Compute the price of an American call option on the same ZCB of the previous three questions.

Fantastic news! We've Found the answer you've been seeking!

Question:

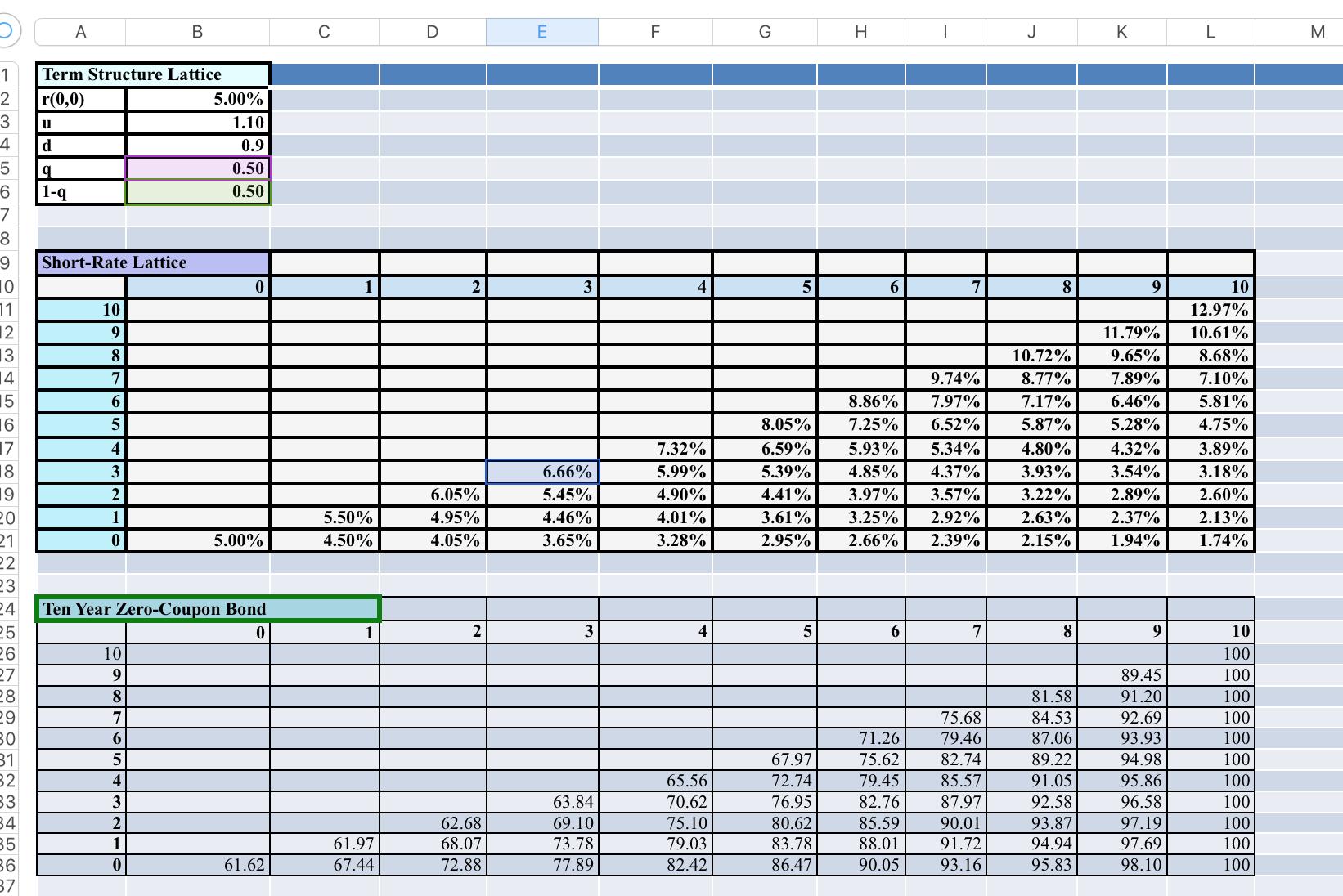

Compute the price of an American call option on the same ZCB of the previous three questions. The option has expiratio t =6 and strike = 80

Transcribed Image Text:

Н K Term Structure Lattice 2 r(0,0) 5.00% 3 1.10 0.9 0.50 b1 1-q 0.50 7. Short-Rate Lattice 10 2 3 4 8 10 10 12.97% 12 13 11.79% 10.61% 10.72% 9.65% 8.68% 14 9.74% 8.77% 7.89% 7.10% 15 6. 8.86% 7.97% 7.17% 6.46% 5.81% 5.87% 5.28% 4.75% 16 17 18 19 20 21 22 23 24 8.05% 7.25% 6.52% 7.32% 6.59% 5.93% 5.34% 4.80% 4.32% 3.89% 3 6.66% 5.99% 5.39% 4.85% 4.37% 3.93% 3.54% 3.18% 2 6.05% 5.45% 4.90% 4.41% 3.97% 3.57% 3.22% 2.89% 2.60% 5.50% 4.95% 4.46% 4.01% 3.61% 3.25% 2.92% 2.63% 2.37% 2.13% 5.00% 4.50% 4.05% 3.65% 3.28% 2.95% 2.66% 2.39% 2.15% 1.94% 1.74% Ten Year Zero-Coupon Bond 25 3 6 10 26 10 100 27 28 29 30 31 32 89.45 100 81.58 91.20 100 75.68 84.53 92.69 100 6. 71.26 79.46 87.06 93.93 100 67.97 89.22 91.05 75.62 82.74 94.98 100 65.56 72.74 79.45 85.57 95.86 100 3 63.84 70.62 76.95 82.76 87.97 92.58 96.58 100 34 62.68 69.10 75.10 80.62 85.59 90.01 93.87 97.19 100 35 36 37 61.97 68.07 73.78 79.03 83.78 88.01 91.72 94.94 97.69 100 61.62 67.44 72.88 77.89 82.42 86.47 90.05 93.16 95.83 98.10 100 B. Н K Term Structure Lattice 2 r(0,0) 5.00% 3 1.10 0.9 0.50 b1 1-q 0.50 7. Short-Rate Lattice 10 2 3 4 8 10 10 12.97% 12 13 11.79% 10.61% 10.72% 9.65% 8.68% 14 9.74% 8.77% 7.89% 7.10% 15 6. 8.86% 7.97% 7.17% 6.46% 5.81% 5.87% 5.28% 4.75% 16 17 18 19 20 21 22 23 24 8.05% 7.25% 6.52% 7.32% 6.59% 5.93% 5.34% 4.80% 4.32% 3.89% 3 6.66% 5.99% 5.39% 4.85% 4.37% 3.93% 3.54% 3.18% 2 6.05% 5.45% 4.90% 4.41% 3.97% 3.57% 3.22% 2.89% 2.60% 5.50% 4.95% 4.46% 4.01% 3.61% 3.25% 2.92% 2.63% 2.37% 2.13% 5.00% 4.50% 4.05% 3.65% 3.28% 2.95% 2.66% 2.39% 2.15% 1.94% 1.74% Ten Year Zero-Coupon Bond 25 3 6 10 26 10 100 27 28 29 30 31 32 89.45 100 81.58 91.20 100 75.68 84.53 92.69 100 6. 71.26 79.46 87.06 93.93 100 67.97 89.22 91.05 75.62 82.74 94.98 100 65.56 72.74 79.45 85.57 95.86 100 3 63.84 70.62 76.95 82.76 87.97 92.58 96.58 100 34 62.68 69.10 75.10 80.62 85.59 90.01 93.87 97.19 100 35 36 37 61.97 68.07 73.78 79.03 83.78 88.01 91.72 94.94 97.69 100 61.62 67.44 72.88 77.89 82.42 86.47 90.05 93.16 95.83 98.10 100 B.

Expert Answer:

Related Book For

Posted Date:

Students also viewed these finance questions

-

The price of an American call on a non-dividend-paying stock is $4. The stock price is $31, the strike price is $30, and the expiration date is in three months. The risk-free interest rate is 8%....

-

Suppose that the strike price of an American call option on a non-dividend-paying stock grows at rate g. Show that if g is less than the risk-free rate, r, it is never optimal to exercise the call...

-

Suppose you own an American call option on Pfizer stock. Pfizer stock has gone up in value considerably since you bought the option, so your investment has been profitable. There is still one month...

-

Starting one month from now, you need to withdraw $210 per month from your bank account to help cover the costs of your university education. You will continue the monthly withdrawals for the next...

-

Martin Myers owns Myers Construction Co. The company maintains accounting records for the purposes of exercising control over its construction activities and meeting its reporting obligations...

-

10. Suppose that E satisfies the hypotheses of Gauss's Theorem and S satisfies the hypotheses of Stokes's Theorem. (a) If!: S -4 R is a C2 function and F = grad! on S, prove that I las (iF) Tds = 0....

-

6. What is an activity? Does it always require human effort? Refer to Figure 4.1. Provide a detailed list of activities needed to accomplish work package 3.3. Do the same for work package 4.2.

-

Poke a hole in a piece of cardboard and hold the cardboard horizontally in the sunlight (as in Figure 1.6). Note the image of the Sun that is cast below. To convince yourself that the round spot of...

-

Question 3: (10 points) A1, B1, B3 The following information has been provided for Bahrain Corporation: Sales price per unit 540 Variable costs per unit $20 Fixed costs S1000 Required: Prepare a...

-

Differentiate broadly between financial accounting and managerial accounting.

-

1. A firm calculates that the marginal product of labor (MPL) can be found from the following equation: MPL = 35 - 2L where L is the number of workers hired. The production function for this firm is...

-

Compare the alternatives that Bergerac is considering for its decision. Include: Comparison of make versus buy option in the type of operation that Bergerac is looking to integrate. You do not need...

-

Let A, B, C and D be non-zero digits, such that CD is a two-digit positive integer. BCD is a three-digit positive integer generated by the digits B, C and D. ABCD is a four-digit positive integer...

-

1.) An aluminum tube is clamped with rigid plates using four bolts as shown. The nut on each bolt is tightened one turn from 'snug'. The thickness of the plate may be considered insignificant in this...

-

4.21 Case Study Competency IV.1RM Determine diagnosis and procedure codes and groupings according to official guidelines. Competency IV.1 Validate assignment of diagnostic and procedural codes and...

-

W.E.B Dubois taught the book called "The State" to his students at Atlanta University. Who wrote this book

-

\ help with entries please On August 1, Crane, Inc. exchanged productive assets with Cheyenne, Inc. Crane's asset is referred to below as "Asset A," and Cheyenne' is referred to as "Asset B." The...

-

Making use of the tables of atomic masses, find the velocity with which the products of the reaction B10 (n, ) Li7 come apart; the reaction proceeds via interaction of very slow neutrons with...

-

Companies with high credit risks are the ones that cannot access fixed-rate markets directly. They are the companies that are most likely to be paying fixed and receiving floating in an interest rate...

-

Explain why a futures contract can be used for either speculation or hedging.

-

Explain how a repo agreement works and why it involves very little risk for the lender.

-

(a) Explain why an analyst may prefer a confidence interval to a hypothesis test. (b) Describe how a confidence interval may be used to assess significance.

-

What recourse do we have if the residual analysis indicates that the regression assumptions have been violated? Describe three different rules, heuristics, or family of functions that will help us.

-

Describe the criterion for rejecting the null hypothesis when using the p-value method for hypothesis testing. Who chooses the value of the level of significance, ????? Make up a situation (one...

Study smarter with the SolutionInn App