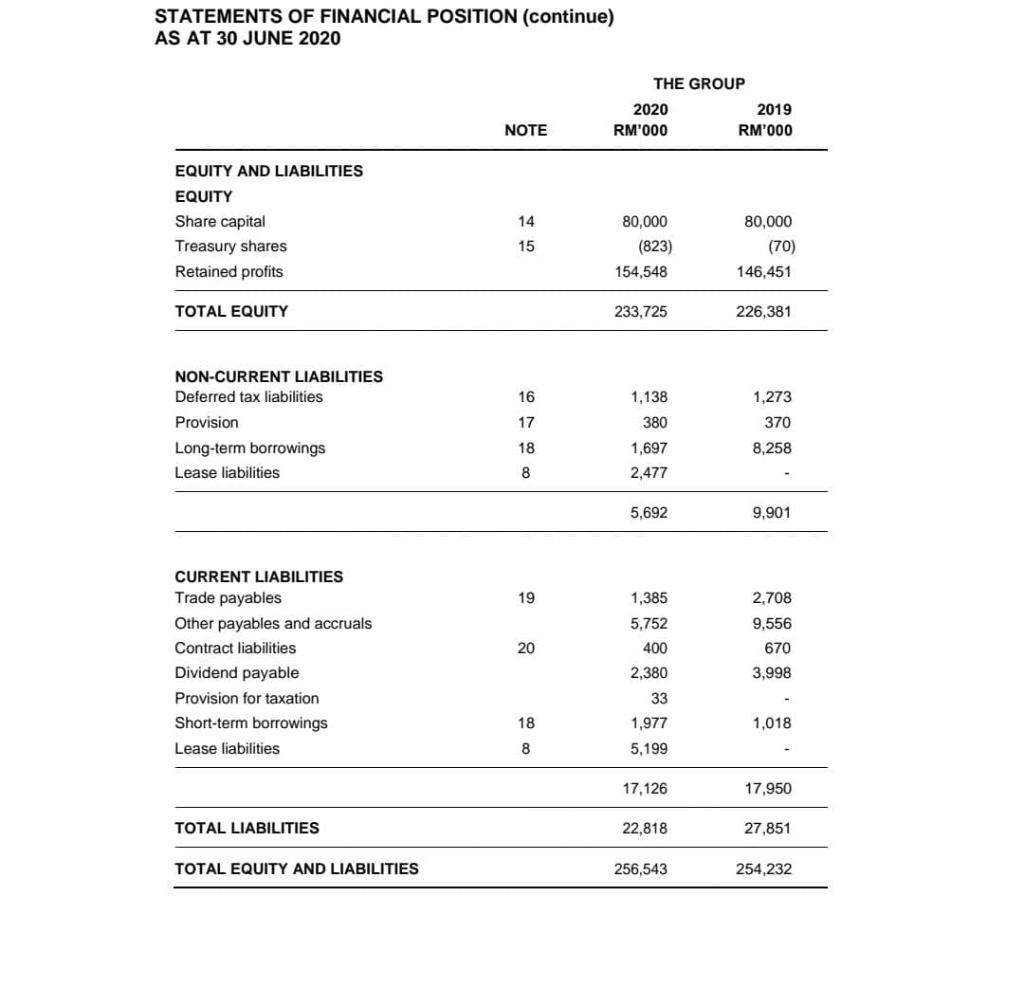

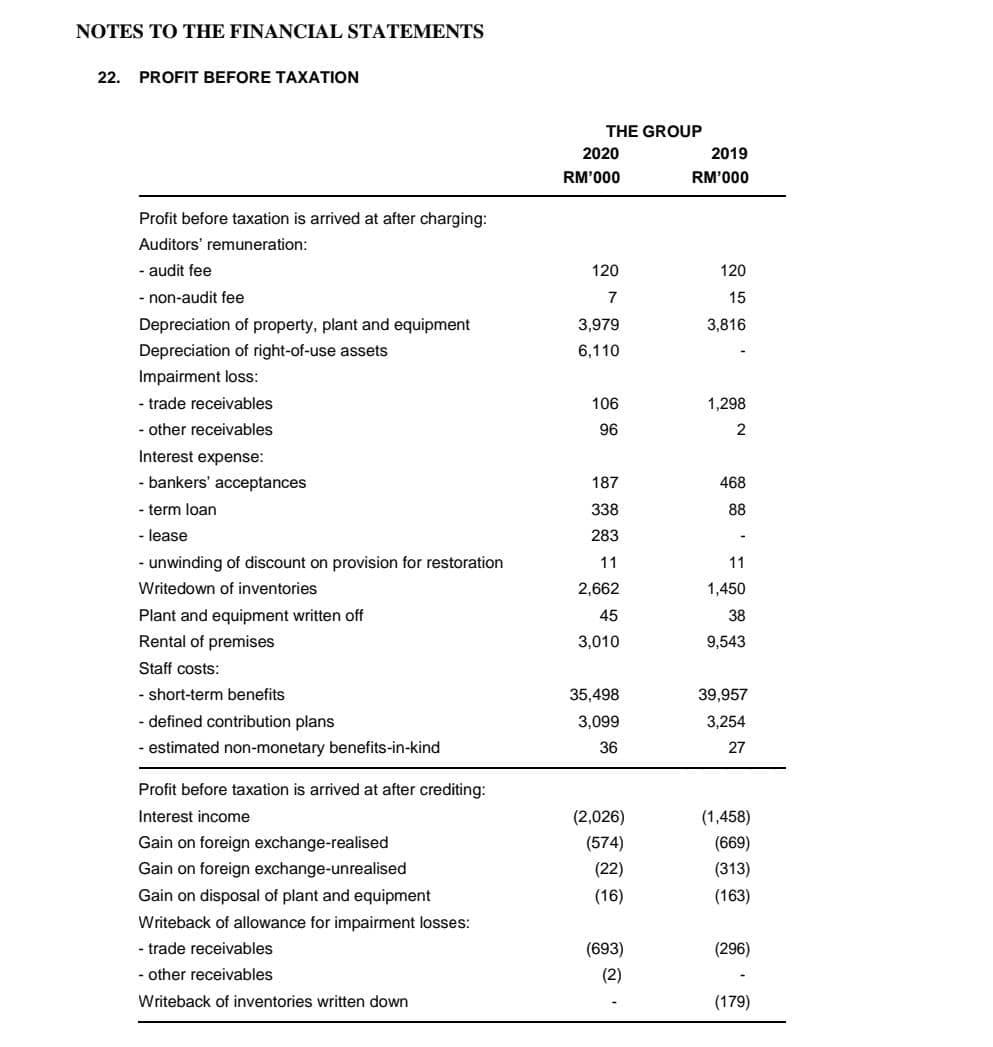

Exhibit 1.0 STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 30 JUNE 2020 THE GROUP 2020 NOTE 2019 RM'000 RM'000 REVENUE 21 201,714 255,625 COST OF SALES (122,072) (156,259) GROSS PROFIT 79,642 99,366 OTHER INCOME 2,790 2,733 82,432 102,099 SELLING AND DISTRIBUTION EXPENSES (12,805) (16,359) ADMINISTRATIVE AND OPERATING EXPENSES (49,649) (54,707) FINANCE COSTS (819) (567) PROFIT BEFORE TAXATION 22 19.159 30,466 INCOME TAX EXPENSE 23 (4,684) (7,638) PROFIT AFTER TAXATION 14,475 22,828 STATEMENTS OF FINANCIAL POSITION AS AT 30 JUNE 2020 THE GROUP 2020 2019 RM'000 RM'000 NOTE 6 ASSETS NON-CURRENT ASSETS Investments in subsidiaries Property, plant and equipment Right-of-use assets Deferred tax assets 7 60,311 8 16 56,777 7,577 2,723 2,216 67,077 62,527 9 10 77,590 46,179 8,466 11 CURRENT ASSETS Inventories Trade receivables Other receivables, deposits and prepayments Income tax asset Short-term investment Deposits with financial institutions Cash and bank balances 83,071 28,279 6,930 728 55,182 2,473 12,803 49 12 13 44,175 2,927 12,319 189,466 191,705 TOTAL ASSETS 256,543 254,232 STATEMENTS OF FINANCIAL POSITION (continue) AS AT 30 JUNE 2020 THE GROUP 2020 2019 RM'000 RM'000 NOTE EQUITY AND LIABILITIES EQUITY Share capital Treasury shares Retained profits 14 15 80,000 (823) 154,548 80,000 (70) 146,451 TOTAL EQUITY 233,725 226,381 16 1,273 NON-CURRENT LIABILITIES Deferred tax liabilities Provision Long-term borrowings Lease liabilities 1,138 380 17 370 18 8,258 1,697 2,477 8 5,692 9,901 19 1,385 2,708 5,752 400 20 CURRENT LIABILITIES Trade payables Other payables and accruals Contract liabilities Dividend payable Provision for taxation Short-term borrowings Lease liabilities 9,556 670 3,998 2,380 33 1,977 18 1,018 8 5,199 17,126 17,950 TOTAL LIABILITIES 22,818 27,851 TOTAL EQUITY AND LIABILITIES 256,543 254,232 NOTES TO THE FINANCIAL STATEMENTS 22. PROFIT BEFORE TAXATION THE GROUP 2020 2019 RM'000 RM'000 120 120 7 3,979 6,110 15 3,816 106 1,298 96 2 Profit before taxation is arrived at after charging: Auditors' remuneration: - audit fee - non-audit fee Depreciation of property, plant and equipment Depreciation of right-of-use assets Impairment loss: - trade receivables - other receivables Interest expense: - bankers' acceptances - term loan - lease - unwinding of discount on provision for restoration Writedown of inventories Plant and equipment written off Rental of premises Staff costs: - short-term benefits - defined contribution plans - estimated non-monetary benefits-in-kind 187 468 338 88 283 11 11 1,450 2,662 45 38 3,010 9,543 35,498 3,099 39,957 3,254 36 27 Profit before taxation is arrived at after crediting: Interest income Gain on foreign exchange-realised Gain on foreign exchange-unrealised Gain on disposal of plant and equipment Writeback of allowance for impairment losses: - trade receivables - other receivables Writeback of inventories written down (2,026) (574) (22) (16) (1,458) (669) (313) (163) (296) (693) (2) (179) Exhibit 1.0 STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 30 JUNE 2020 THE GROUP 2020 NOTE 2019 RM'000 RM'000 REVENUE 21 201,714 255,625 COST OF SALES (122,072) (156,259) GROSS PROFIT 79,642 99,366 OTHER INCOME 2,790 2,733 82,432 102,099 SELLING AND DISTRIBUTION EXPENSES (12,805) (16,359) ADMINISTRATIVE AND OPERATING EXPENSES (49,649) (54,707) FINANCE COSTS (819) (567) PROFIT BEFORE TAXATION 22 19.159 30,466 INCOME TAX EXPENSE 23 (4,684) (7,638) PROFIT AFTER TAXATION 14,475 22,828 STATEMENTS OF FINANCIAL POSITION AS AT 30 JUNE 2020 THE GROUP 2020 2019 RM'000 RM'000 NOTE 6 ASSETS NON-CURRENT ASSETS Investments in subsidiaries Property, plant and equipment Right-of-use assets Deferred tax assets 7 60,311 8 16 56,777 7,577 2,723 2,216 67,077 62,527 9 10 77,590 46,179 8,466 11 CURRENT ASSETS Inventories Trade receivables Other receivables, deposits and prepayments Income tax asset Short-term investment Deposits with financial institutions Cash and bank balances 83,071 28,279 6,930 728 55,182 2,473 12,803 49 12 13 44,175 2,927 12,319 189,466 191,705 TOTAL ASSETS 256,543 254,232 STATEMENTS OF FINANCIAL POSITION (continue) AS AT 30 JUNE 2020 THE GROUP 2020 2019 RM'000 RM'000 NOTE EQUITY AND LIABILITIES EQUITY Share capital Treasury shares Retained profits 14 15 80,000 (823) 154,548 80,000 (70) 146,451 TOTAL EQUITY 233,725 226,381 16 1,273 NON-CURRENT LIABILITIES Deferred tax liabilities Provision Long-term borrowings Lease liabilities 1,138 380 17 370 18 8,258 1,697 2,477 8 5,692 9,901 19 1,385 2,708 5,752 400 20 CURRENT LIABILITIES Trade payables Other payables and accruals Contract liabilities Dividend payable Provision for taxation Short-term borrowings Lease liabilities 9,556 670 3,998 2,380 33 1,977 18 1,018 8 5,199 17,126 17,950 TOTAL LIABILITIES 22,818 27,851 TOTAL EQUITY AND LIABILITIES 256,543 254,232 NOTES TO THE FINANCIAL STATEMENTS 22. PROFIT BEFORE TAXATION THE GROUP 2020 2019 RM'000 RM'000 120 120 7 3,979 6,110 15 3,816 106 1,298 96 2 Profit before taxation is arrived at after charging: Auditors' remuneration: - audit fee - non-audit fee Depreciation of property, plant and equipment Depreciation of right-of-use assets Impairment loss: - trade receivables - other receivables Interest expense: - bankers' acceptances - term loan - lease - unwinding of discount on provision for restoration Writedown of inventories Plant and equipment written off Rental of premises Staff costs: - short-term benefits - defined contribution plans - estimated non-monetary benefits-in-kind 187 468 338 88 283 11 11 1,450 2,662 45 38 3,010 9,543 35,498 3,099 39,957 3,254 36 27 Profit before taxation is arrived at after crediting: Interest income Gain on foreign exchange-realised Gain on foreign exchange-unrealised Gain on disposal of plant and equipment Writeback of allowance for impairment losses: - trade receivables - other receivables Writeback of inventories written down (2,026) (574) (22) (16) (1,458) (669) (313) (163) (296) (693) (2) (179)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts