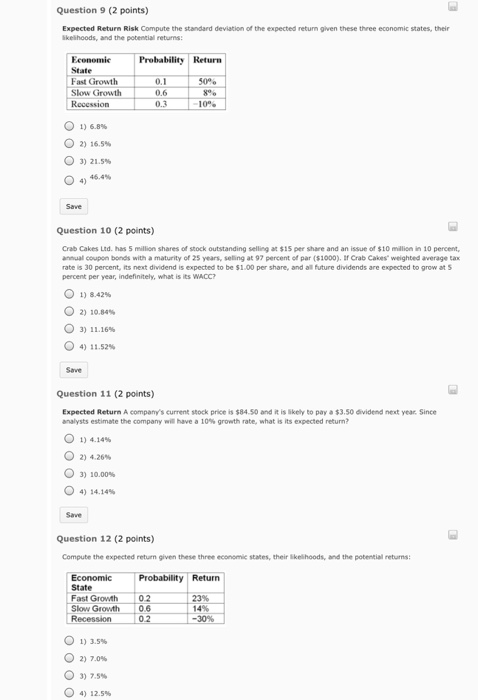

Question: Compute the standard deviation of the expected return given these three economic states, their Likelihoods, and the potential returns: 6.8% 16.5% 21.5% 46.4% Crab Cakes

Compute the standard deviation of the expected return given these three economic states, their Likelihoods, and the potential returns: 6.8% 16.5% 21.5% 46.4% Crab Cakes Ltd. has 5 million shares of stock outstanding selling at $15 per share and an issue of $10 million in 10 percent, annual coupon bonds with a maturity of 25 years, selling at 97 percent of par ($1000). If Crab Cakes* weighted average tax rate is 30 percent, its next dividend is expected to be $1.00 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely, what is its WACC? 8.42% 10.84% 11.16% 11.52% A company's current stock price is $84.50 and it is to pay a $3.50 dividend next year. since analysts estimate the company will have a 10% growth rate. what is its expected return? 4.14% 4.26% 10.00% 14.14% Compute the expected return given these three economic states, their likelihoods, and the potential returns: 3.5% 7.0% 7.5% 12.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts