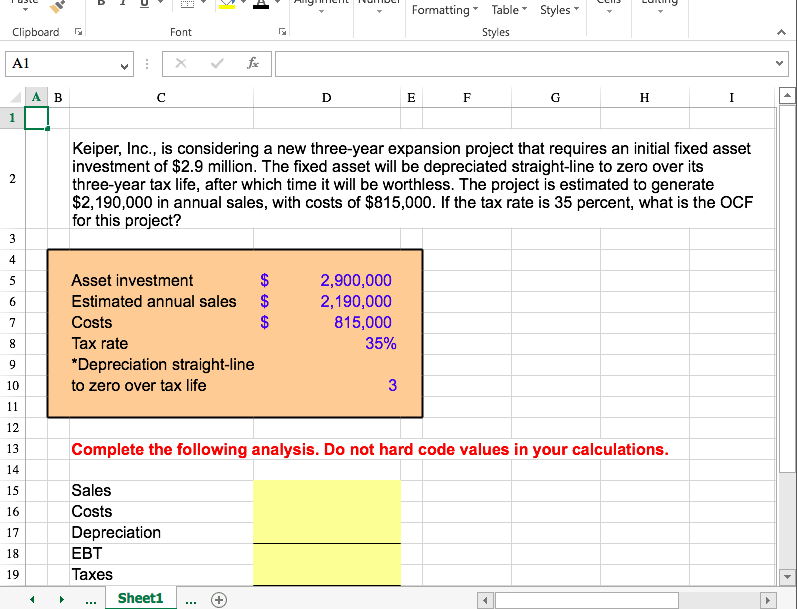

Question: Compute the OCF for this project. Formatting Table Styles* Clipboard Font Styles A1 A B Keiper, Inc., is considering a new three-year expansion project that

Compute the OCF for this project.

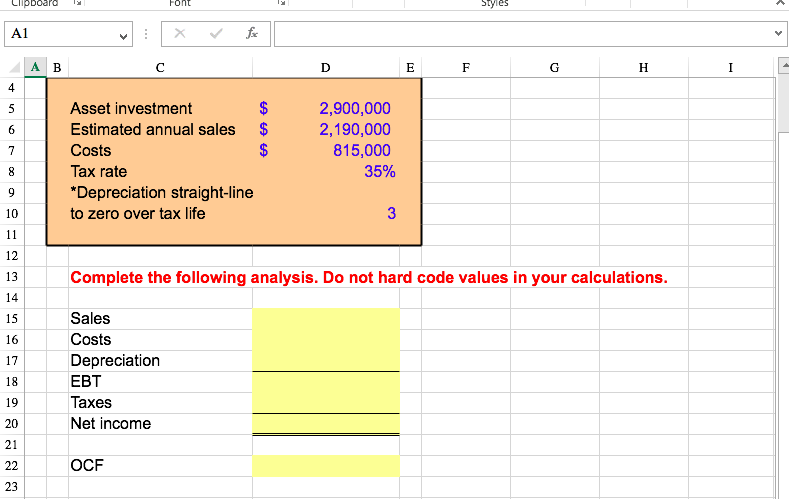

Formatting" Table" Styles* Clipboard Font Styles A1 A B Keiper, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. If the tax rate is 35 percent, what is the OCF for this project? 4 Asset investment Estimated annual sales$ Costs Tax rate Depreciation straight-line to zero over tax life 2,900,000 2,190,000 815,000 35% 10 12 13 14 15 16 17 18 19 Complete the following analysis. Do not hard code values in your calculations Sales Costs Depreciation EBT Taxes ...Sheeti .. + Clipboard A1 A B 4 Asset investment Estimated annual sales$ Costs Tax rate Depreciation straight-line to zero over tax life 2,900,000 2,190,000 815,000 35% 10 12 13 14 15 16 17 18 19 20 21 Complete the following analysis. Do not hard code values in your calculations Sales Costs Depreciation EBT Taxes Net income OCF 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts