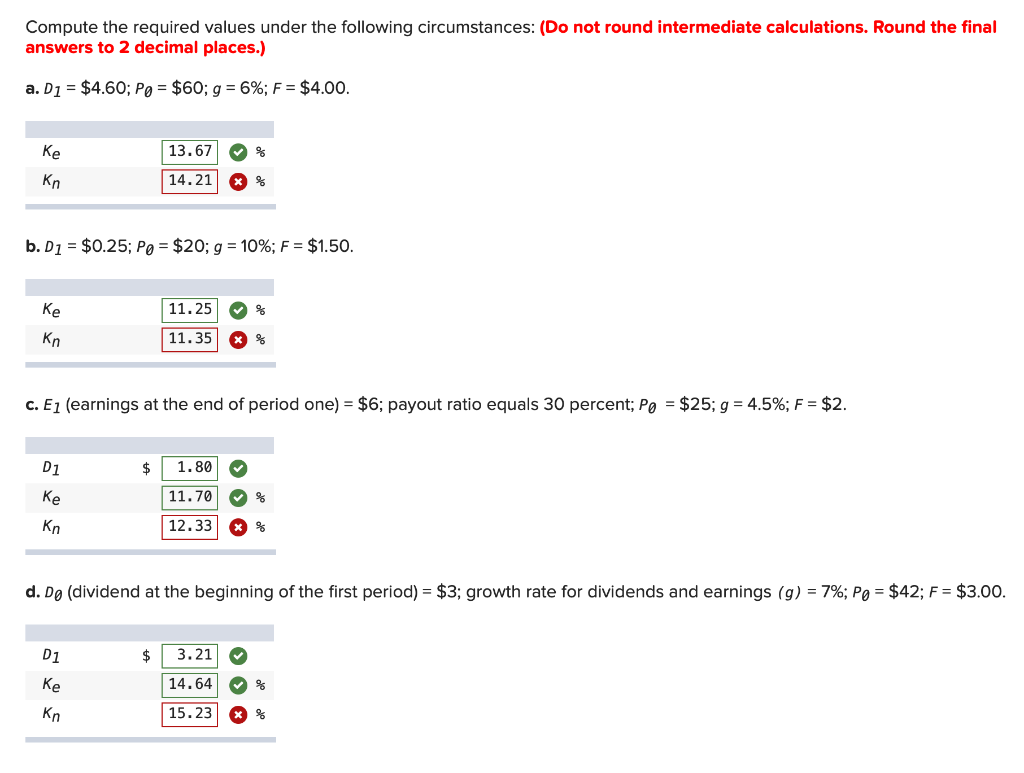

Question: Compute the required values under the following circumstances: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Di = $4.60;

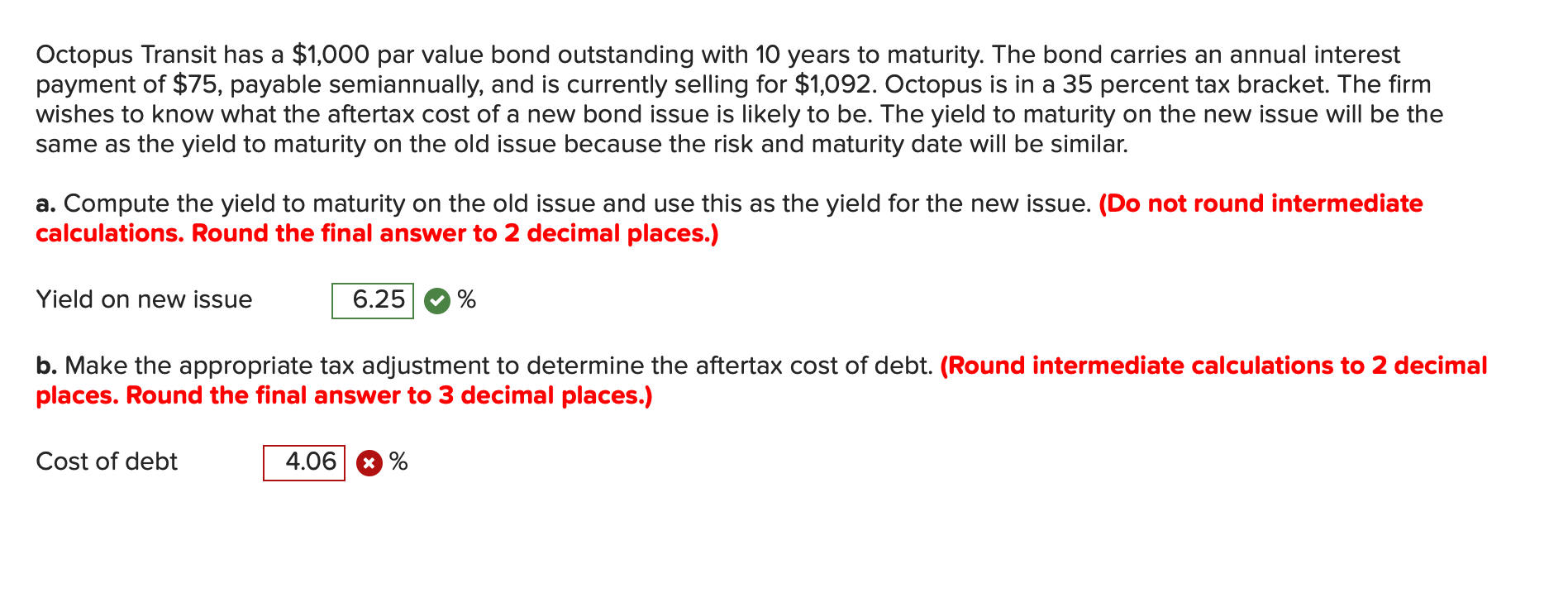

Compute the required values under the following circumstances: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Di = $4.60; P = $60; g = 6%; F = $4.00. 13.67 % Kn 14.21 x % b. D1 = $0.25; Po = $20; g = 10%; F = $1.50. 11.25 % Kn 11.35 X % C. E1 (earnings at the end of period one) = $6; payout ratio equals 30 percent; P = $25; g = 4.5%; F = $2. D1 $ 1.80 11.70 Kn 12.33 d. Do (dividend at the beginning of the first period) = $3; growth rate for dividends and earnings (g) = 7%; Po = $42; F = $3.00. D1 $ 3.21 14.64 Kn 15.23 x % Octopus Transit has a $1,000 par value bond outstanding with 10 years to maturity. The bond carries an annual interest payment of $75, payable semiannually, and is currently selling for $1,092. Octopus is in a 35 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Yield on new issue 6.25 % b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Round intermediate calculations to 2 decimal places. Round the final answer to 3 decimal places.) Cost of debt 4.06 % % Compute the required values under the following circumstances: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Di = $4.60; P = $60; g = 6%; F = $4.00. 13.67 % Kn 14.21 x % b. D1 = $0.25; Po = $20; g = 10%; F = $1.50. 11.25 % Kn 11.35 X % C. E1 (earnings at the end of period one) = $6; payout ratio equals 30 percent; P = $25; g = 4.5%; F = $2. D1 $ 1.80 11.70 Kn 12.33 d. Do (dividend at the beginning of the first period) = $3; growth rate for dividends and earnings (g) = 7%; Po = $42; F = $3.00. D1 $ 3.21 14.64 Kn 15.23 x % Octopus Transit has a $1,000 par value bond outstanding with 10 years to maturity. The bond carries an annual interest payment of $75, payable semiannually, and is currently selling for $1,092. Octopus is in a 35 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Yield on new issue 6.25 % b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Round intermediate calculations to 2 decimal places. Round the final answer to 3 decimal places.) Cost of debt 4.06 % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts