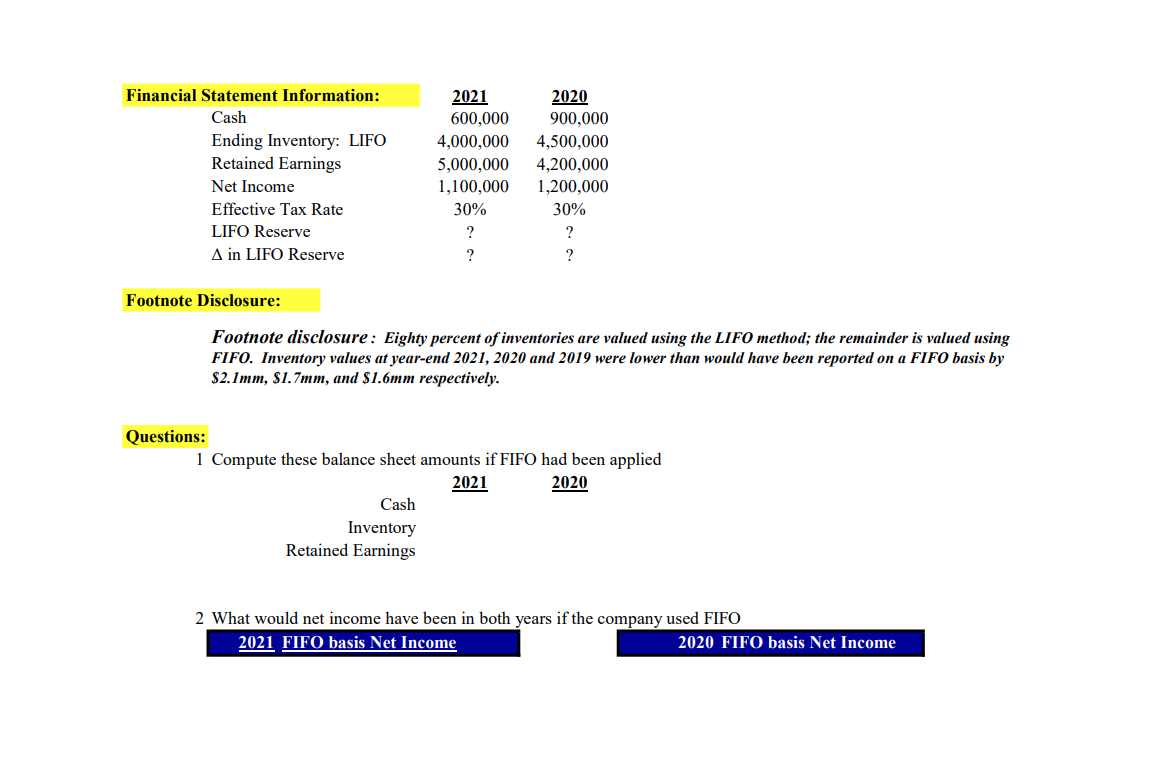

Question: Compute these balance sheet amounts if FIFO had been applied Cash Inventory Retained Earnings. 2 What would net income have been in both years if

Compute these balance sheet amounts if FIFO had been applied Cash Inventory Retained Earnings.

What would net income have been in both years if the company used FIFO

Financial Statement Information: Cash Ending Inventory: LIFO Retained Earnings Net Income Effective Tax Rate LIFO Reserve A in LIFO Reserve Footnote Disclosure: Questions: 2021 600,000 4,000,000 5,000,000 1,100,000 30% ? ? 2020 900,000 Cash Inventory Retained Earnings 4,500,000 4,200,000 1,200,000 30% ? ? Footnote disclosure: Eighty percent of inventories are valued using the LIFO method; the remainder is valued using FIFO. Inventory values at year-end 2021, 2020 and 2019 were lower than would have been reported on a FIFO basis by $2.1mm, $1.7mm, and $1.6mm respectively. 1 Compute these balance sheet amounts if FIFO had been applied 2021 2020 2 What would net income have been in both years if the company used FIFO 2021 FIFO basis Net Income 2020 FIFO basis Net Income

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

To compute the balance sheet amounts using FIFO instead of LIFO and to find out what the net income would have been if the company used FIFO we need to adjust the given LIFO figures according to the f... View full answer

Get step-by-step solutions from verified subject matter experts