Question: Compute the Regular Pay, Overtime Rate, Overtime Pay, and Gross Pay for each employee. Employees are paid weekly. Filing Employee Status Henry Smith Parker

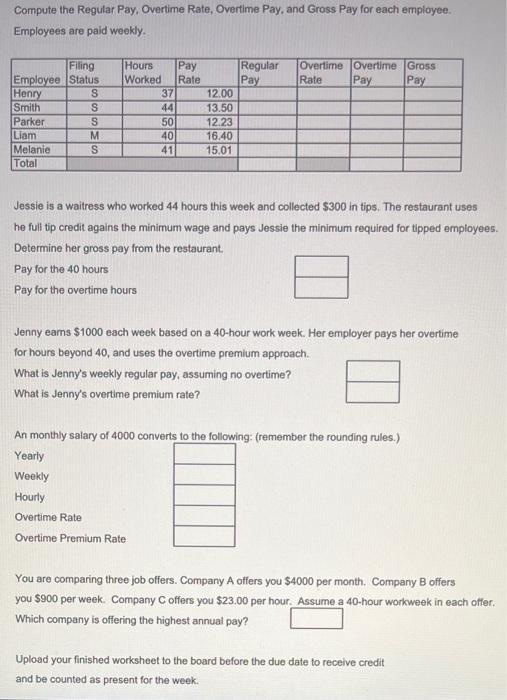

Compute the Regular Pay, Overtime Rate, Overtime Pay, and Gross Pay for each employee. Employees are paid weekly. Filing Employee Status Henry Smith Parker Liam Melanie Total S S S M S Hours Pay Worked Rate 37 44 50 40 41 Pay for the 40 hours Pay for the overtime hours 12.00 13.50 12.23 16.40 15.01 Regular Pay Overtime Overtime Rate Pay Jessie is a waitress who worked 44 hours this week and collected $300 in tips. The restaurant uses he full tip credit agains the minimum wage and pays Jessie the minimum required for tipped employees. Determine her gross pay from the restaurant. Gross Pay Jenny ears $1000 each week based on a 40-hour work week. Her employer pays her overtime for hours beyond 40, and uses the overtime premium approach. What is Jenny's weekly regular pay, assuming no overtime? What is Jenny's overtime premium rate? An monthly salary of 4000 converts to the following: (remember the rounding rules.) Yearly Weekly Hourly Overtime Rate Overtime Premium Rate You are comparing three job offers. Company A offers you $4000 per month. Company B offers you $900 per week. Company C offers you $23.00 per hour. Assume a 40-hour workweek in each offer. Which company is offering the highest annual pay? Upload your finished worksheet to the board before the due date to receive credit and be counted as present for the week.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts