Question: compute the ratios listed below for Marriott International, Inc. using the 2019 annual report 'financial statements'. You are to present all figures for each ratio

compute the ratios listed below for Marriott International, Inc. using the 2019 annual report 'financial statements'. You are to present all figures for each ratio including the numerator and denominator (please see next page for the format). The information should be prepared using a spreadsheet program

Liquidity Ratios

1.Current Ratio

2.Quick Ratio

3.Cash Flow from Operating Activities to Current Liabilities

Accounts Receivable Ratios

4.Accounts Receivable Percentage

5.Accounts Receivable Turnover

6.Average Collection Period

Solvency Ratios

7.Total Assets to Total Liabilities Ratio

8.Total Liabilities to Total Assets Ratio

9.Total Liabilities to Total Equity (Debt-Equity)

10.Cash Flow from Operating Activities to Total Liabilities

11.Number of Times Interest Earned

12.Cash Flow from Operating Activities to Interest

Profitability Ratios

13.Net Income to Revenue (Profit Margin)

14.Operating Efficiency Ratio

15.Gross Return on Assets

16.Net Return on Assets

17.Return on Equity (ROE)

18.Earnings per Share

19.Price Earnings

Turnover Ratios

20.Working Capital Turnover

21.Fixed Asset Turnover

Marriott's Financial Report - https://learn.wsu.edu/bbcswebdav/pid-3868749-dt-content-rid-116043437_1/courses/2020-SUMM-ONLIN-HBM-491-2823-LEC/Marriott%2010k%202019.pdf

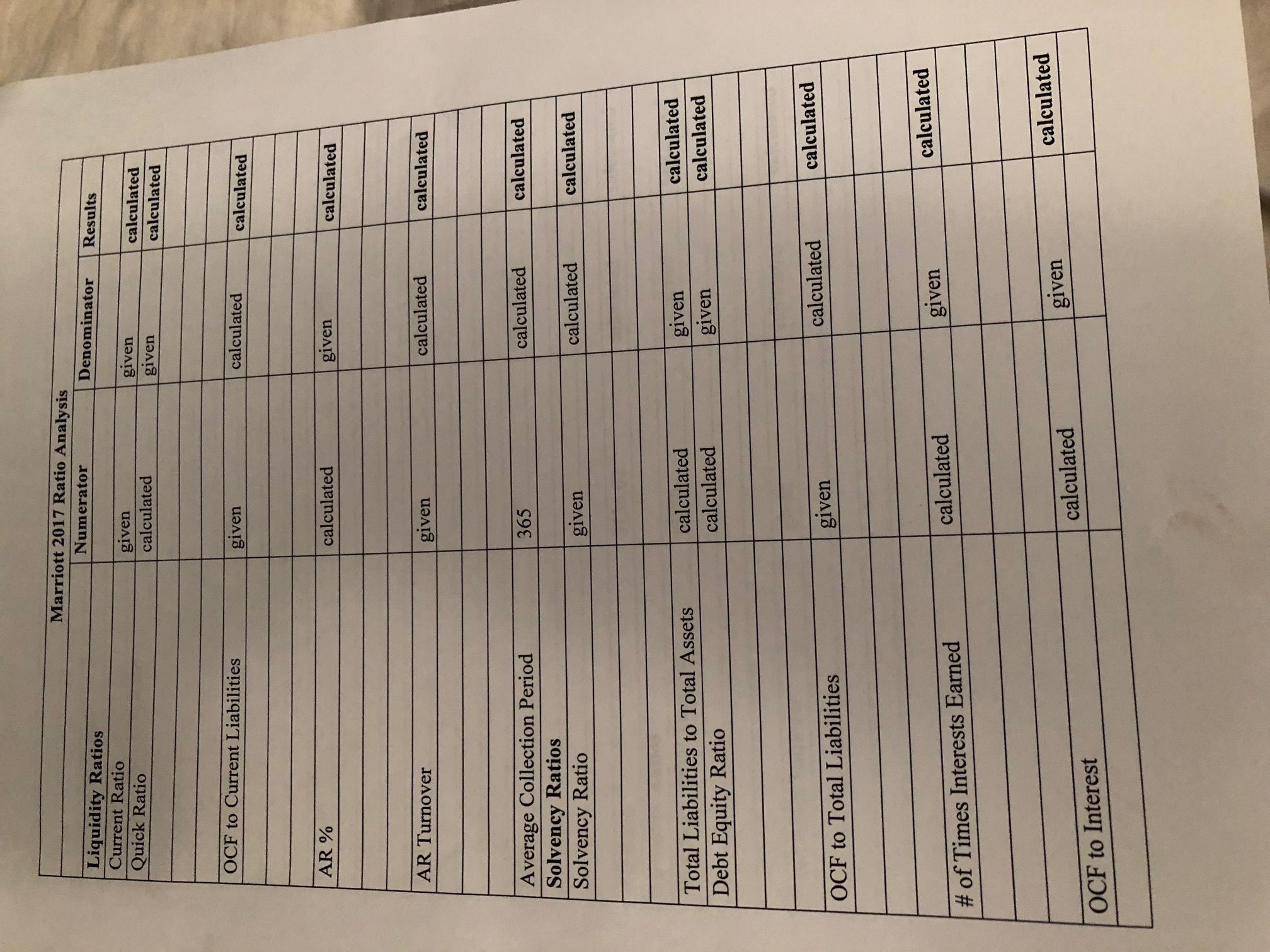

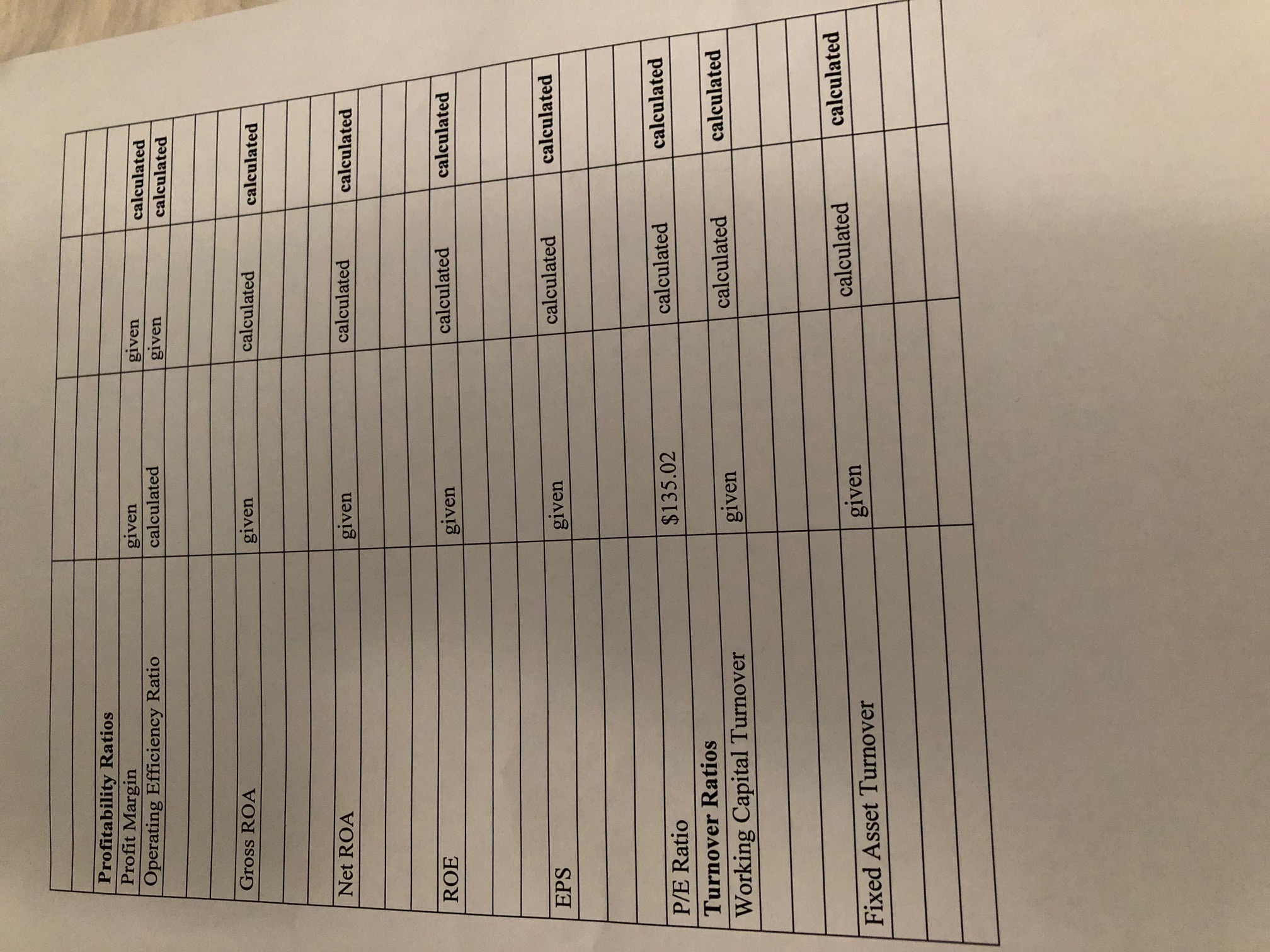

Marriott 2017 Ratio Analysis Liquidity Ratios Numerator Denominator Current Ratio Results Quick Ratio given calculated given given calculated calculated OCF to Current Liabilities given calculated calculated AR % calculated given calculated AR Turnover given calculated calculated Average Collection Period 365 calculated calculated Solvency Ratios Solvency Ratio given calculated calculated Total Liabilities to Total Assets calculated given calculated Debt Equity Ratio calculated given calculated OCF to Total Liabilities given calculated calculated # of Times Interests Earned calculated given calculated given calculated OCF to Interest calculatedProfitability Ratios Profit Margin Operating Efficiency Ratio given given calculated given calculated calculated Gross ROA given calculated calculated Net ROA given calculated calculated ROE given calculated calculated EPS given calculated calculated P/E Ratio $135.02 calculated calculated Turnover Ratios Working Capital Turnover given calculated calculated Fixed Asset Turnover given calculated calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts